4 Time Series Models

The goal of the LRM of the previous Chapter is to relate the variation (over time or in the cross-section) of variable \(Y\) with that of an explanatory variable \(X\). Time series models assume that the independent variable \(X\) is represented by past values of the dependent variable \(Y\). We typically denote by \(Y_t\) the value of a variable in time period \(t\) (e.g., days, weeks, and months) and \(Y_{t-1}\) refers to the value of the variable in the previous time period relative to today (i.e., \(t\)). More generally, \(Y_{t-k}\) (for \(k\geq 1\)) indicates the value of the variable \(k\) periods before \(t\). The notation \(\Delta Y_t\) refers to the one-period change in the variable, that is, \(\Delta Y_t = Y_{t} - Y_{t-1}\), while \(\Delta^k Y_t = Y_t - Y_{t-k}\) represents the change over \(k\) periods of the variable. The aim of time series models can be stated as follows: is there useful information in the current and past values of a variable to predict its future?

4.1 The Auto-Correlation Function (ACF)

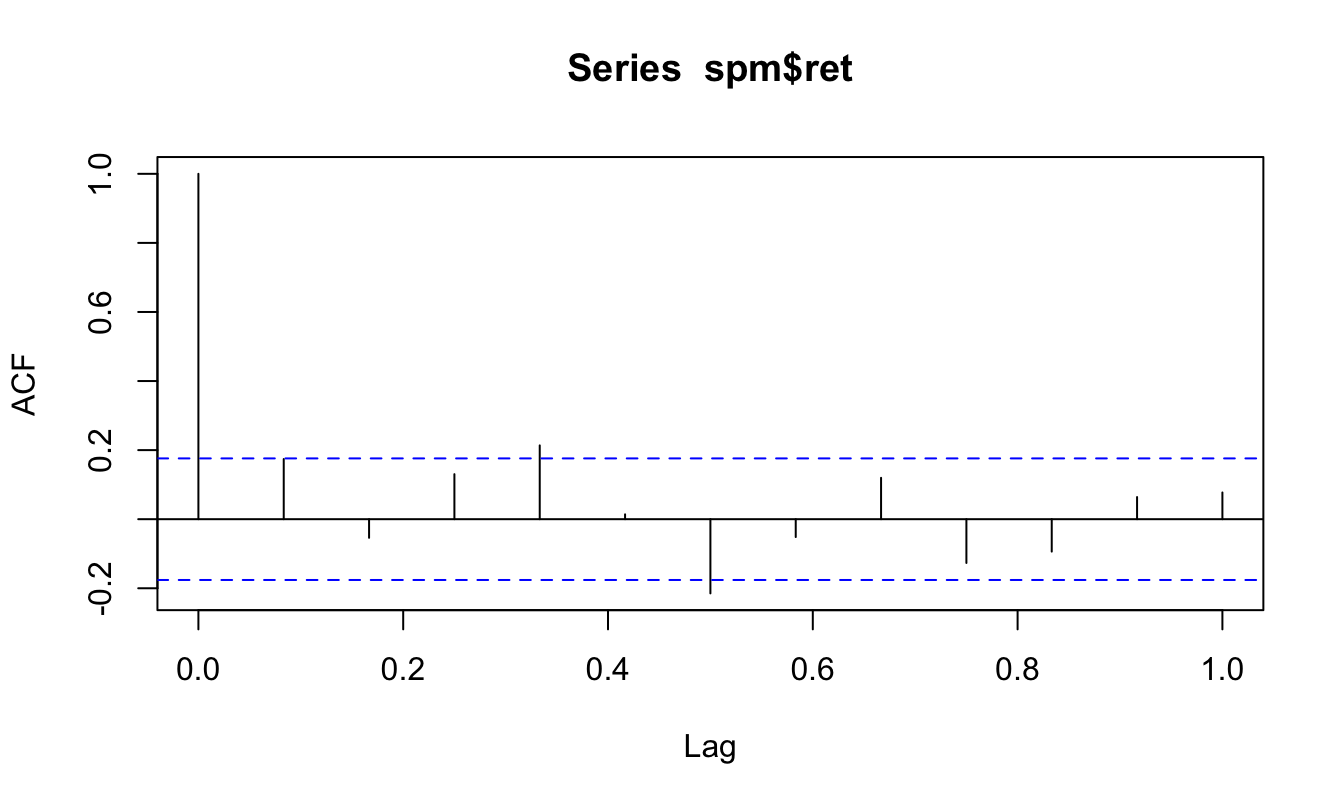

A first exploratory tool that is used in time series analysis is the Auto-Correlation Function (ACF) that represents the correlation coefficient between the variable \(Y_t\) and its lagged value \(Y_{t-k}\) (hence the Auto part). We denote the sample correlation coefficient at lag \(k\) by \(\hat\rho_k\) that is calculated as follows: \[\hat{\rho}_k = \frac{\sum_{t=1}^T (Y_t - \bar{Y})(Y_{t-k}-\bar{Y}) / T}{\hat\sigma^2_Y}\] where \(\bar{Y}\) and \(\hat\sigma^2_Y\) denote the sample mean and variance of \(Y_t\). The auto-correlation is bounded between \(\pm\) 1 with positive values indicating that values of \(Y_{t-k}\) above/below the mean \(\mu_Y\) are more likely to be associated with values of \(Y_t\) above/below the mean. In this sense, positive correlation means that the variable has some persistence in its fluctuations around the mean. On the other hand, negative values represent a situation in which the variable is more likely to reverse its past behavior. The ACF is called a function because \(\hat\rho_k\) is typically calculated for many values of \(k\). The R function to calculate the ACF is acf() and in the example below we apply it to the monthly returns of the S&P 500 Index from January 1990 until May 2017. The acf() function requires to specify the lag.max that represents the maximum value of \(k\) to use and the option plot that can be set to TRUE if the ACF should be plotted or FALSE if the estimated values should be returned.

library(quantmod)

sp.data <- getSymbols("^GSPC", start="1990-01-01", auto.assign=FALSE)

spm <- Ad(to.monthly(sp.data))

names(spm) <- "price" # rename the column "price" from "..Adjusted"

spm$return <- 100 * diff(log(spm$price)) # create the returns

spm <- na.omit(spm) # drops the first observation that is NA

# plot the ACF function

acf(spm$ret, lag.max=12, plot=TRUE)

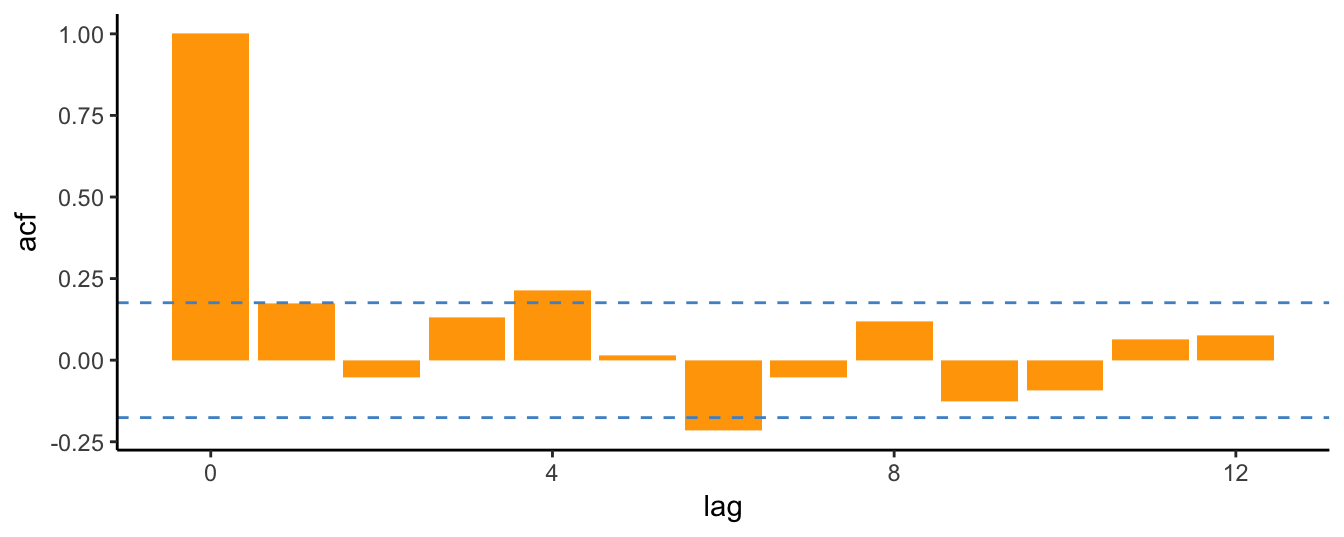

The function provides a graph with the horizontal axis representing the lag \(k\) (starting at 0 and expressed as a fraction of a year) and the vertical axis representing the value of \(\hat\rho_k\). The horizontal dashed lines are equal to \(\pm 1.96/\sqrt{T}\) and represent the confidence interval for the null hypothesis that the autocorrelation is equal to 0. If the auto-correlation at lag \(k\) is within the interval we conclude that we fail to reject the null that the auto-correlation coefficient is equal to zero (at 5% level). The plot produced by acf() uses the default R plotting function, although we might prefer a more customized and elegant graphical output using the ggplot2 package. This package does not provide a ready-made function to plot the ACF31, but we can easily solve this problem by creating a data frame that contains the lag \(k\) and the estimate of the auto-correlation \(\hat\rho_k\) and pass it to ggplot() function for plotting. The code below provides an example of how to produce a ggplot of the ACF.

Tm = length(spm$return)

spm.acf <- acf(spm$return, lag.max=12, plot=FALSE)

spm.acf <- data.frame(lag= 0:12, acf = spm.acf$acf)

library(ggplot2)

ggplot(spm.acf, aes(lag, acf)) +

geom_bar(stat="identity", fill="orange") +

geom_hline(yintercept = 1.96 * Tm^(-0.5), color="steelblue3", linetype="dashed") +

geom_hline(yintercept = -1.96 * Tm^(-0.5), color="steelblue3", linetype="dashed") +

theme_classic()

The analysis of monthly returns for the S&P 500 Index shows that the auto-correlations are quite small and only few of them are statistically different from zero at 5% (such as lags 4, 6). The ACF results indicate that there is very weak dependence in monthly returns so that lagged values might not be very useful in forecasting future returns. The conclusion is not very different when considering the daily frequency. The code below uses the dataset downloaded earlier to create a data frame spd with the adjusted closing price and the return at the daily frequency. In addition, we can exploit the flexibility of ggplot2 to write a function to perform the task. In the example below, the function ggacf is created that takes the following arguments:

- y is a numerical vector that represents a time series

- lag represents the maximum lag to calculate the ACF; if not specified, the default is 12

- plot.zero takes values yes/no if the user wants to plot the autocorrelation at lag 0 (which is always equal to 1); the default is no

- alpha the significance level for the confidence bands in the graph; default is 0.05

spd <-merge(Ad(sp.data), 100*ClCl(sp.data))

names(spd) <- c("price","return")

spd <- na.omit(spd)

# a function to plot the ACF using ggplot2

ggacf <- function(y, lag = 12, plot.zero="no", alpha = 0.05)

{

T <- length(y)

y.acf <- acf(y, lag.max=lag, plot=FALSE)

if (plot.zero == "yes") y.acf <- data.frame(lag= 0:lag, acf = y.acf$acf)

if (plot.zero == "no") y.acf <- data.frame(lag= 1:lag, acf = y.acf$acf[-1])

library(ggplot2)

ggplot(y.acf, aes(lag, acf)) +

geom_bar(stat="identity", fill="orange") +

geom_hline(yintercept = qnorm(1-alpha/2) * T^(-0.5), color="steelblue3", linetype="dashed") +

geom_hline(yintercept = qnorm(alpha/2) * T^(-0.5), color="steelblue3", linetype="dashed") +

geom_hline(yintercept = 0, color="steelblue3") +

theme_classic() + ylab("") + ggtitle("ACF")

}

# use the function

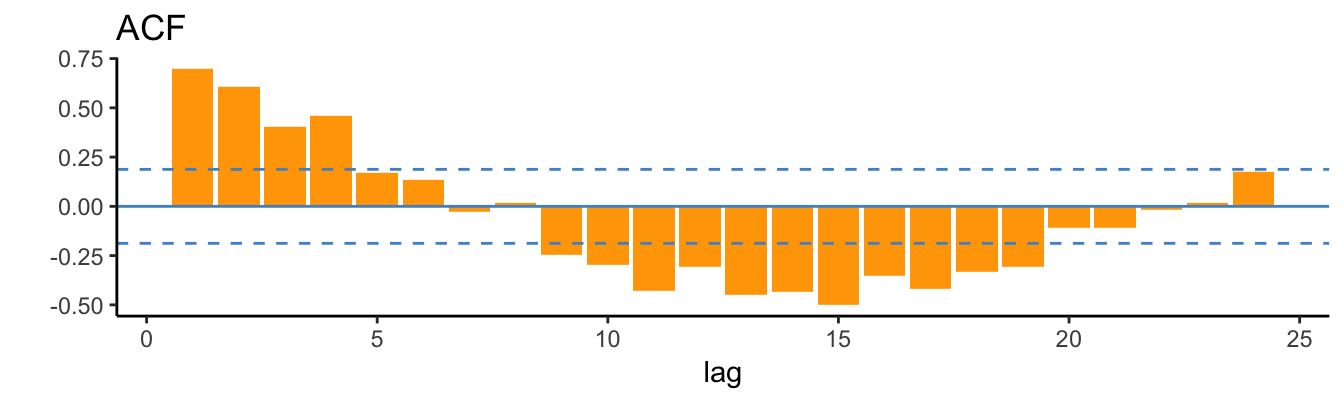

ggacf(spd$return, lag=25)

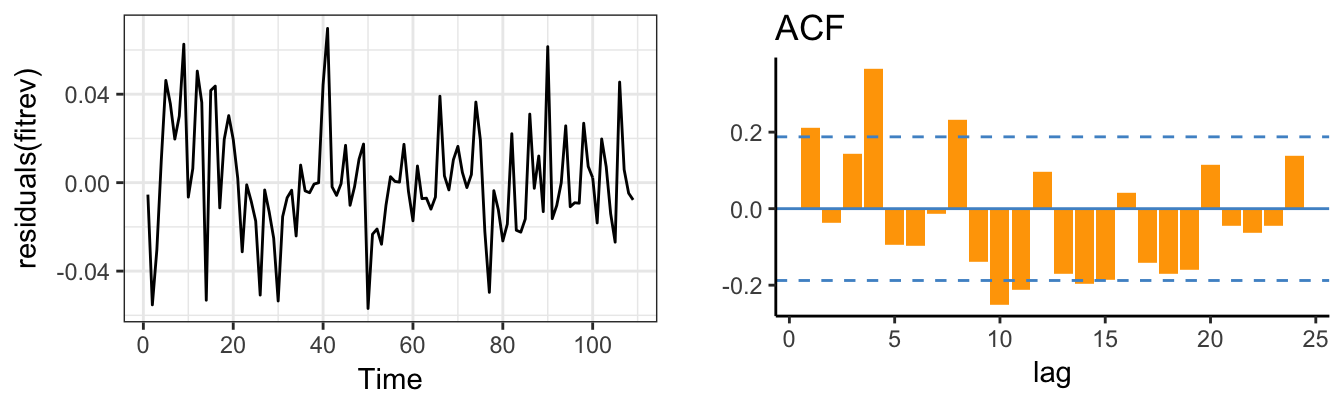

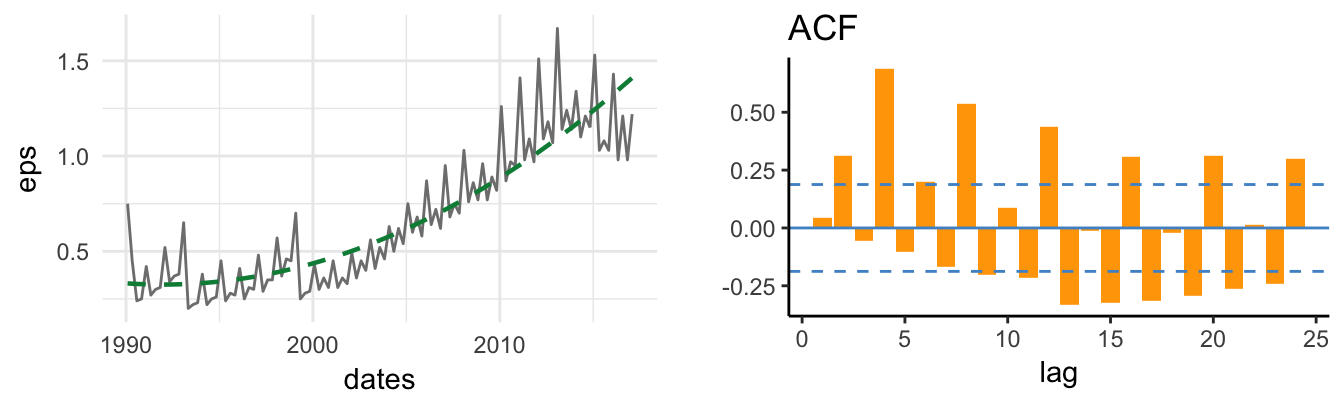

Figure 4.1: Auto-Correlation Function (ACF) for the daily returns of the SP 500.

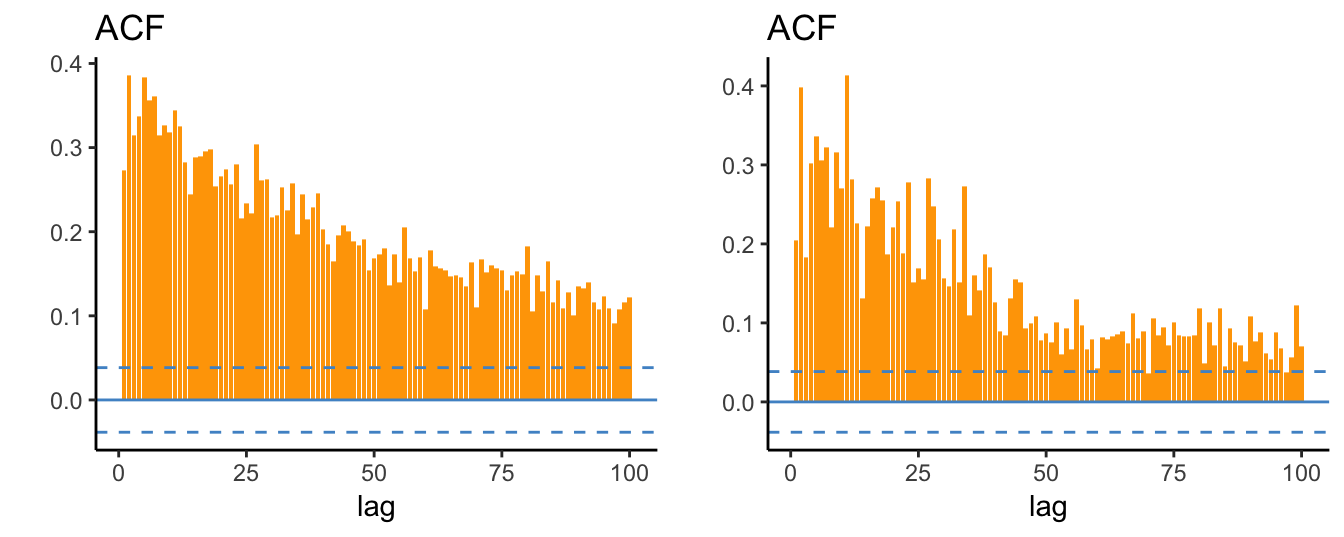

There are 2606 daily returns in the sample so that the confidence band in Figure 4.1 is narrower around zero and several auto-correlations are significantly different from 0 (at 5% signficance level). Interestingly, the first order correlation is negative and significant suggesting that daily returns have a weak tendency to reverse the previous day change. A stylized fact is that daily returns are characterized by small auto-correlations, but large values of \(\hat\rho_k\) when the returns are in absolute value or squared. Figure 4.2 shows the ACF for the absolute and squared daily returns up to lag 100 days:

p1 <- ggacf(abs(spd$return), 100)

p2 <- ggacf(spd$ret^2, 100)

Figure 4.2: Auto-correlation function of absolute (left) and square (right) daily returns of the SP 500.

These plots make clear that the absolute and square returns are significantly and positively correlated and that the auto-correlations decay very slowly as the lag increases. This shows that large (small) absolute returns are likely to be followed by large (small) absolute returns since the magnitude of the returns is auto-correlated rather than their direction. This pattern is consistent with the evidence that returns display volatility clusters that represent periods of high volatility that can last several months, followed by long periods of lower volatility. This suggests that volatility (in the sense of absolute or squared returns) is persistent and strongly predictable, while returns are weakly predictable. We will discuss this topic and volatility models in the next Chapter.

4.2 The Auto-Regressive (AR) Model

The evidence in the ACF indicates that lagged values of the returns or absolute/square returns might be informative about the future value of the variable itself and we would like to incorporate this information in a regression model. The Auto-Regressive (AR) model is a regression model in which the independent variables are lagged values of the dependent variable \(Y_t\). If we include only one lag of the dependent variable, we denote the model by AR(1) which is given by \[Y_t = \beta_0 + \beta_1 Y_{t-1} + \epsilon_t\] where \(\beta_0\) and \(\beta_1\) are coefficients to be estimated and \(\epsilon_t\) is an error term with mean zero and variance \(\sigma^2_{\epsilon}\). More generally, the AR(p) model might include p lags of the dependent variable to account for the possibility that information relevant to predict \(Y_t\) is dispersed over several lags. The AR(p) model is given by \[Y_t = \beta_0 + \beta_1 Y_{t-1} + \beta_2 Y_{t-2} + \cdots + \beta_p Y_{t-p} + \epsilon_t\] The properties of the AR(p) model are:

- \(E(Y_t | Y_{t-1}, \cdots, Y_{t-p}) = \beta_0 + \beta_1 Y_{t-1} \cdots + \beta_p Y_{t-p}\): the expected value of \(Y_t\) conditional on the recent p realizations of the variable can be interpreted as a forecast since only past information is used to produce an expectation of the variable today.

- \(E(Y_t) = \beta_0 / (1-\beta_1 - \cdots - \beta_p)\): represents the unconditional expectation or the long-run mean of \(Y_t\) \[\begin{array}{rl}E(Y_t) =& \beta_0 + \beta_1 E(Y_{t-1})+\cdots+\beta_2 E(Y_{t-p}) + E(\epsilon_t)\\ = & \frac{\beta_0}{1-\sum_{j=1}^p \beta_j}\end{array}\] assuming that \(E(Y_t) = E(Y_{t-k})\) for all values of \(k\). If the sum of the slopes \(\beta_i\), for \(i=1\),\(\cdots\), \(p\), is equal to one the mean is not defined.

- \(Var(Y_t) = \sigma^2_{\epsilon} / (1-\beta_1^2 - \cdots - \beta_p^2)\) since \[\begin{array}{rl}var(Y_t) =& \beta_1^2 Var(Y_{t-1})+\cdots+\beta_2^2 Var(Y_{t-p}) + Var(\epsilon_t)\\ = & \left(\sum_{j=1}^p \beta_j^2\right)Var(Y_{t}) + \sigma^2_{\epsilon}\\= & \frac{\sigma^2_{\epsilon}}{1-\sum_{j=1}^p \beta^2_j}\end{array}\] where \(Var(Y_t) = Var(Y_{t-k})\) for all values of \(k\).

- The sum of the slopes \(\beta_i\) is interpreted as a measure of persistence of the time series; persistence measures the extent that past values above/below the mean are likely to persist above/below the mean in the current period.

The concept of persistence is also related to that of mean-reversion which measures the speed at which a time series reverts back to its long-run mean. The higher the persistence of a time series the longer it will take for deviations from the long-run mean to be absorbed. Persistence is associated with positive values of the sum of the betas, while negative values of the coefficients imply that the series fluctuates closely around the mean. This is because a value above the mean in the previous period is expected to be below the mean in the following period, and viceversa for negative values. In economics and finance we typically experience positive coefficients due to the persistent nature of economic shocks, although the daily returns considered above are a case of first-order negative auto-correlation.

4.2.1 Estimation

The AR model can be estimated using the OLS estimation method, but there are also alternative estimation methods, such as Maximum Likelihood (ML). Although both OLS and ML are consistent in large sample, estimating an AR model with these methods might provide slightly different results (see Tsay (2005) for a more extensive discussion of this topic). There are various functions available in R to estimate time series models and we will discuss three of them below. While the first consist of using the lm() function and thus uses OLS in estimation, the functions ar() and arima() are specifically targeted for time series models and have ML as the default estimation method. Let’s estimate an AR(12) model on the S&P 500 return at the monthly frequency.

lm()

The first approach is to use the lm() function discussed in the previous chapter together with the dyn package that gives lm() the capabilities to handle time series data and operations, such as the lag() and diff() operators. The estimation is implemented below32:

library(dyn)

fit <- dyn$lm(return ~ lag(return, 1:12), data = spm) Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.38768 0.422 0.9183 0.361

lag(return, 1:12)1 0.17071 0.099 1.7269 0.087

lag(return, 1:12)2 -0.03190 0.100 -0.3185 0.751

lag(return, 1:12)3 0.15708 0.100 1.5736 0.119

lag(return, 1:12)4 0.15012 0.100 1.5005 0.137

lag(return, 1:12)5 0.00093 0.100 0.0093 0.993

lag(return, 1:12)6 -0.21437 0.100 -2.1407 0.035

lag(return, 1:12)7 -0.07022 0.100 -0.7014 0.485

lag(return, 1:12)8 0.12011 0.100 1.1954 0.235

lag(return, 1:12)9 -0.11326 0.100 -1.1330 0.260

lag(return, 1:12)10 0.04731 0.100 0.4750 0.636

lag(return, 1:12)11 0.04440 0.100 0.4449 0.657

lag(return, 1:12)12 0.00451 0.098 0.0460 0.963The Table with the results is in the familiar format from the previous chapter. The estimate of the sum of the coefficients of the lagged values is 0.26 which is not very high. This suggests that the monthly returns have weak persistence and that it is difficult to predict the return next month by only knowing the return for the current month. In terms of significance, at 5% level the only lag that is significant is 6 (with a negative coefficient), while the third lag is significant at 10%. The lack of persistence in financial returns at high-frequencies (intra-daily or daily), but also at lower frequencies (weekly, monthly, quarterly), is well documented and it is one of the stylized facts of returns common across asset classes.

ar()

Another function that can be used to estimate AR models is the ar() from the tseries package. The inputs of the function are the series \(Y_t\), the maximum order or lag of the model, and the estimation method. An additional argument of the function is aic that can be TRUE/FALSE. This option refers to the Akaike Information Criterion (AIC) that is a method to select the optimal number of lags in the AR model and will be discussed in more detail below. The code below shows the estimation results for an AR(12) model when the option aic is set to FALSE33:

# estimation method "mle" for ML and "ols" or OLS

ar(spm$return, method="ols", aic=FALSE, order.max=12, demean = FALSE, intercept = TRUE)

Call:

ar(x = spm$return, aic = FALSE, order.max = 12, method = "ols", demean = FALSE, intercept = TRUE)

Coefficients:

1 2 3 4 5 6 7 8 9 10 11 12

0.171 -0.032 0.157 0.150 0.001 -0.214 -0.070 0.120 -0.113 0.047 0.044 0.005

Intercept: 0.388 (0.397)

Order selected 12 sigma^2 estimated as 16.7Since I opted for method="ols" the coefficient estimates are equal to the one obtained above with the lm() command. A problem with this function is that it does not provide the standard errors of the estimates. To evaluate their statistical significance we can obtain the standard errors of the estimates and calculate the t-statistics for the null hypothesis that the coefficients are equal to zero:

data.table <- data.frame(COEF = fit.ar$ar,

SE = fit.ar$asy.se.coef$ar,

TSTAT = fit.ar$ar /fit.ar$asy.se.coef$ar,

PVALUE = pnorm(-abs(fit.ar$ar /fit.ar$asy.se.coef$ar))) COEF SE TSTAT PVALUE

1 0.171 0.093 1.837 0.033

2 -0.032 0.094 -0.339 0.367

3 0.157 0.094 1.674 0.047

4 0.150 0.094 1.596 0.055

5 0.001 0.094 0.010 0.496

6 -0.214 0.094 -2.277 0.011

7 -0.070 0.094 -0.746 0.228

8 0.120 0.094 1.271 0.102

9 -0.113 0.094 -1.205 0.114

10 0.047 0.094 0.505 0.307

11 0.044 0.094 0.473 0.318

12 0.005 0.092 0.049 0.480where we can see that only the third and sixth lags are significant at 5%. The standard errors are close but not equal to the values obtained for lm().

arima()

The third function that can be used to estimate AR model is arima(). The function is more general relative to the previous one since it is able to estimate time series models called Auto-Regressive Integrated Moving Average (ARIMA) models. In this Chapter we will not discuss MA processes, and postpone the presentation of the Integrated part to a later Section of the Chapter. We can use the arima() to estimate the AR(p) model and the results shown below are similar in magnitude to the those obtained earlier:

# default estimation method is "ML", for OLS set method="CSS"

arima(spm$return, order=c(12, 0, 0))

Call:

arima(x = spm$return, order = c(12, 0, 0))

Coefficients:

ar1 ar2 ar3 ar4 ar5 ar6 ar7 ar8 ar9 ar10 ar11 ar12 intercept

0.18 -0.040 0.128 0.15 0.016 -0.192 -0.065 0.099 -0.12 0.038 0.054 0.004 0.41

s.e. 0.09 0.091 0.091 0.09 0.091 0.091 0.090 0.091 0.09 0.090 0.090 0.090 0.48

sigma^2 estimated as 16.2: log likelihood = -349, aic = 726The coefficient estimates in this case are slightly different from the previous results since the default estimation method in this case is ML instead of OLS.

4.2.2 Lag selection

The most important modeling question when using AR(p) models is the choice of the lag order \(p\). This choice is made by estimating the AR model for many values of \(p\), e.g. from 0 to \(p_{max}\), and then select the order that minimizes a criterion. A popular criterion is the Akaike Information Criterion (AIC) that is similar to the adjusted \(R^2\) calculated for LRM, but with a different penalization term for the number of parameters included in the model. The Akaike Information Criterion (AIC) is calculated as \[AIC(p) = \log(RSS/T) + 2* (1+p) /T\] where \(RSS\) is the Residual Sum of Squares of the model, \(T\) is the sample size, and \(p\) is the lag order of the AR model. The AIC is calculated for models with different \(p\) and the lag selected is the one that minimizes the criterion. This is done automatically by the function ar() when setting the argument aic=TRUE and the results are shown below for the monthly and daily returns:

ar(spm$return, aic=TRUE, order.max=24, demean = FALSE, intercept = TRUE)

ar(spd$return, aic=TRUE, order.max=24, demean = FALSE, intercept = TRUE)

Call:

ar(x = spm$return, aic = TRUE, order.max = 24, demean = FALSE, intercept = TRUE)

Coefficients:

1 2 3 4 5 6

0.180 -0.053 0.157 0.152 0.007 -0.214

Order selected 6 sigma^2 estimated as 17.9

Call:

ar(x = spd$return, aic = TRUE, order.max = 24, demean = FALSE, intercept = TRUE)

Coefficients:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

-0.106 -0.059 0.013 -0.037 -0.047 0.002 -0.030 0.021 -0.014 0.035 -0.016 0.033 0.002 -0.042 -0.047

16 17 18 19 20 21

0.047 0.012 -0.060 0.008 0.039 -0.030

Order selected 21 sigma^2 estimated as 1.63The AIC has selected lag 6 for the monthly returns and 21 for the daily returns. However, a criticism against AIC is that it tends to select large models, that is, models with a large number of lags. In the case of the monthly returns, the ACF showed that they are hardly predictable based on the weak correlations and yet AIC suggests to use information up to 6 months earlier to predict next month returns. As for the daily returns, the order selected is 21 which seems large given the scarse predictability of the time series. An alternative criterion that can be used to select the optimal lag is the Bayesian Information Criterion (BIC) which is calculated as follows: \[BIC(p) = \log(RSS/T) + \log(T) * (1+p) /T\] The only difference with AIC is that the number of lags in the model is multiplied by \(\log(T)\) (instead of \(2\) for AIC). For time series with 8 or more observations the BIC penalization is larger relative to AIC and will lead to the selection of fewer lags. Unfortunately, the function ar() uses only the AIC and does not provide results for other selection criteria. The package FitAR provides the SelectModel() function that does the selection according to the criterion specified by the user, for example AIC or BIC. Below is the application to the monthly returns of the S&P 500 Index where the spm$ret is transformed to a ts object using as.ts() which is the time series type required by this function:

library(FitAR)

SelectModel(as.ts(spm$return), lag.max=24, Criterion="AIC")

SelectModel(as.ts(spm$return), lag.max=24, Criterion="BIC") p AIC-Exact AIC-Approx

1 6 364 -2.1

2 7 366 -1.2

3 8 367 -0.9

p BIC-Exact BIC-Approx

1 0 372 5.8

2 1 373 9.7

3 2 377 11.2BIC indicates the optimal lag is 0 while AIC selects 6. This is expected since BIC requires a larger improvement in fit to justify including additional lags. Also when considering the top 3 models, AIC chooses larger models relative to BIC.

SelectModel(as.ts(spd$return), lag.max=24, Criterion="AIC")

SelectModel(as.ts(spd$return), lag.max=24, Criterion="BIC") p AIC-Exact AIC-Approx

1 21 1299 -58

2 20 1300 -58

3 22 1300 -56

p BIC-Exact BIC-Approx

1 2 1339 -11.5

2 1 1344 -18.3

3 3 1346 -5.5At the daily frequency, the order selected by the two criteria is remarkably different: AIC suggests to include 21 lags of the dependent variable, while BIC only 2 days. In general, it is not always the case that more parsimonious models are preferable to larger models, although when forecasting time series it is preferable since they provide more stable forecasts. Adding the argument Best=1 to the SelectModel() function returns the optimal order.

4.3 Forecasting with AR models

One of the advantages of AR models is that they are very suitable to produce forecasts about the future value of the series. Let’s assume that the current time period is \(t\) and we observe the current observation. Assuming that we are using an AR(1) model, the forecast for the value of \(Y_{t+1}\) is given by \[\hat{E}(Y_{t+1}|Y_t) = \hat\beta_0 + \hat\beta_1 * Y_t\] where \(\hat\beta_0\) and \(\hat\beta_1\) are the estimates of the parameters. If we want to forecast the variable two steps ahead, then the forecast is given by

\[\hat{E}(Y_{t+2}|Y_t) = \hat\beta_0 + \hat\beta_1 * \hat{E}(Y_{t+1}|Y_t) = \hat\beta_0(1+\hat\beta_1) + \beta_1^2 * Y_t\] The formula can be generalized to forecasting \(k\) steps ahead which is given by \[\hat E(Y_{t+k} | Y_t) = \hat\beta_0 \left(\sum_{j=1}^k\hat\beta_1^{k-1}\right) + \hat\beta_1^k * Y_t\]

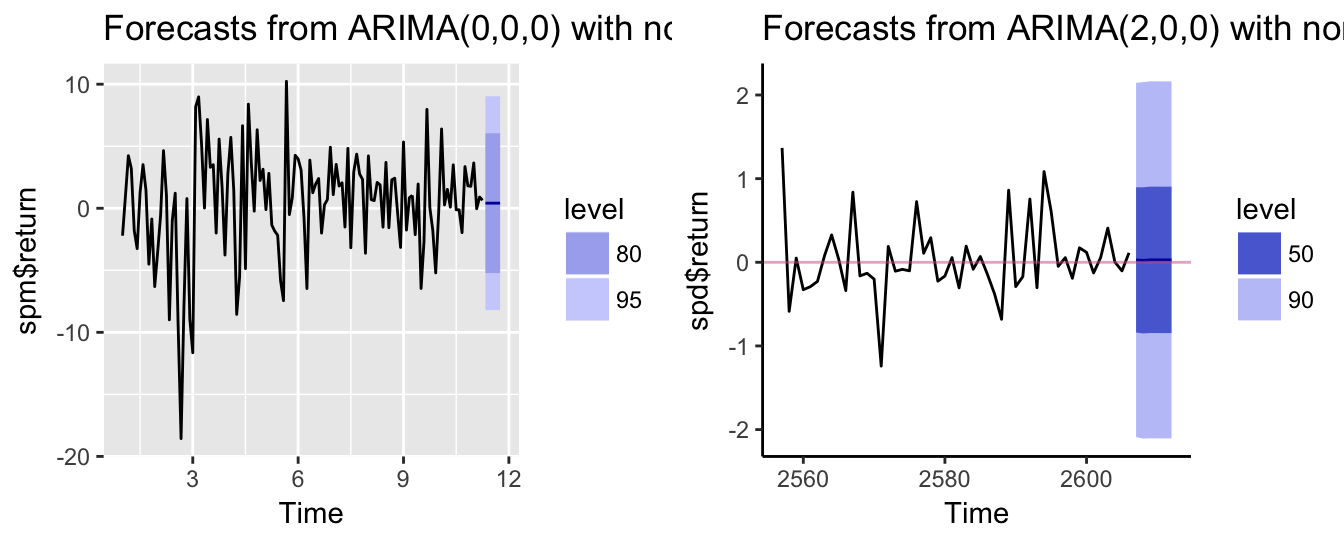

Let’s forecast the daily and monthly returns of the S&P 500 Index. We already discussed how to select and estimate an AR model so that we need only to discuss how to produce the forecasts \(Y_{t+k}\) with \(k\) representing the forecast horizon. The functions predict() and forecast() (from package forecast) calculate the forecast based on a estimation object and the forecast horizon \(k\). The code below shows how to perform these three steps and produce 6-step ahead forecast, in addition to print a table with the results.

bic.monthly <- SelectModel(as.ts(spm$return), lag.max = 24, Criterion = "BIC", Best=1)

fit.monthly <- arima(spm$return, order = c(bic.monthly, 0, 0))

forecast.monthly <- forecast::forecast(fit.monthly, h = 6) # h is the forecast horizon

knitr::kable(as.data.frame(forecast.monthly), digits=4, caption=paste("Point and interval forecast for the monthly

returns of the SP 500 Index starting in", end(spm)," and for 12 months ahead."))| Point Forecast | Lo 80 | Hi 80 | Lo 95 | Hi 95 | |

|---|---|---|---|---|---|

| May 11 | 0.41 | -5.2 | 6 | -8.2 | 9 |

| Jun 11 | 0.41 | -5.2 | 6 | -8.2 | 9 |

| Jul 11 | 0.41 | -5.2 | 6 | -8.2 | 9 |

| Aug 11 | 0.41 | -5.2 | 6 | -8.2 | 9 |

| Sep 11 | 0.41 | -5.2 | 6 | -8.2 | 9 |

| Oct 11 | 0.41 | -5.2 | 6 | -8.2 | 9 |

bic.daily <- SelectModel(as.ts(spd$return), lag.max = 24, Criterion = "BIC", Best=1)

fit.daily <- arima(spd$return, order = c(bic.daily, 0, 0))

forecast.daily <- forecast::forecast(fit.daily, h = 6, level=c(50,90))

knitr::kable(as.data.frame(forecast.daily), digits=4, caption=paste("Point and interval forecast for the daily

returns of the SP 500 Index starting in", end(spd)," and for 12 days ahead."))| Point Forecast | Lo 50 | Hi 50 | Lo 90 | Hi 90 | |

|---|---|---|---|---|---|

| 2607 | 0.028 | -0.84 | 0.9 | -2.1 | 2.1 |

| 2608 | 0.023 | -0.85 | 0.9 | -2.1 | 2.2 |

| 2609 | 0.029 | -0.85 | 0.9 | -2.1 | 2.2 |

| 2610 | 0.029 | -0.85 | 0.9 | -2.1 | 2.2 |

| 2611 | 0.029 | -0.85 | 0.9 | -2.1 | 2.2 |

| 2612 | 0.029 | -0.85 | 0.9 | -2.1 | 2.2 |

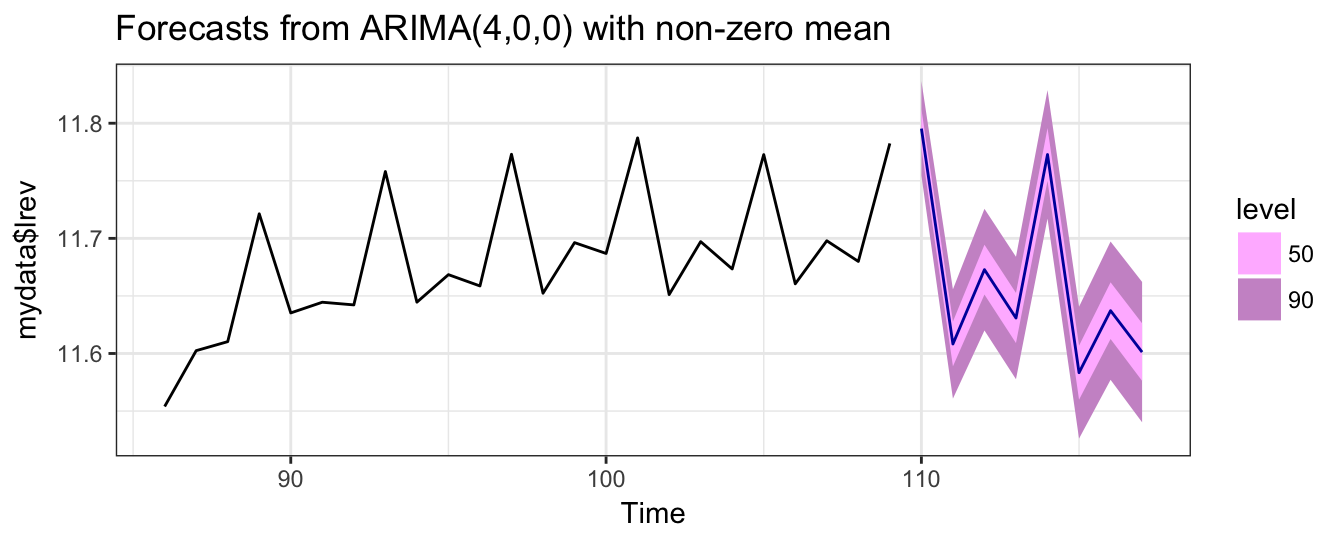

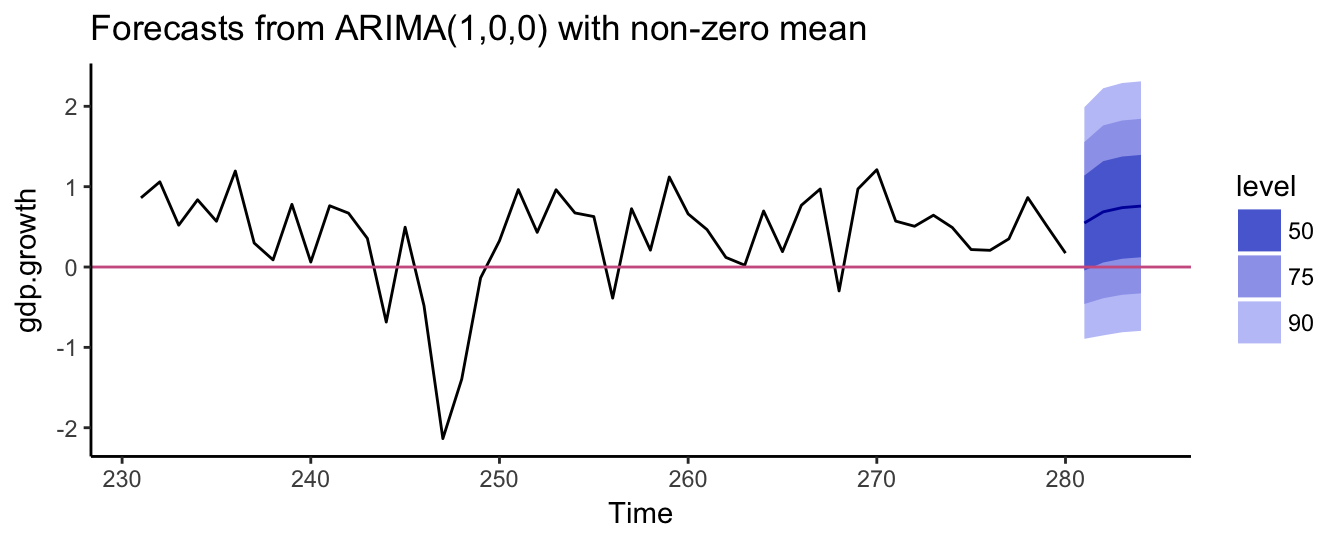

The Table of the S&P 500 forecasts at the monthly frequency shows that they are equal at all horizons. This is due to the fact that BIC selected order 0 and in this case the forecast is given by \(\hat E(Y_{t+k} | Y_t) = \hat\beta_0 = \hat\mu_Y\), where \(\hat\mu_Y\) represents the sample average of the monthly returns. However, at the daily frequency the order selected is 2, and the forecasts start from a different value but rapidly converge toward the sample average of the daily returns. Visualizing the forecasts and the uncertainty around the forecast is a useful tool to understand the strength and the weakness of the forecasts. Figure 4.3 shows the forecast, the forecast intervals around the forecast, and the time series that is being forecast34.

library(ggfortify)

plot.monthly <- autoplot(forecast.monthly)

plot.daily <- autoplot(forecast.daily, include=50) + theme_classic() +

geom_hline(yintercept = 0, color="hotpink3",alpha = 0.5)

grid.arrange(plot.monthly, plot.daily, ncol=2)

Figure 4.3: Point and interval forecasts for the monthly (left) and daily (right) returns of the SP 500 Index

Let’s consider a different example. Assume that we want to produce a forecast of the growth rate of real GDP for the coming quarters using time series models. This can be done as follows:

- download from

FREDthe time series of real GDP with tickerGDPC1 - transform the series to percentage growth rate

- select the order \(p^*\) using BIC

- estimate the AR(\(p^*\)) model

- produce the forecasts

As an example, assume that we are interested in forecasting the growth rate of GDP in the following quarter. Figure 4.4 shows the most recent 100 quarter of the real GDP growth rate until January 2017 together with 4 quarters of point and interval forecasts. The model forecasts that the GDP growth will moderately increase in the future quarters and that there is approximately 25% probability that output growth becomes negative.

gdp.level <- getSymbols("GDPC1", src="FRED", auto.assign=FALSE)

gdp.growth <- 100 * diff(log(gdp.level)) %>% na.omit

gdp.p <- SelectModel(as.ts(gdp.growth), lag.max=12, Criterion="BIC", Best=1)

gdp.fit <- arima(gdp.growth, order=c(gdp.p, 0,0))

gdp.forecast <- forecast::forecast(gdp.fit, h=4, level=c(50,75,90))

autoplot(gdp.forecast, include=50) + theme_classic() + geom_hline(yintercept = 0, color="hotpink3")

Figure 4.4: The growth rate of real GDP at the quarterly frequency.

4.4 Seasonality

Seasonality in a time series represents a regular pattern of higher/lower realizations of the variable in certain periods of the year. A seasonal pattern for daily data is represented by the 7 days of the week, for monthly data by the 12 months in a year, and for quarterly data by the 4 quarters in a year. For example, electricity consumption spikes during the summer months while being lower in the rest of the year. Of course there are many other factors that determine the consumption of electricity which might change over time, but seasonality captures the characteristic of systematically higher/lower values at certain times of the year. As an example, let’s assume that we want to investigate if there is seasonality in the S&P 500 returns at the monthly frequency. To capture the seasonal pattern we use dummy variables that take value 1 in a certain month and zero in all other months. For example, we define the dummy variable \(JAN_t\) to be equal to 1 if month \(t\) is January and 0 otherwise, \(FEB_t\) takes value 1 every February and it is 0 otherwise, and similarly for the remaining months. We can then include the dummy variables in a regression model, for example, \[Y_t = \beta_0 + \beta_1 X_t + \gamma_2 FEB_t + \gamma_3 MAR_t +\gamma_4 APR_t +\gamma_5 MAY_t+\] \[ \gamma_6 JUN_t +\gamma_7 JUL_t +\gamma_8 AUG_t +\gamma_9 SEP_t + \gamma_{10} OCT_t +\gamma_{11} NOV_t +\gamma_{12} DEC_t + \epsilon_t\] where \(X_t\) can be lagged values of \(Y_t\) and/or some other relevant independent variable. Notice that in this regression we excluded one dummy variable (in this case \(JAN_t\)) to avoid perfect collinearity among the regressors (dummy variable trap). The coefficients of the other dummy variables should then be interpreted as the expected value of \(Y\) in a certain month relative to the expectation in January, once we control for the independent variable \(X_t\). There is an alternative way to specify this regression which consists of including all 12 dummy variables and excluding the intercept: \[Y_t = \beta_1 X_t + \gamma_1 JAN_t + \gamma_2 FEB_t + \gamma_3 MAR_t +\gamma_4 APR_t +\gamma_5 MAY_t +\] \[ \gamma_6 JUN_t +\gamma_7 JUL_t +\gamma_8 AUG_t +\gamma_9 SEP_t + \gamma_{10} OCT_t +\gamma_{11} NOV_t +\gamma_{12} DEC_t + \epsilon_t\] The first regression is typically preferred because a test of the significance of the coefficients of the 11 monthly dummy variables provides evidence in favor or against seasonality. The same hypothesis could be evaluated in the second specification by testing that the 12 parameters of the dummy variables are equal to each other.

We can create the seasonal dummy variables by first defining a variable sp.month using the month() function from package lubridate which identifies the month for each observation in a time series object either with a number from 1 to 12 or with the month name. For example, for the monthly S&P 500 returns we have:

sp.month <- lubridate::month(spm$return, label=TRUE)

head(sp.month, 12) [1] Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan

Levels: Jan < Feb < Mar < Apr < May < Jun < Jul < Aug < Sep < Oct < Nov < DecWe can then use the model.matrix() function that simply converts the qualitative variable sp.month to a matrix of dummy variables with one column for each month and value 1 when the date of the observation is in each of the months. The code below shows how to convert the sp.month variable to the matrix of dummy variables sp.month.mat:

sp.month.mat <- model.matrix(~ -1 + sp.month)

colnames(sp.month.mat) <- levels(sp.month)

head(sp.month.mat, 8) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1 0 1 0 0 0 0 0 0 0 0 0 0

2 0 0 1 0 0 0 0 0 0 0 0 0

3 0 0 0 1 0 0 0 0 0 0 0 0

4 0 0 0 0 1 0 0 0 0 0 0 0

5 0 0 0 0 0 1 0 0 0 0 0 0

6 0 0 0 0 0 0 1 0 0 0 0 0

7 0 0 0 0 0 0 0 1 0 0 0 0

8 0 0 0 0 0 0 0 0 1 0 0 0To illustrate the use of seasonal dummy variables we consider a simple example in which the monthly return of the S&P 500 is regressed on the 12 monthly dummy variables. As discussed before, to avoid the dummy variable trap the regression models does not include the intercept in favor of including the 12 dummy variables. The model is implemented as follows:

fit <- lm(spm$return ~ -1 + sp.month.mat) Estimate Std. Error t value Pr(>|t|)

sp.month.matJan -1.782 1.4 -1.278 0.204

sp.month.matFeb 0.586 1.3 0.441 0.660

sp.month.matMar 2.373 1.3 1.785 0.077

sp.month.matApr 2.347 1.3 1.765 0.080

sp.month.matMay 0.036 1.3 0.027 0.978

sp.month.matJun -1.592 1.4 -1.142 0.256

sp.month.matJul 1.741 1.4 1.248 0.215

sp.month.matAug -0.903 1.4 -0.647 0.519

sp.month.matSep -0.059 1.4 -0.042 0.967

sp.month.matOct 0.543 1.4 0.389 0.698

sp.month.matNov 0.144 1.4 0.103 0.918

sp.month.matDec 1.150 1.4 0.824 0.412The results indicate that, in most months, the expected return is not significantly different from zero, except for March and April. In both cases the coefficient is positive which indicates that in those months it is expected that returns are higher relative to the other months. To develop a more intuitive understanding of the role of the seasonal dummies, the graph below shows the fitted or predicted returns from the model above. In particular, the expected return of the S&P 500 in January is -1.78%, that is, \(E(R_t | JAN_t = 1) =\) -1.78, while in February the expected return is \(E(R_t | FEB_t = 1) =\) 0.59% and so on. These coefficients are plotted in the graph below and create a regular pattern that is expected to repeat every year:

Returns seems to be positive in the first part of the year and then go into negative territory during the summer months only to return positive toward the end of the year. However, keep in mind that only March and November are significant at 10%. We can also add the lag of the S&P 500 return to the model above to see if the significance of the monthly dummy variables changes and to evaluate if the goodness of the regression increases:

fit <- dyn$lm(return ~ -1 + lag(return, 1) + sp.month.mat, data = spm) Estimate Std. Error t value Pr(>|t|)

lag(return, 1) 0.201 0.093 2.157 0.033

sp.month.mat1 -2.013 1.380 -1.459 0.148

sp.month.mat2 1.224 1.386 0.883 0.379

sp.month.mat3 2.256 1.313 1.718 0.089

sp.month.mat4 1.870 1.330 1.405 0.163

sp.month.mat5 -0.435 1.330 -0.327 0.744

sp.month.mat6 -1.588 1.376 -1.154 0.251

sp.month.mat7 2.061 1.384 1.489 0.139

sp.month.mat8 -1.253 1.385 -0.904 0.368

sp.month.mat9 0.123 1.378 0.089 0.929

sp.month.mat10 0.555 1.376 0.403 0.688

sp.month.mat11 0.035 1.377 0.025 0.980

sp.month.mat12 1.121 1.376 0.815 0.417The -1 in the lm() formula is introduced when we want to exclude the intercept from the model.

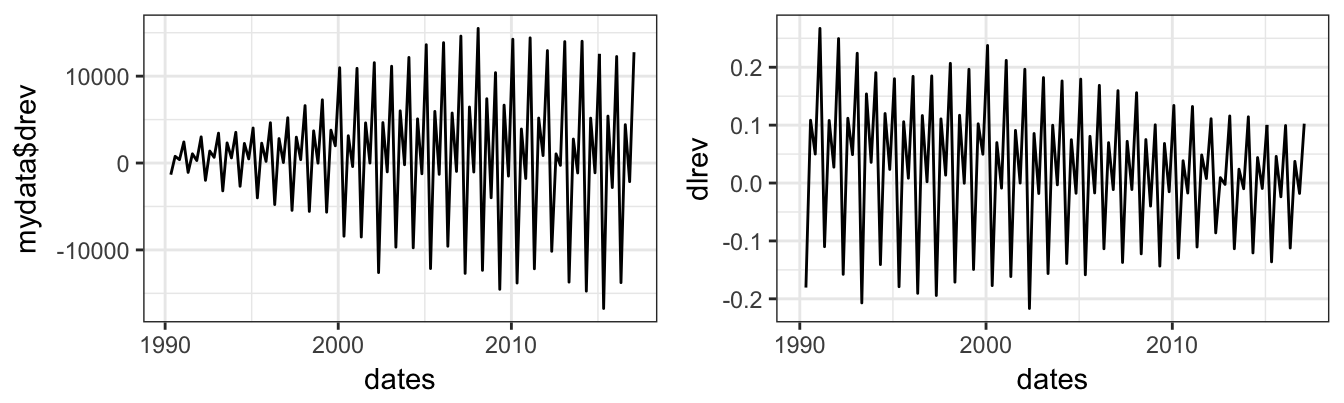

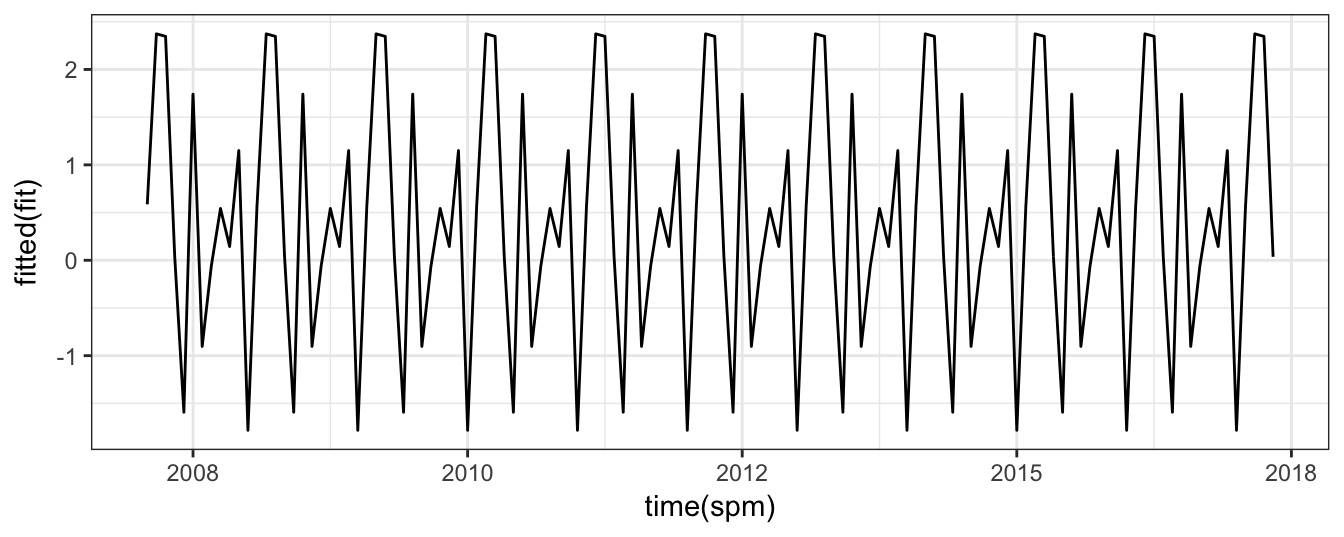

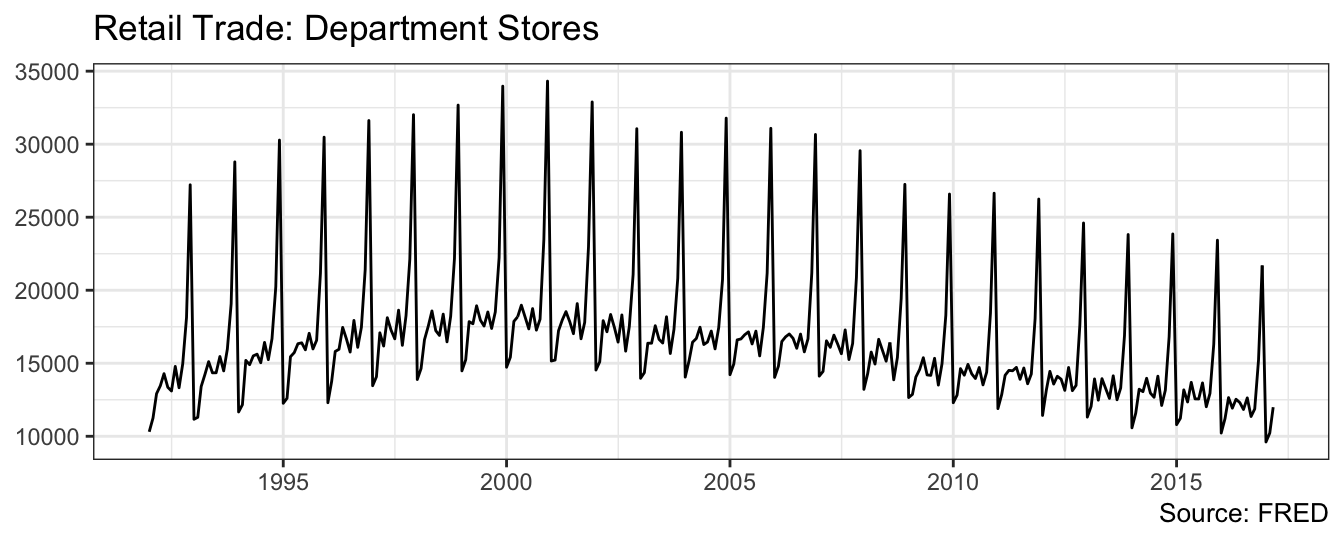

Seasonality is a common characteristics of macroeconomic variables. Typically, we analyze these variables on a seasonally-adjusted basis, which means that the statistical agencies have already removed the seasonal component from the variable. However, they also provide the variables before the adjustment as in the case of the Department Stores Retail Trade series (FRED ticker RSDSELDN) at the monthly frequency. The time series graph for this variable from January 1992 is shown below.

library(quantmod)

deptstores <- getSymbols("RSDSELDN", src="FRED", auto.assign = FALSE)

qplot(time(deptstores), deptstores, geom="line") +

labs(x=NULL, y=NULL, title="Retail Trade: Department Stores", caption="Source: FRED") + theme_bw()

[1] Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan

Levels: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecThe seasonal pattern is quite clear in the data and it seems to happen toward the end of the year. We can conjecture that the spike in sales is probably associate with the holiday season in December, but we can test this hypothesis by estimating a linear regression model in which we include monthly dummy variables as explanatory variables to account for this pattern. The regression model for the sales in $ of department stores, denoted by \(Y_t\), is

\[Y_t = \beta_0 + \beta_1 Y_{t-1} + \gamma_2 FEB_t + \gamma_3 MAR_t +\gamma_4 APR_t +\gamma_5 MAY_t+\] \[ \gamma_6 JUN_t +\gamma_7 JUL_t +\gamma_8 AUG_t +\gamma_9 SEP_t + \gamma_{10} OCT_t +\gamma_{11} NOV_t +\gamma_{12} DEC_t + \epsilon_t\]

where, in addition to the monthly dummy variables, we have the first order lag of the variable. The regression results are shown below:

dept.month.mat <- model.matrix(~ -1 + dept.month)

colnames(dept.month.mat) <- levels(dept.month)

fit <- arima(deptstores, order=c(1,0,0), xreg = dept.month.mat[,-1])

Call:

arima(x = deptstores, order = c(1, 0, 0), xreg = dept.month.mat[, -1])

Coefficients:

ar1 intercept Feb Mar Apr May Jun Jul Aug Sep Oct

0.912 12512.667 711.110 2676.430 2585.476 3494.866 2848.780 2356.04 3704.680 2036.551 3245.653

s.e. 0.024 552.364 162.592 218.792 255.383 278.441 291.423 295.80 292.016 279.712 257.551

Nov Dec

7110.664 16216.001

s.e. 222.354 165.536

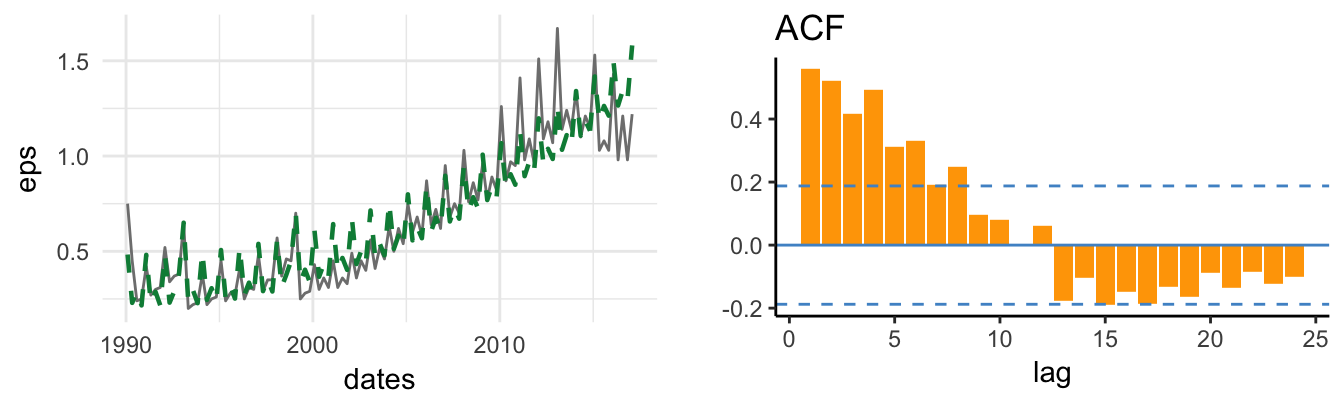

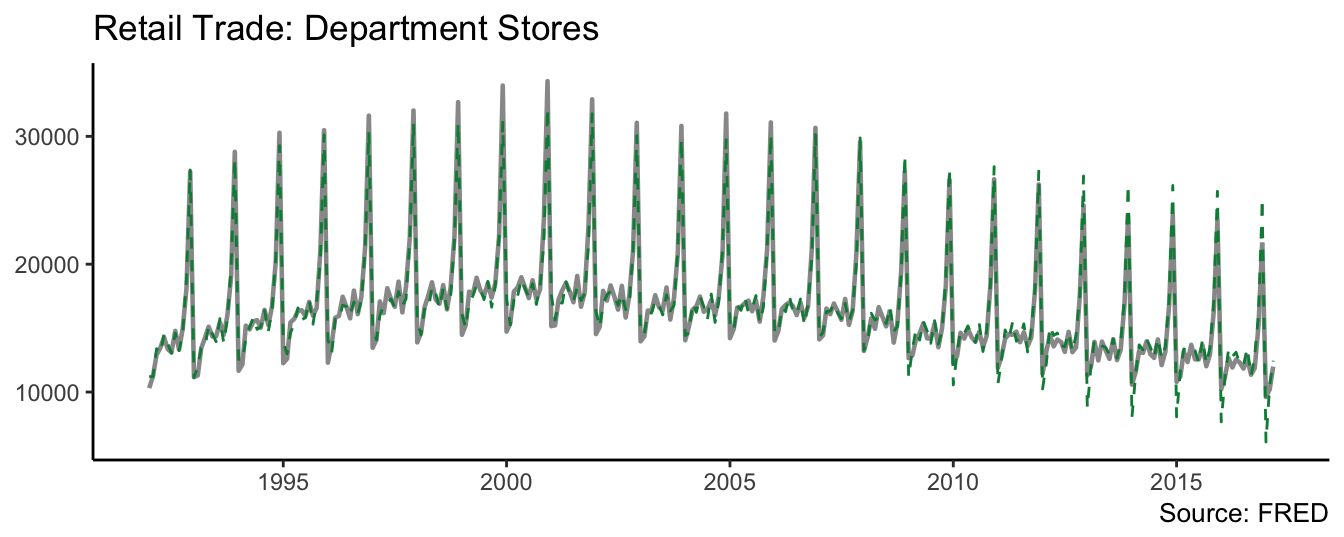

sigma^2 estimated as 689002: log likelihood = -2467.45, aic = 4962.89The results indicate the retail sales at department stores are highly persistent with an AR(1) coefficient of 0.912. To interpret the estimate of the seasonal coefficients, notice that the dummy for the month of January was left out so that all other seasonal dummies should be interpreted as the difference in sales relative to the first month of the year. The results indicate that all coefficients are positive and thus retail sales are higher than January. From the low levels of January, sales seems to increase and remain relative stable during the summer months, and then increase significantly in November and December. Figure 4.5 of the variable and the model fit (springgreen4 dashed line).

ggplot() + geom_line(aes(time(deptstores), deptstores),color="gray60", size=0.8) +

geom_line(aes(time(deptstores), fitted(fit)), color="springgreen4", linetype=2) +

theme_classic() + labs(x=NULL, y=NULL, title="Retail Trade: Department Stores", caption="Source: FRED")

Figure 4.5: Retail trade and fitted value from the time series model.

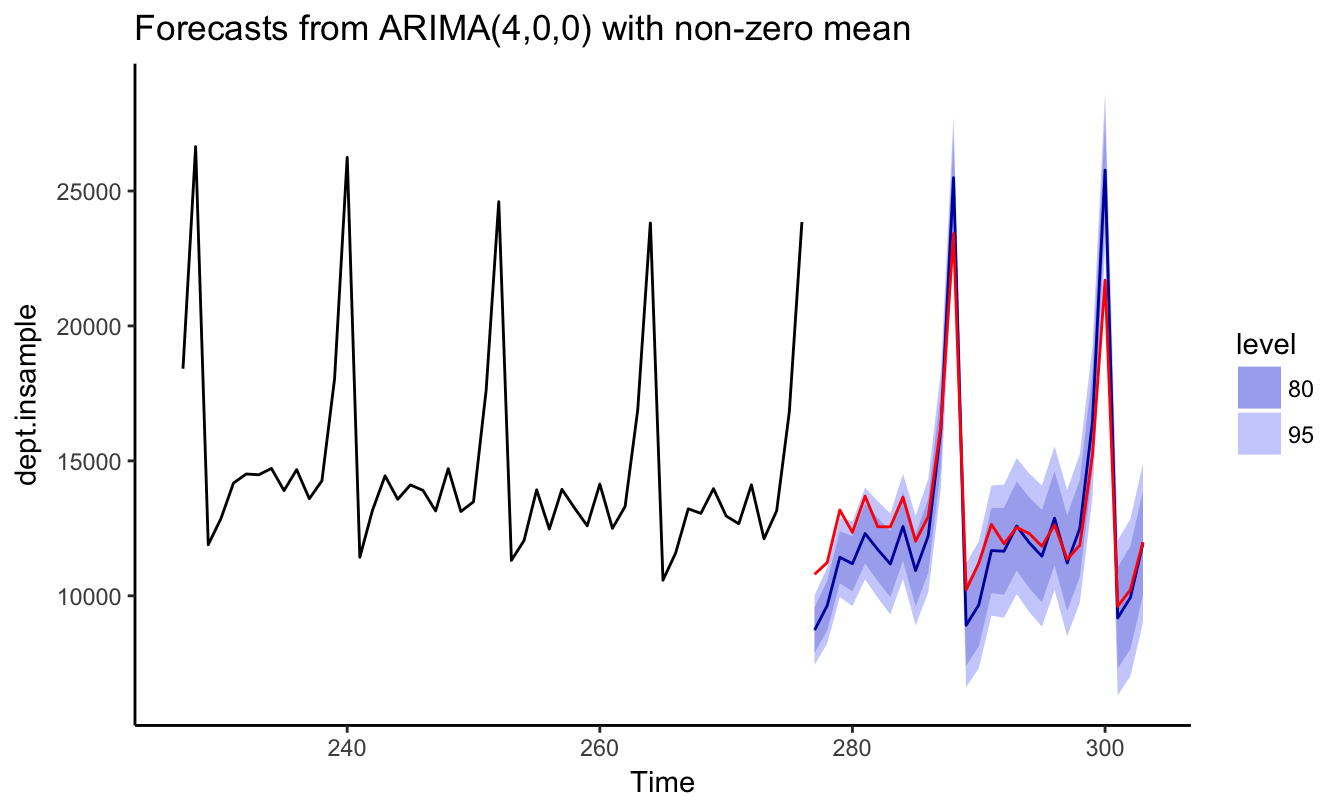

So far we estimated the model and compared the realization of the variable with the prediction or fitted value of the model. In practice, it is useful to perform an out-of-sample exercise which consist of estimating the model up to a certain date and forecast the future even though we observe the realization for the out-of-sample period. This simulates the situation of a forecaster that in real-time observes only the past and is interested to forecast the future. Figure 4.6 shows the results of an out-of-sample exercise in which an AR(4) model with seasonal dummies is estimated with data up to December 2014 and forecasts are produced from that date onward. The blue line shows the forecast, the shaded areas the 80% and 95% forecast intervals, and the red line represents the realization of the variable. In the first part of the out-of-sample period, the forecasts underpredicted the realization of sales, but underpredicted the peak of sales at the end of the year. In the second year, the forecasts during the year were closer to the realization, but again the model overpredicted end-of-year sales.

library(forecast)

index = sum(time(deptstores) < "2014-12-31")

dept.insample <- window(deptstores, end = "2014-12-31")

month.insample <- dept.month.mat[1:index,]

dept.outsample <- window(deptstores, start = "2014-12-31")

month.outsample <- dept.month.mat[(index+1):length(dept.month),]

fit <- arima(dept.insample, order = c(4,0,0), xreg = month.insample[,-1])

autoplot(forecast(fit, h = length(dept.outsample), xreg = month.outsample[,-1]), include=50) +

theme_classic() +

geom_line(aes((index+1):(index+length(dept.outsample)), dept.outsample), color="red")

Figure 4.6: Out-of-sample forecast of Retail Trade starting in December 2014 and for forecast horizons 1 to 27 .

4.5 Trends in time series

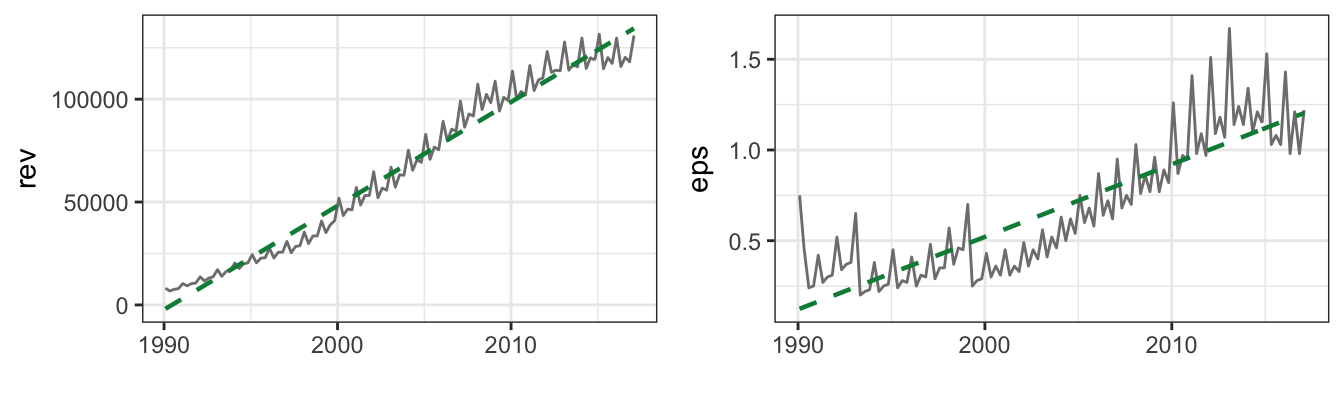

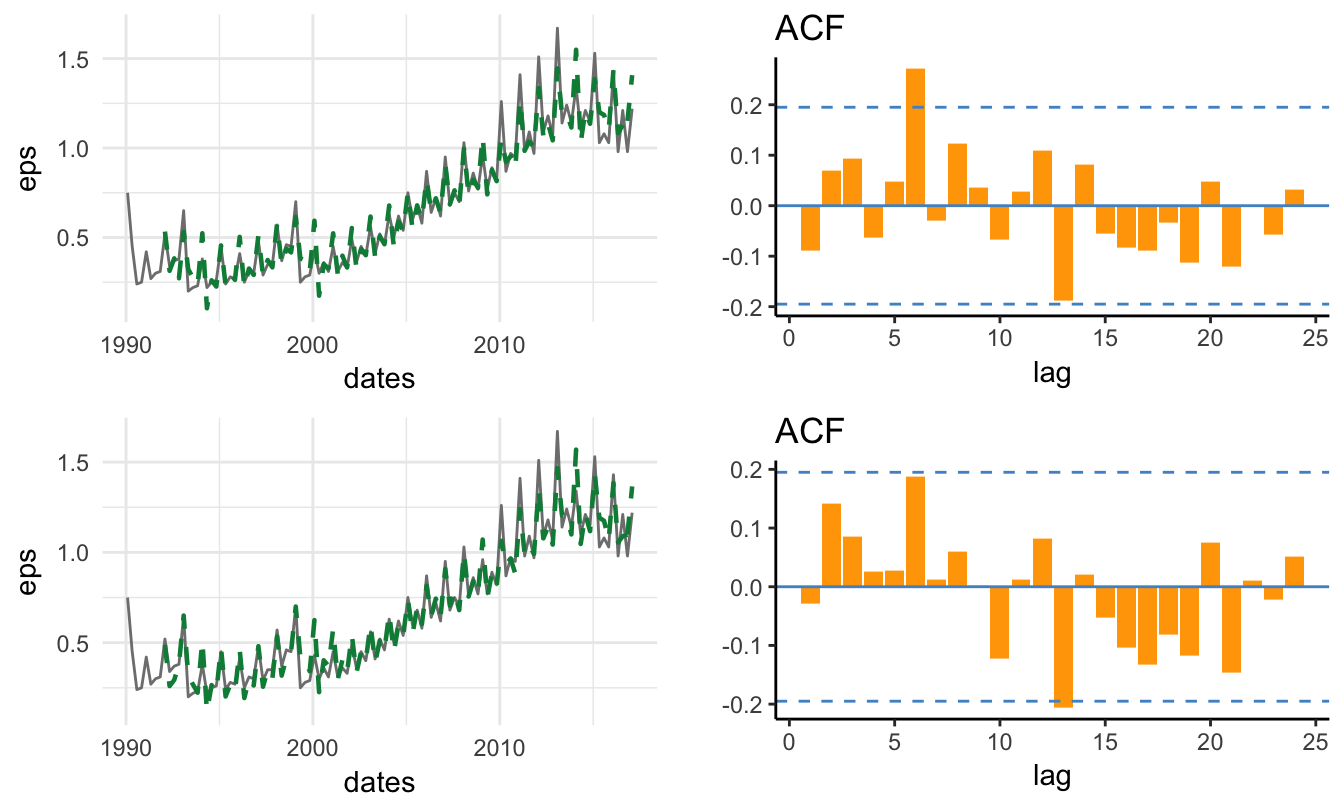

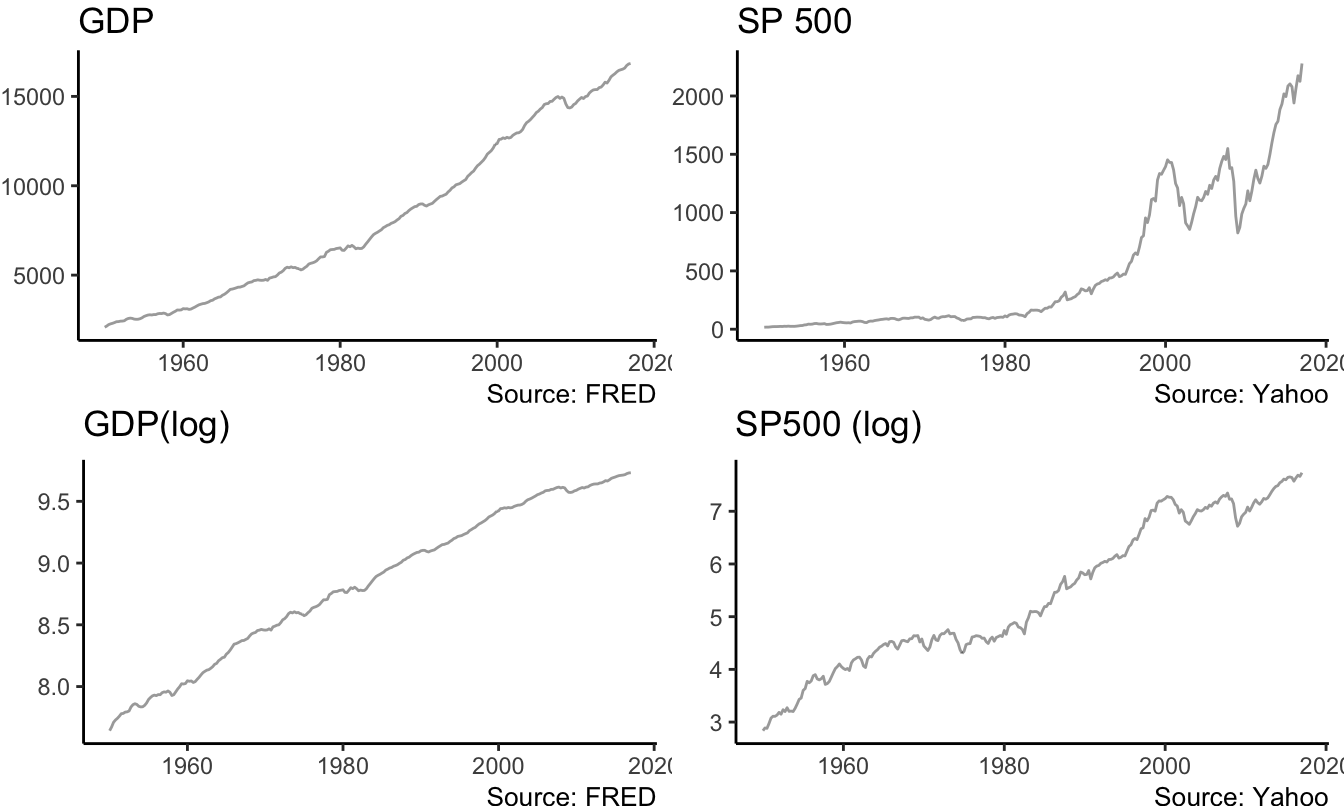

A trend is defined as the tendency of an economic or financial time series to grow over time. Examples are provided in Figure 4.7 that shows the real Gross Domestic Product (FRED ticker: GDPC1) and the S&P 500 index (YAHOO ticker: ^GSPC) at the quarterly frequency.

gdp.level <- getSymbols("GDPC1", src="FRED", auto.assign=FALSE)

sp.level <- getSymbols("^GSPC", src="yahoo", auto.assign=FALSE, from="1947-01-01")

macrodata <- merge(gdp.level, Ad(to.monthly(sp.level)))

names(macrodata) <- c("GDP","SP500")

macrodata.q <- to.quarterly(macrodata, OHLC = FALSE)

p1 <- ggplot(macrodata.q) + geom_line(aes(time(macrodata.q), GDP), alpha=0.4) + theme_classic() +

labs(x=NULL, y=NULL, title="GDP", caption="Source: FRED")

p2 <- ggplot(macrodata.q) + geom_line(aes(time(macrodata.q), SP500), alpha=0.4) + theme_classic() +

labs(x=NULL, y=NULL, title="SP 500", caption="Source: Yahoo")

Figure 4.7: Real GDP (FRED: GDPC1) and the Standard and Poors 500 Index at the quarterly frequency starting in January 1947. Bottom graphs are in logarithmic scale.

The series have in common the feature of growing over time with no tendency to revert back to the mean. Actually, the trending behavior of the variables implies that the mean of the series is also increasing over time rather than being approximately constant. For example, if we were to estimate the mean of GDP and the S&P 500 in 1985 it would not have been a good predictor of the future value of the mean because the variables kept growing over time. This type of series are called non-stationary since some features of the distribution (e.g., the mean and/or the variance) change over time instead of being constant as it is the case for stationary processes. For the variables in the Figure, we can thus conclude that they are clearly non-stationary. In addition, very often in economics and finance we prefer to take the natural logarithm of the variables which makes exponential growth approximately linear. The same variables discussed above are plotted in natural logarithm in Figure 4.7. Taking the log of the variables is particularly relevant for the S&P 500 Index which shows a considerable exponential behavior, at least until the end of the 1990s.

4.5.1 Deterministic Trend

A simple approach to model the non-stationarity of these time series is to assume that they follow a deterministic trend, which we can assume that it is linear as a starting point. We thus assume that the series \(Y_t\) evolves according to the model \[Y_t = \beta_0 + \beta_1 * t + d_t\] where the deviation \(d_t\) is a zero mean stationary random variable (e.g., an AR(1) process). The independent variable, denoted \(t\), represents the time trend and takes value 1 for the first observation, value 2 for the second observation and value \(T\) for the last observation35. This model decomposes the series \(Y_t\) in two components:

- a permanent (non-stationary) component represented by \(\beta_0 + \beta_1 * t\) that captures the long-run growth of the series

- a transitory (stationary) component \(d_t\) that captures the deviations from the long-run trend (e.g., business cycle fluctuations)

This type of trend is called deterministic since it makes the prediction that every time period the series \(Y_t\) is expected to increase by \(\beta_1\) units. It is often referred as the trend-stationary model after the two components that constitute the model. The model can be estimated by OLS using the lm() function:

macrodata.q$trend <- 1:nrow(macrodata.q) # creates the trend variable

fit.gdp <- lm(log(GDP) ~ trend, data=macrodata.q)| (Intercept) | trend | |

|---|---|---|

| GDP | 7.77606 | 0.007839 |

| SP500 | 3.08990 | 0.017248 |

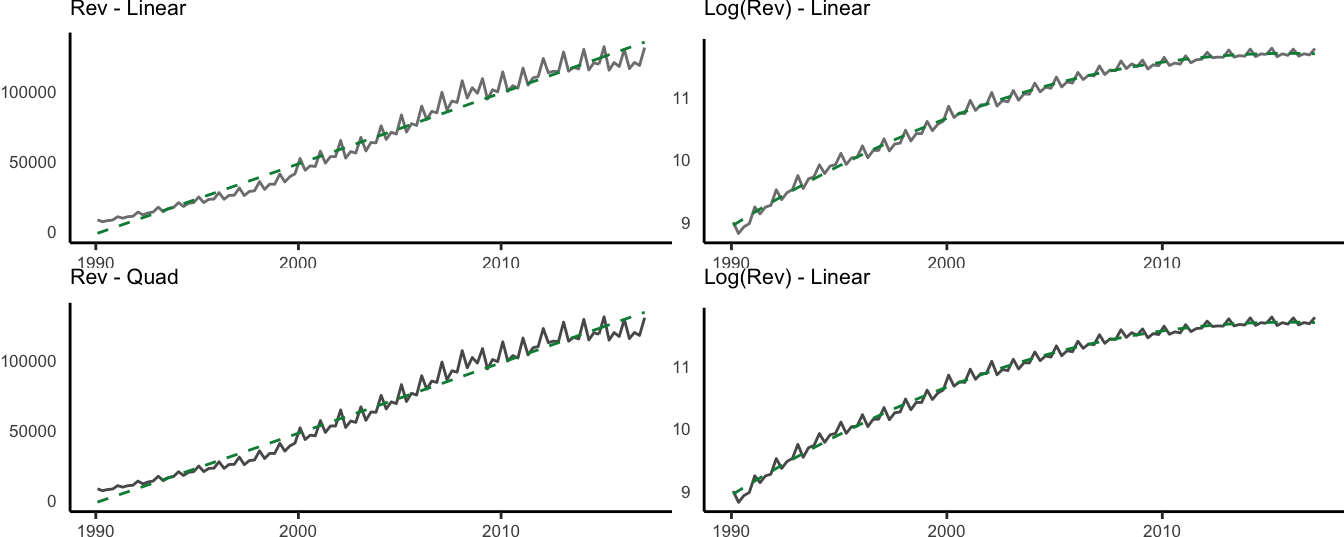

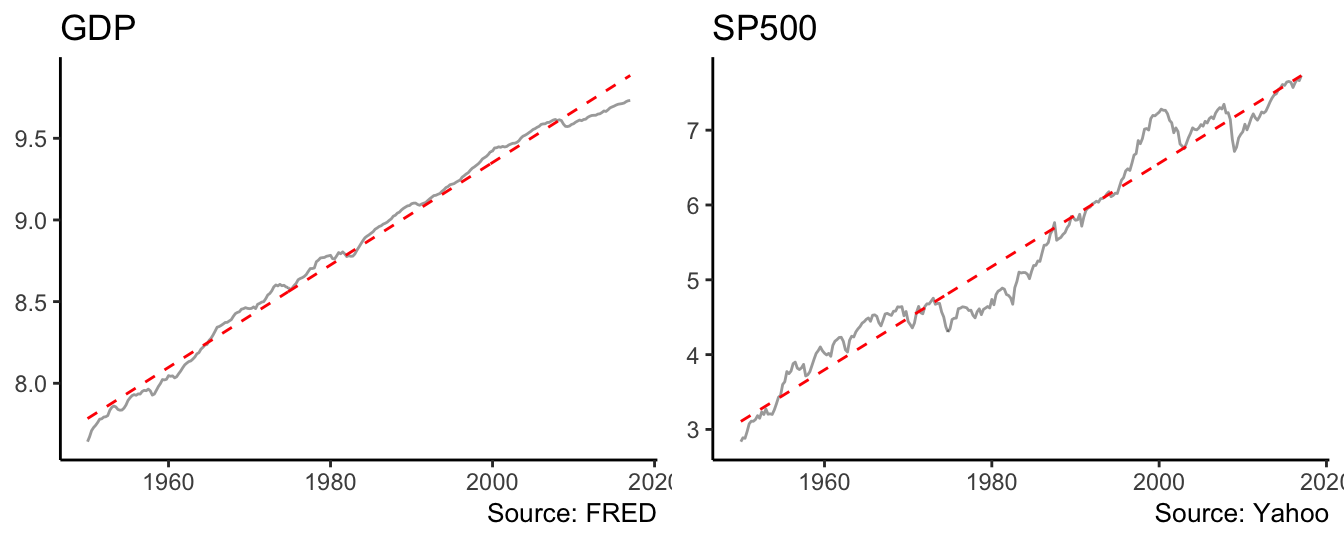

where the estimate of \(\beta_1\) is 0.0078 and indicates that real GDP is expected to grow 0.78% every quarter. For the S&P 500 \(\hat\beta_1\) = 0.0172 and represents a quarterly growth of 1.72%. The application of the linear trend model to the series shown above gives as a result the dashed trend line shown in Figure 4.8:

fit.gdp <- lm(log(GDP) ~ trend, data=macrodata.q)

fit.sp500 <- dyn$lm(log(SP500) ~ trend, data=macrodata.q)

p1 <- ggplot(macrodata.q) + geom_line(aes(time(macrodata.q), log(GDP)), alpha=0.4) +

geom_line(aes(time(macrodata.q), fitted(fit.gdp)), color="red", linetype="dashed")

p2 <- ggplot(macrodata.q) + geom_line(aes(time(macrodata.q), log(SP500)), alpha=0.4) +

geom_line(aes(time(macrodata.q), fitted(fit.sp500)), color="red", linetype="dashed")

p1 <- p1 + theme_classic() + labs(x=NULL,y=NULL, title="GDP", caption="Source: FRED")

Figure 4.8: Linear trend model for the real GDP and the SP500.

The deviation of the series from the fitted trend line are small for GDP, but for the S&P 500 index they are persistent and last for long periods of time (i.e., 10 years or even longer). Such persistent deviations might be due to the inadequacy of the linear trend model and the need to consider a nonlinear trend. This can be accommodated by adding a quadratic and/or cubic term to the linear trend model which becomes: \[ Y_t = \beta_0 + \beta_1 * t + \beta_2 * t^2 + \beta_3 * t^3 + d_t\] where \(t^2\) and \(t^3\) represent the square and cube of the trend variable. The implementation in R requires the only additional step of including the square and cube of trend in the lm() formula:

fitsq <- lm(log(GDP) ~ trend + I(trend^2), data=macrodata.q)

fitcb <- lm(log(GDP) ~ trend + I(trend^2) + I(trend^3), data=macrodata.q) Estimate Std. Error t value Pr(>|t|)

(Intercept) 7.6611 0.0064 1196.5683 0

trend 0.0104 0.0001 94.8250 0

I(trend^2) 0.0000 0.0000 -23.9916 0

Estimate Std. Error t value Pr(>|t|)

(Intercept) 7.6932 0.0081 951.1638 0.0000

trend 0.0090 0.0003 34.6535 0.0000

I(trend^2) 0.0000 0.0000 1.6210 0.1062

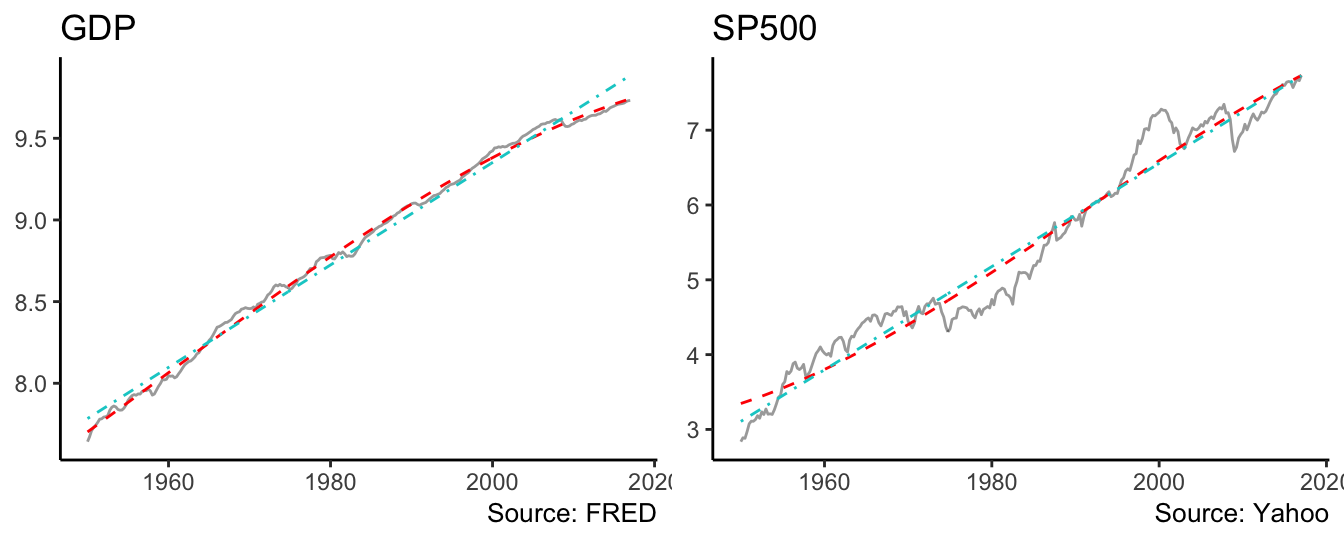

I(trend^3) 0.0000 0.0000 -5.9360 0.0000The linear (dashed line) and cubic (dot-dash line) deterministic trends are shown in Figure 4.9. For the case of GDP the differences between the two lines is not visually large, although the quadratic and/or cubic regression coefficients might be statistically significant at conventional levels. In terms of fitness, the AIC of the linear model is -731.34 and -1039.18 and -1070.76 for the quadratic and cubic models, respectively. Hence, in this case we would select the cubic model which does slightly better relative to the quadratic, and significantly better relative to the linear trend model36. However, it could be argued that the deterministic trend model might not represent well the behavior of the S&P 500 index since there are significant departures of the series from the trend models for long periods of time.

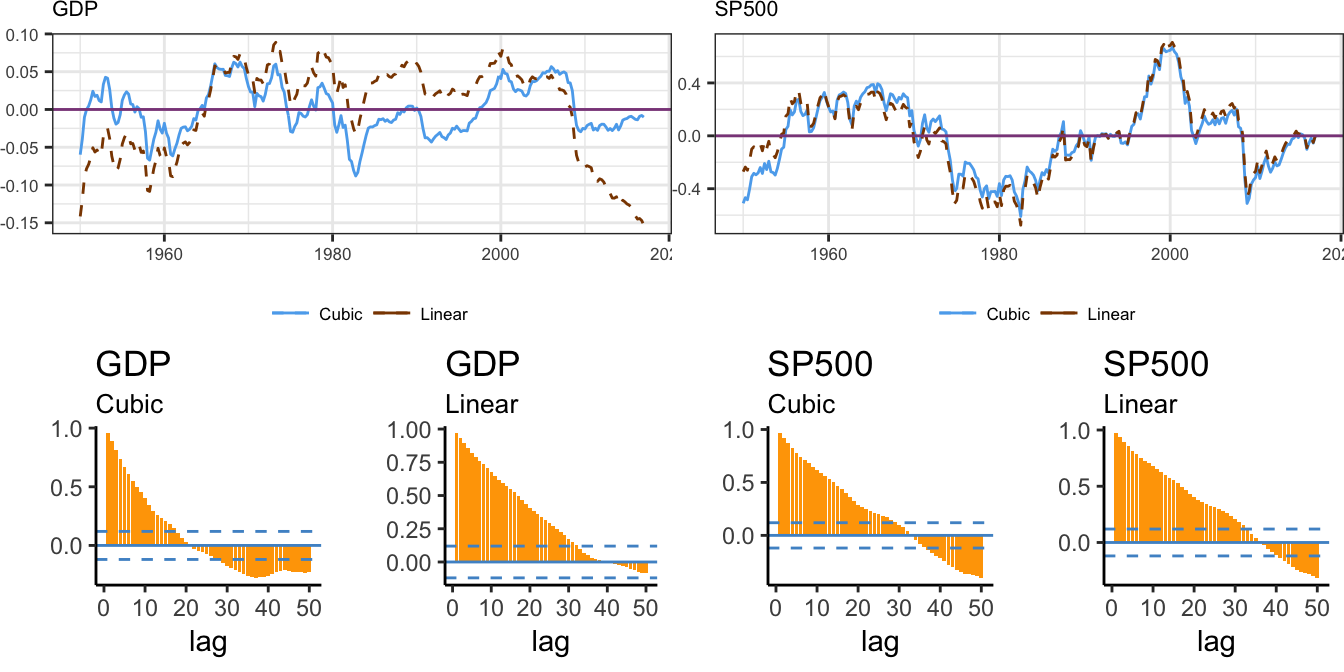

Figure 4.9: Linear and cubic trend model for the real GDP and the SP500.

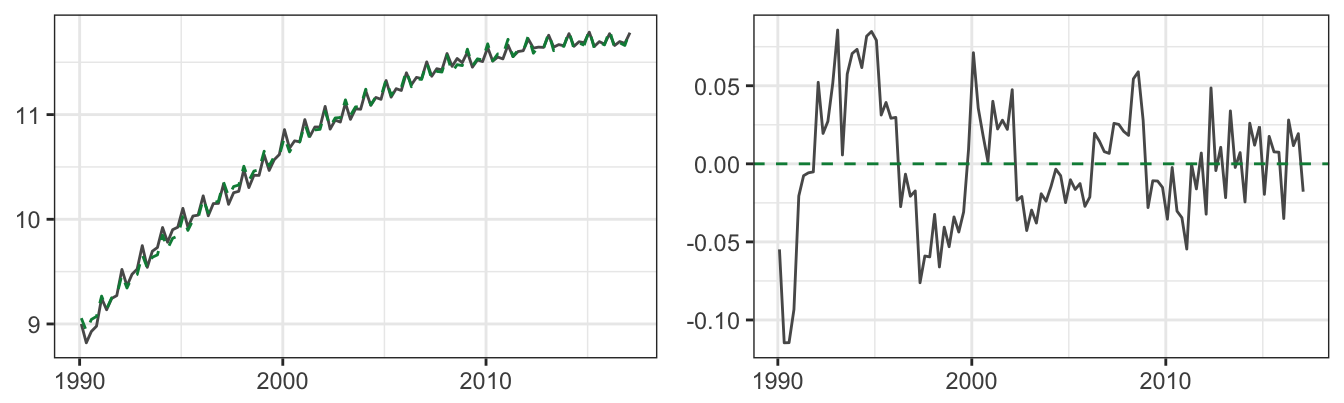

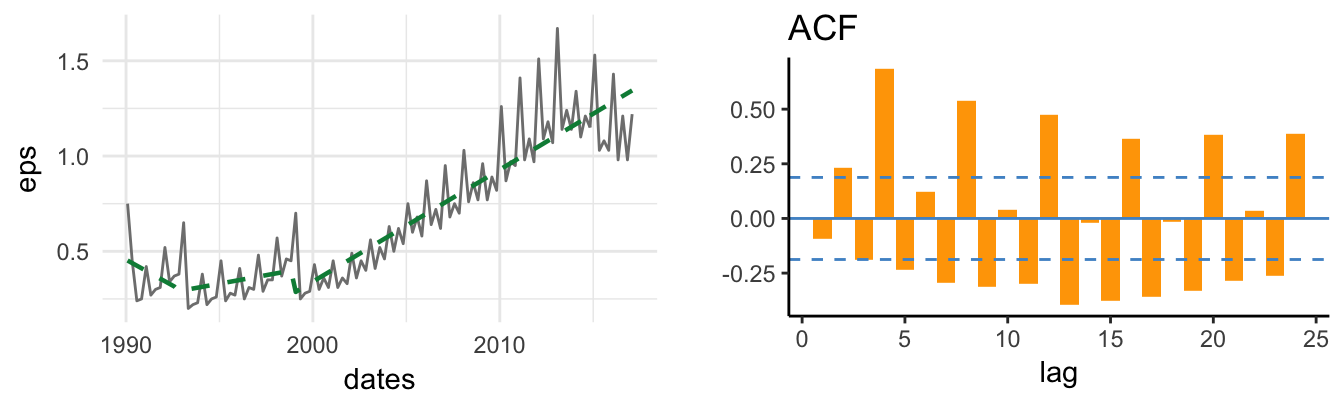

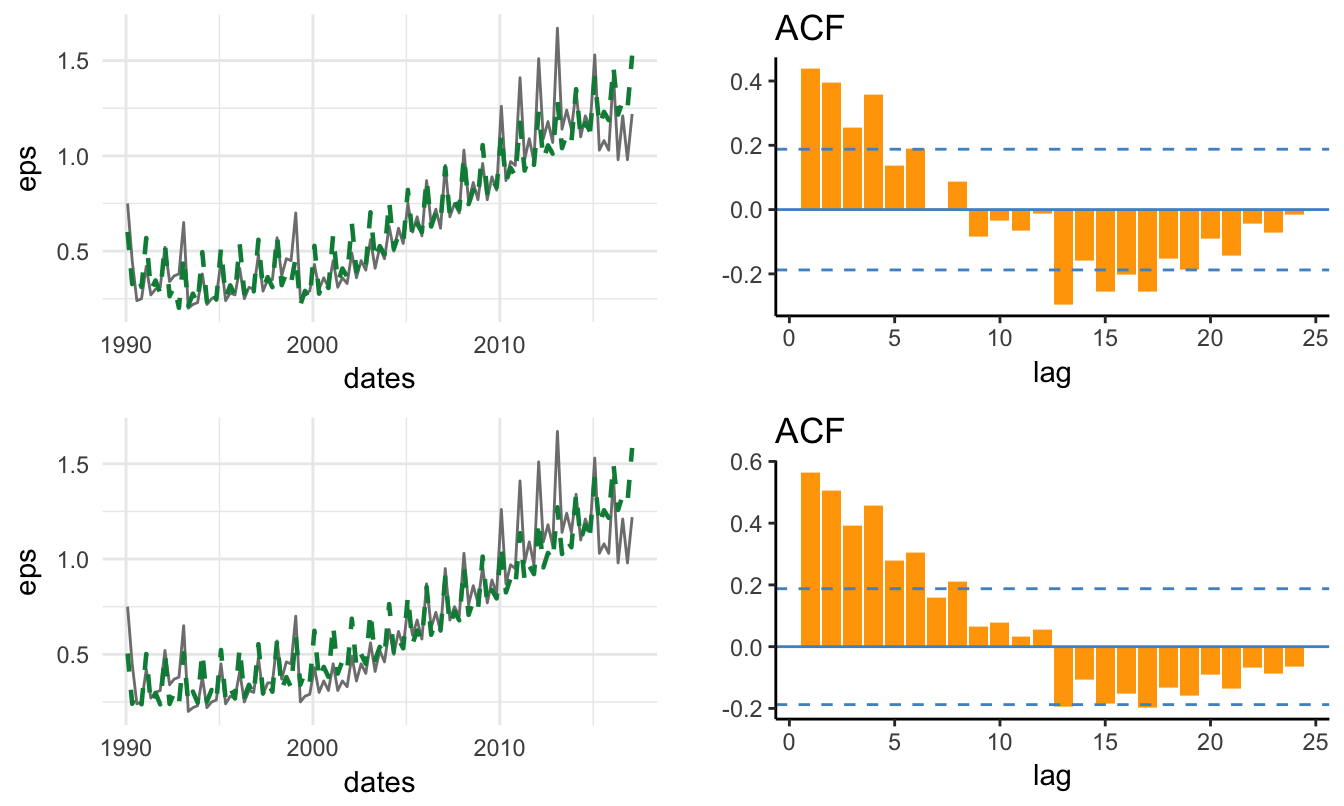

Another way to visualize the ability of the trend-stationary model to explain these series is to plot the residuals or deviation from the cubic trend, \(d_t\). Figure 4.10 shows the time series graph of the \(d_t\) for the linear and cubic models and the ACF functions with lag up to 50 (quarters for GDP and months for S&P 500):

p1 <- qplot(time(macrodata.q), residuals(fitcb.gdp), data=macrodata.q, geom="line", color="Cubic") +

geom_line(aes(time(macrodata.q), residuals(fit.gdp), color="Linear"), linetype="dashed") +

geom_hline(yintercept = 0, color="orchid4") + labs(title="GDP") +

scale_colour_manual("", breaks=c("Cubic","Linear"), values=c("steelblue2","darkorange4"))

p2 <- qplot(time(macrodata.q), residuals(fitcb.sp500), data=macrodata.q, geom="line", color="Cubic") +

geom_line(aes(time(macrodata.q), residuals(fit.sp500), color="Linear"), linetype="dashed") +

geom_hline(yintercept = 0, color="orchid4") + labs(title="SP500") +

scale_colour_manual("", breaks=c("Cubic","Linear"), values=c("steelblue2","darkorange4"))

p3 <- ggacf(residuals(fitcb.gdp), 50) + labs(title="GDP", subtitle="Cubic")

p4 <- ggacf(residuals(fit.gdp), 50)+ labs(title="GDP", subtitle="Linear")

p5 <- ggacf(residuals(fitcb.sp500), 50) + labs(title="SP500", subtitle="Cubic")

p6 <- ggacf(residuals(fit.sp500), 50) + labs(title="SP500", subtitle="Linear")

mylayout <- rbind(c(1,1,2,2),

c(3,4,5,6))

grid.arrange(p1, p2, p3, p4,p5, p6, layout_matrix=mylayout)

Figure 4.10: Deviation of the logarithm of real GDP and SP 500 from the linear and cubic trend model and its ACF up to lag 50.

The ACF shows clearly that the deviation of the log GDP from the cubic trend is persistent but with rapidly decaying values relative to the residuals of the linear trend model. On the other hand, for the S&P 500 it seems that the serial correlation decays at a slower rate, that might be an indication of a non-stationary time series. Even when we account for the trend in a variable, the deviation from the trend \(d_t\) might still be non-stationary and we will discuss later how to formally test this hypothesis.

4.5.2 Stochastic Trend

An alternative model that is often used in asset and option pricing is the random walk with drift model. The model takes the following form: \[ Y_t = \mu + Y_{t-1} + \epsilon_t\] where \(\mu\) is a constant and \(\epsilon_t\) is an error term with mean zero and variance \(\sigma^2\). The random walk model assumes that the expected value of \(Y_t\) is equal to the previous value of the series (\(Y_{t-1}\)) plus a constant term \(\mu\) (which can be positive or negative), that is, \(E(Y_t | Y_{t-1}) = \mu + Y_{t-1}\). The model can also be reformulated by substituting backward the value of \(Y_{t-1}\), that is, \(\mu + Y_{t-2} + \epsilon_{t-1}\) and we obtain \(Y_t = 2*\mu + Y_{t-2} + \epsilon_t + \epsilon_{t-1}\). We can then continue by substituting \(Y_{t-2}\), \(Y_{t-3}\), and so on until we reach the initial value \(Y_0\) and the model can be written as \[\begin{eqnarray*} Y_t &=& \mu + Y_{t-1} + \epsilon_t \\ &=& \mu + (\mu + Y_{t-2} + \epsilon_{t-1}) + \epsilon_t \\ & = & \mu + \mu + (\mu + Y_{t-3} + \epsilon_{t-2}) + \epsilon_{t-1} + \epsilon_t \\ & = & \cdots \\ & = & Y_0 + \mu t + \sum_{j=1}^{t}\epsilon_{t-j+1}\\ \end{eqnarray*}\]This shows that a random walk with drift model can be expressed as the sum of two components (in addition to the starting value \(Y_0\)):

- deterministic trend (\(\mu t\))

- the sum of all past errors/shocks to the series

In case the drift term \(\mu\) is set equal to zero, the model reduces to \(Y_t = Y_{t-1} + \epsilon_t = Y_0 + \sum_{j=1}^{t}\epsilon_{t-j+1}\) which is called the random walk model (without drift since \(\mu\) is equal to zero). Hence, another way to think of the random walk model with drift is as the sum of a deterministic linear trend and a random walk process.

The relationship between the trend-stationary and the random walk with drift models becomes clear if we assume that the deviation from the trend \(d_t\) follow an AR(1) process, that is, \(d_t = \phi d_{t-1} + \epsilon_t\), where \(\phi\) is the coefficient of the first lag which is assumed to be smaller than 1 in absolute value and \(\epsilon_t\) is a mean zero random variable. We can do backward substitution of the AR term in the trend-stationary model, that is, \[\begin{eqnarray*} Y_t = \beta_0 + \beta_1 t & + & d_t \\ & + & \phi d_{t-1} + \epsilon_{t}\\ & + & \phi^2 d_{t-2}+ \phi * \epsilon_{t-1} + \epsilon_{t} \\ & + & ...\\ & + & \epsilon_t + \phi * \epsilon_{t-1} + \phi^2 * \epsilon_{t-2} + \cdots + \phi^{t-1} \epsilon_1\\ & + & \sum_{j=1}^{t} \phi^{j-1} \epsilon_{t-j+1} \end{eqnarray*}\]Comparing this equation with the one obtained for the random walk with drift model we find that the former is a special case of the latter for \(\phi = 1\). Hence, the only difference between these models consists of the assumption on the persistence of the deviation from the trend. If the coefficient \(\phi\) is less than 1 the deviation is stationary and thus the trend-stationary model can be used to de-trend the series and then conduct the analysis on the deviation. However, when \(\phi = 1\) the deviation from the trend as well is non-stationary (i.e., random walk) and the approach just described is not valid. We will discuss later what to do in this case. A more practical way to understand the issue of the (non-)stationarity of the deviation from the trend is to think in terms of the speed at which the series is likely to revert back to the trend-line. Series that oscillate around the trend are stationary while persistent deviations from the trend (slow reversion) are an indication of non-stationarity. How do we know if a series (e.g., the deviation from the trend) is stationary or not? In the following section we will discuss a test that evaluates this hypothesis and provides guidance as to what modeling approach to take.

The previous analysis of real GDP shows that the deviations of GDP from its trend seem to revert to the mean faster relative to the other two series: this can be seen both in the time series plot and also from the quickly decaying ACF. The estimate of the trend-stationary model shows that we expect GDP to grow around 0.773% per quarter (approximately 3.092% annualized), although GDP alternates periods above trend (expansions) and periods below trend (recessions). Alternating between expansions and recessions captures the mean-reverting nature of the GDP deviations from the long-run trend. We can evaluate the ability of the trend-stationary model to capture the expansion-recession feature of the business cycle by comparing the periods of positive and negative deviations with the peak and trough dates of the business cycle decided by the NBER dating committee. In the graph below we plot the deviation from the cubic trend estimated earlier together with the shaded areas that indicate the period of recessions.

# dates from the NBER business cycle dating committee

xleft = c(1953.25, 1957.5, 1960.25, 1969.75, 1973.75, 1980,

1981.5, 1990.5, 2001, 2007.917) # beginning

xright = c(1954.25, 1958.25, 1961, 1970.75, 1975, 1980.5, 1982.75,

1991, 2001.75, 2009.417) # end

#fitgdp is the lm() object for the cubic trend model

ggplot() + geom_rect(aes(xmin=xleft, xmax=xright, ymin=rep(-0.10,10), ymax=rep(0.10, 10)),fill="lightcyan3") +

geom_hline(yintercept = 0, color="grey35", linetype="dashed") +

geom_line(aes(time(macrodata.q), residuals(fitcb.gdp))) +

theme_classic() + labs(x=NULL, y=NULL)

Figure 4.11: Deviation of the log real GDP from a cubic trend. The shaded areas represent the NBER recession periods.

Overall, there is a tendency for the deviation to sharply decline during recessions (shaded areas), and then increase during the recovery period and the expansion, which seems to have last longer since the mid-1980s.

Earlier we discussed that the distribution of a non-stationary variable changes over time. We can verify the stationarity properties of the trend-stationary model and the random walk with drift model by deriving the mean and variance of \(Y_t\). Under the trend-stationary model the dynamics follows \(Y_t = \beta_0 + \beta_1 t + d_t\) and we can make the simplifying assumption that \(d_t = \phi d_{t-1} + \epsilon_t\) with \(\epsilon_t\) a mean zero and variance \(\sigma^2_{\epsilon}\) error term. Based on these assumptions, we obtain that \(E(d_t) = 0\) and \(Var(d_t) = \sigma^2_{\epsilon}/ (1-\phi^2)\) so that:

- \(E_t(Y_t) = \beta_0 + \beta_1 t\)

- \(Var_t(Y_t) = Var(d_t) = \sigma^2_{\epsilon}/(1-\phi^2)\)

This demonstrates that the mean of a trend-stationary variable is a function of time and not constant, while the variance is constant. On the other hand for the random walk with drift model we have that:

- \(E_t(Y_t) = E_t\left( Y_0 + \mu t + \sum_{j=1}^{t} \epsilon_{t-j+1} \right) = Y_0 + \mu t\)

- \(Var_t(Y_t) = t\sigma^2_{\epsilon}\)

From these results we see that for the random walk with drift model both the mean and the variance are time varying, while for the trend-stationary model only the mean varies with time.

The main difference between the trend-stationary and random walk with drift models thus consists in the non-stationarity properties of the deviations from the deterministic trend. For the trend-stationary model the deviations are considered stationary and they can be analysed using regression models estimated by OLS. However, for the random walk with drift the deviations are non-stationary and its time series cannot be considered in regression models because of several statistical issues that will be discussed in the next Section, followed by a discussion of an approach to statistically test if a series is non-stationary and non-stationary around a (deterministic) trend.

4.5.3 Why non-stationarity is a problem for OLS?

The estimation of time series models can be conducted by standard OLS techniques, as long as the series is stationary. If this is the case, the OLS estimator is consistent and \(t\)-statistics are distributed according to the Student \(t\) distribution. However, these properties fail to hold when the series is non-stationary and three problems arise:

- the OLS estimate of the AR coefficients is biased in small samples

- the \(t\) statistic is not normally distributed (even in large samples)

- the regression of a non-stationary variables on a non-stationary variable leads to spurious results of dependence between the two series

We will discuss and illustrate these problems in the context of a simulation study using R. To show the first fact we follow the steps:

- simulate B time series from a random walk with drift model \(Y_t = \mu + Y_{t-1} + \epsilon_t\) for \(t=1,\cdots,T\)

- estimate an AR(1) model \(Y_t = \beta_0 + \beta_1 * Y_{t-1} + \epsilon_t\)

- store the B OLS estimates of \(\beta_1\)

We perform this simulation for a short and a long time series (\(T = 25\) and \(T = 500\), respectively) and compare the mean, median, and histogram of the \(\hat{\beta}_1\) across the B simulations. Below is the code for \(T = 25\) and the histogram of the simulated values for \(T=25\) and \(500\) is provided in Figure 4.12:

set.seed(1234)

T = 25 # length of the time series

B = 1000 # number of simulation

mu = 0.1 # value of the drift term

sigma = 1 # standard deviation of the error

beta25 = numeric(B) # object to store the DF test stat

for (b in 1:B)

{

Y <- as.xts(arima.sim(n=T, list(order=c(0,1,0)), mean=mu, sd=sigma))

fit <- dyn$lm(Y ~ lag(Y,1)) # OLS estimation of DF regression

beta25[b] <- summary(fit)$coef[2,1] # stores the results

}

# plotting

p1 <- ggplot() + geom_histogram(aes(beta25),color="grey35", fill="grey90", bins=40) + theme_bw() + labs(x=NULL,y=NULL) +

geom_vline(xintercept = 1, color="cadetblue", size=1.2, linetype="dashed")

T = 500 # length of the time series

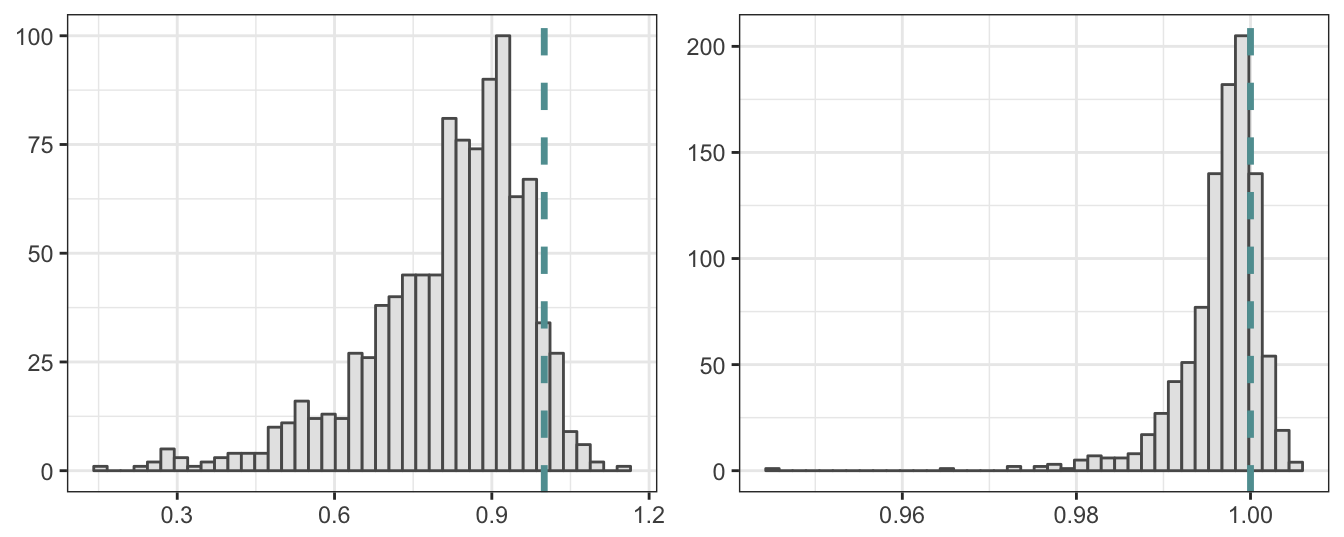

Figure 4.12: Simulated distribution of the OLS estimate of the AR(1) coefficient when the true generating process is a random walk with drift. Sample size is 25 for the left plot and 500 for the right plot.

The histogram when the sample size is 25 shows that the \(\hat\beta_1\) over 1000 simulations ranges between 0.5 and 0.5 with a mean of 0.5 and median of 0.5. Both the mean and the median are significantly smaller relative to the true value of 1. This demonstrates the bias in the OLS estimates in small samples when the variable is non-stationary. However, this bias has a tendency to decline for larger sample sizes as shown in the right histogram of Figure 4.12 where the sample size is set to \(500\). In this case the min/max estimates are 0.5 and 0.5 with a mean and median of 0.5 and 0.5, respectively. For the larger sample of 500 periods, even though the series is non-stationary, the coefficient estimates of \(\beta_1\) are close to the theoretical value of 1 and thus there is no bias.

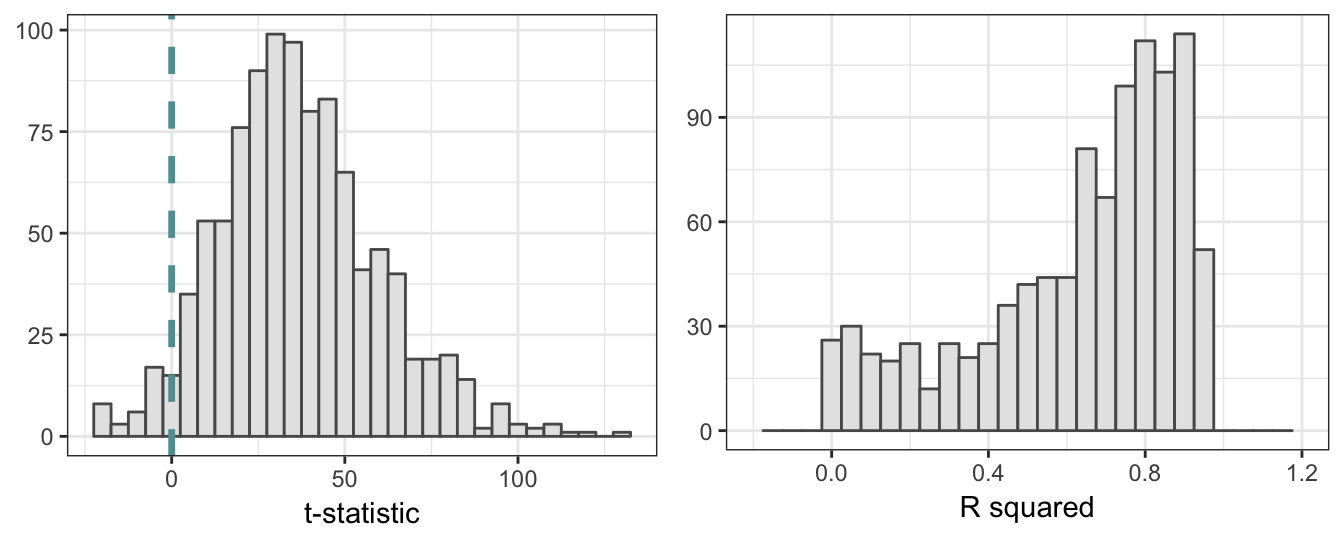

The second fact that arises when estimating AR by OLS when variables are non-stationary is that the t statistic does not follow the normal distribution even when samples are large. This can be seen clearly in Figure 4.13 for the statistic of the null hypothesis that \(\beta_1 = 1\) and for T=500. The histogram below shows that the distribution of \(t\) statistic is shifted to the left relative to the standard normal distribution.

Figure 4.13: Simulated distribution of t-statistic of the OLS estimate of the AR(1) coefficient when the true generating process is a random walk with drift. Sample size is 500.

The third problem with non-stationary variables occurs when the interest is to model is the relationship between \(X\) and \(Y\) and both variables are non-stationary. This could lead to spurious results of statistical evidence of a relationship between the two series when indeed they are independent of each other. An intuitive explanation for this result can be provided when considering, e.g., two independent random walk with drift: estimating a LRM finds co-movement between the series due to the existence of a trend in both variables that makes the series move in the same or opposite direction. The simulation below shows more intuitively this results for two independent processes \(X\) and \(Y\) with the same drift parameter \(\mu\), but independent of each other (i.e., \(Y\) is not a function of \(X\)). The histogram of the t statistics for the significance of \(\beta_1\) in \(Y_t = \beta_0 + \beta_1 X_t + \epsilon_t\) is shown in the left plot of Figure 4.14, while the R\(^2\) of the regression is shown on the right. The distribution of the \(t\) test statistic has a significant positive mean and would lead to an extremely large number of rejections of the hypothesis that \(\beta_1 = 0\), when its true value is equal to zero. In addition, the distribution of the R\(^2\) shows that in the vast majority of these 1000 simulations we would find a moderate to large goodness-of-fit measure which would suggest a significant relationship between the two variables, although the truth is that there is no relationship.

T = 500 # length of the time series

B = 1000 # number of simulation

mu = 0.1 # value of the drift term

sigma = 1 # standard deviation of the error

tstat = numeric(B) # object to store the DF test stat

R2 = numeric(B)

for (b in 1:B)

{

Y <- as.xts(arima.sim(n=T, list(order=c(0,1,0)), mean=mu, sd=sigma)) # simulates the Y series

X <- as.xts(arima.sim(n=T, list(order=c(0,1,0)), mean=mu, sd=sigma)) # simulates the X series

fit <- lm(Y ~ X) # OLS estimation of DF regression

fit.tab <- summary(fit)$coefficients

tstat[b] <- fit.tab[2,3] # stores the results

R2[b] <- summary(fit)$r.square

}

p1 <- ggplot() + geom_histogram(aes(tstat),color="grey35", fill="grey90", binwidth=5) +

theme_bw() + labs(x="t-statistic",y=NULL) +

geom_vline(xintercept = 0, color="cadetblue", size=1.2, linetype="dashed")

p2 <- ggplot() + geom_histogram(aes(R2),color="grey35", fill="grey90", binwidth=0.05) +

xlim(c(-0.2, 1.2)) + theme_bw() + labs(x="R squared",y=NULL)

grid.arrange(p1, p2, ncol=2)

Figure 4.14: Simulated distribution of the t-statistic and R square for the regression of two independent non-stationary variables. Sample size is 500.

4.5.4 Testing for non-stationarity

The first task when analyzing economic and financial time series is to evaluate if the variable can be considered stationary or not, since non-stationarity leads to several inferential problems that can be problematic for our analysis. Once we conclude that a time series is non-stationary we need to decide whether it is consistent with a trend-stationary model or rather with a random walk model (with or without drift). So, what we are really asking are two questions: is the time series stationary or non-stationary? and if it non-stationary, which of the two models discussed earlier is more likely to be consistent with the data?

The approach that we follow is to combine the trend-stationary and random walk models and test hypothesis about the coefficients of the combined model that provide answers to the previous questions. The trend-stationary model with an AR(1) process for the deviation is defined as \[\begin{array}{rl}Y_t =& \beta_0 + \beta_1 t + d_t\\ d_t =& \phi d_{t-1} + \epsilon_t\end{array}\] from the first Equation we obtain that \(d_{t-1} = Y_{t-1} - \beta_0 - \beta_1 (t-1)\) so that we can replace \(d_t\) in the first Equation and formulate the model in terms of \(t\) and \(Y_{t-1}\), that is: \[\begin{array}{rl}Y_t =& \beta_0 + \beta_1 t + \phi d_{t-1} + \epsilon_t\\ =& \beta_0 + \beta_1 t + \phi \left[Y_{t-1} - \beta_0 - \beta_1 (t-1)\right] + \epsilon_t\\ = & \beta_0(1-\phi) + \phi\beta_1 + \beta_1 (1-\phi) t +\phi Y_{t-1} + \epsilon_t \end{array} \] if we set \(\gamma_0 = \beta_0(1-\phi) + \phi\beta_1\) and \(\gamma_1 = \beta_1 (1-\phi)\) then the model becomes \[Y_{t} = \gamma_0 + \gamma_1 t + \phi Y_{t-1} + \epsilon_t\] and the null hypothesis that we want to test is that \(\phi = 1\) against the alternative that \(\phi < 1\). Notice that if \(\phi_1 = 1\) then \(\gamma_1 = 0\) and the model becomes \(Y_t = \beta_1 + Y_{t-1} + \epsilon_t\), which is the random walk with drift model. Testing the hypothesis can lead to the two following outcomes:

- Failing to reject the null hypothesis that \(\phi = 1\) (and \(\gamma_1=0\)) indicates that \(Y_t\) follows the random walk with drift model

- Rejecting the null hypothesis in favor of the alternative that \(\phi < 1\) supports the trend-stationary model

If the time series \(Y_t\) does not show a clear pattern of growing over time, we can assume that \(\beta_1 = 0\) which simplifies the model to \(Y_t = \gamma_0 + \phi Y_{t-1} + \epsilon_t\) with \(\gamma_0 = \beta_0(1-\phi)\). Testing the hypothesis that \(\phi = 1\) in this case provides the following results:

- Failing to reject \(H_0\) implies that the model is \(Y_t = Y_{t-1} + \epsilon_t\) that represents the random walk without drift model

- Rejecting the null hypothesis suggests that \(Y_t\) should be modeled as a stationary AR process

The important choice to make is whether to include a trend (i.e., \(\beta_1\)) or not in the testing Equation. While for the real GDP and the S&P 500 in Figure 4.7 it is clear that a trend is necessary, in other situations (e.g., the unemployment rate or interest rates) a trend might not be warranted. To test \(H_0: \phi = 1\) (non-stationarity) against the alternative \(H_1 : \phi < 1\) (stationarity) the model is reformulated by subtracting \(Y_{t-1}\) to both the left and right hand-side of the Equation: \[\begin{array}{rl}Y_{t} - Y_{t-1} = & \gamma_0 + \gamma_1 t + \phi Y_{t-1} - Y_{t-1} + \epsilon_t\\ \Delta Y_t =& \gamma_0 + \gamma_1 t + \delta Y_{t-1} + \epsilon_t\end{array} \] with \(\delta = \phi - 1\). Testing the null that \(\phi = 1\) is equivalent to testing \(\delta = 0\) in this model against the alternative that \(\delta < 0\). This model is estimated by OLS and the test statistic for what is called the Dickey-Fuller (DF) test is given by the t-statistic of \(\hat\delta\), that is, \[DF = \frac{\hat{\delta}}{\hat\sigma_{\delta}} \] where \(\hat\sigma_{\delta}\) represents the standard error of \(\hat\delta\) assuming homoskedasticity. Even though subtracting \(Y_{t-1}\) makes the LHS of the Equation stationary, under the null hypothesis the regressor \(Y_{t-1}\) is non-stationary and leads to the distribution of the \(DF\) not being t distributed. Instead, it follows a different distribution with critical values that are tabulated and are provided below.

The non-standard distribution of the DF test statistic can be investigated via a simulation study using R. The code below performs a simulation in which:

- random walk time series (with drift) are generated

- the DF regression equation is estimated

- the \(t\)-statistic of \(Y_{t-1}\) is stored

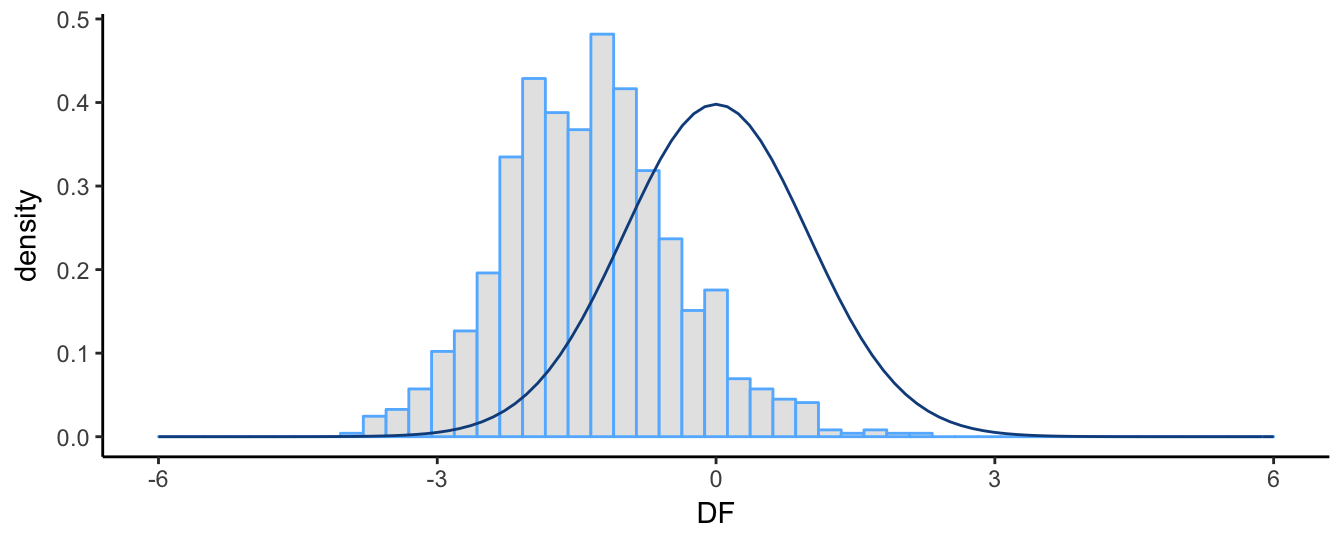

These steps are repeated B times and Figure 4.15 shows the histogram of the DF statistic together with the Student \(t\) distribution with T-1 degree-of-freedom (T represents the length of the time series set in the code).

T = 100 # length of the time series

B = 1000 # number of simulation

mu = 0.1 # value of the drift term

sigma = 1 # standard deviation of the error

DF = numeric(B) # object to store the DF test stat

for (b in 1:B)

{

Y <- as.xts(arima.sim(n=T, list(order=c(0,1,0)), mean=mu, sd=sigma))

fit <- dyn$lm(diff(Y) ~ lag(Y,1)) # OLS estimation of DF regression

DF[b] <- summary(fit)$coef[2,3] # stores the results

}

# plotting

ggplot(data=data.frame(DF), aes(x=DF)) +

geom_histogram(aes(y=..density..), bins=50, fill="grey90", color="steelblue1") +

stat_function(fun = dt, colour = "dodgerblue4", args = list(df = (T-1))) +

theme_classic() + xlim(-6,6)

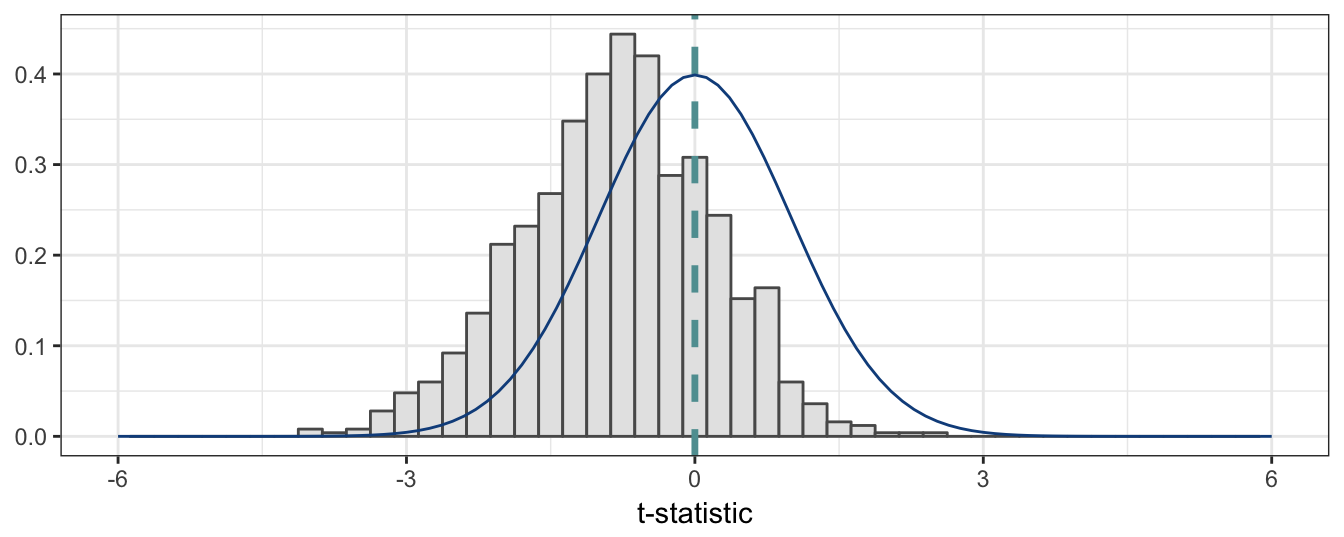

Figure 4.15: Simulated distribution of the DF test statistic and the t distribution. Sample size 100.

The graph shows clearly that the distribution of the DF statistic does not follow the \(t\) distribution: it has a negative mean and median (instead of 0), it is slightly skewed to the right (positive skewness) rather than being symmetric, and its empirical 5% quantile is -2.851 instead of the theoretical value of -1.66. Since we are performing a one-sided test against the alternative hypothesis \(H_1: \delta < 0\), using the one-sided 5% critical value from the \(t\) distribution would lead to reject the null hypothesis of non-stationarity too often relative to the appropriate critical values of the DF statistic. For the simulation exercise above, the (asymptotic) critical value for the null of a random walk with drift is -2.86 at 5% significance level. The percentage of simulations for which we reject the null based on this critical value and that from the \(t\) distribution are

c(DF = sum(DF < -2.86) / B, T = sum(DF < -1.67) / B) DF T

0.049 0.390 This shows that using the critical value from the \(t\)-distribution would lead to reject too often (39% of the times) relative to the expected level of 5%. Instead, using the correct critical value the null is rejected 4.9% which is quite close to the 5% significance level.

In practice, it is advisable to include lags of \(\Delta Y_{t}\) to control for serial correlation in the time series \(Y_t\) and its changes. This is called the Augmented Dickey Fuller (ADF) and requires to estimate the following regression model (for the case with a constant): \[\Delta Y_t = \gamma_0 + \gamma_1 t + \delta Y_{t-1} + \sum_{j=1}^{p} \omega_j \Delta Y_{t-j} + \epsilon_t\] which is simply adding lags of \(\Delta Y_t\) on the RHS of the previous Equation. The \(ADF\) test statistic is calculated as before by taking the \(t\)-statistic of the coefficient estimate of \(Y_{t-1}\), that is, \(ADF = \hat{\delta}/\hat\sigma_{\delta}\). The decision to reject the null hypothesis that \(\delta = 0\) against the alternative that \(\delta < 0\) relies on comparing the \(DF\) or \(ADF\) test statistic with the appropriate critical values. As discussed earlier, the DF statistic has a special distribution and critical values have been tabulated for the case with/without a constant and with/without a trend and for various sample sizes. Below you can find the critical values obtained for various sample sizes for a model with constant and with or without trend and the null is rejected if the test statistic is smaller relative to the critical value:

| Sample Size | Without | Trend | With | Trend |

|---|---|---|---|---|

| 1% | 5% | 1% | 5% | |

| T = 25 | -3.75 | -3.00 | -4.38 | -3.60 |

| T = 50 | -3.58 | -2.93 | -4.15 | -3.50 |

| T = 100 | -3.51 | -2.89 | -4.04 | -3.45 |

| T = 250 | -3.46 | -2.88 | -3.99 | -3.43 |

| T = 500 | -3.44 | -2.87 | -3.98 | -3.42 |

| T = \(\infty\) | -3.43 | -2.86 | -3.96 | -3.41 |

There are several packages that provide functions that perform the ADF test on a time series. The package tseries provides the adf.test() function that assumes a model with constant and trend and the user is only required to specify the time series and the lags of \(\Delta Y_{t}\). The application to the logarithm of real GDP discussed above gives the following results37:

library(tseries)

adf.test(log(macrodata.q$GDP), k=4)

Augmented Dickey-Fuller Test

data: log(macrodata.q$GDP)

Dickey-Fuller = -0.935, Lag order = 4, p-value = 0.948

alternative hypothesis: stationaryThe ADF test statistic is equal to -0.935 with a p-value of 0.948 which is larger than 5% and we thus conclude that we do not reject the hypothesis that \(\delta = 0\) or, equilevantly, \(\phi = 1\). Hence, the logarithm of GDP is not stationary even when including a trend in the analysis and a random walk with drift is the most appropriate modeling choice. The code below shows the application of the ADF test to the logarithm of the S&P 500 and the returns at the monthly and daily frequency:

adf.sp <- rbind(`Price monthly` = adf.test(log(spm$price))[c("statistic", "p.value")],

`Return monthly` = adf.test(spm$return)[c("statistic", "p.value")],

`Price daily` = adf.test(log(spd$price))[c("statistic", "p.value")],

`Price daily` = adf.test(spd$return)[c("statistic", "p.value")])| statistic | p.value | |

|---|---|---|

| Price monthly | -3.18738 | 0.0932597 |

| Return monthly | -4.02599 | 0.0103085 |

| Price daily | -2.20653 | 0.490885 |

| Price daily | -14.1847 | 0.01 |

The results show that at the 5% level the null of non-stationarity is not rejected for the monthly and daily price, but they are strongly rejected for the returns. This is expected since the returns are the growth rate of the price variable and they exhibit very small auto-correlation and a constant long-run mean. A problem with the adf.test() function is that it does not allow to change the type of test, in case we are interested to run the test without the trend variable. In this case we can use the ur.df() function from the urca package. Below is an application to the logarithm of the real GDP:

library(urca)

adf <- ur.df(log(macrodata.q$GDP), type="trend", lags=4) # type: "none", "drift", "trend"

summary(adf)

###############################################

# Augmented Dickey-Fuller Test Unit Root Test #

###############################################

Test regression trend

Call:

lm(formula = z.diff ~ z.lag.1 + 1 + tt + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-0.03073 -0.00417 0.00040 0.00485 0.03369

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0715265 0.0688867 1.04 0.30

z.lag.1 -0.0083048 0.0088822 -0.93 0.35

tt 0.0000513 0.0000703 0.73 0.47

z.diff.lag1 0.3246072 0.0623695 5.20 4e-07 ***

z.diff.lag2 0.0974953 0.0654656 1.49 0.14

z.diff.lag3 -0.0440104 0.0648115 -0.68 0.50

z.diff.lag4 -0.0482718 0.0614166 -0.79 0.43

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.00834 on 257 degrees of freedom

Multiple R-squared: 0.155, Adjusted R-squared: 0.136

F-statistic: 7.88 on 6 and 257 DF, p-value: 8.45e-08

Value of test-statistic is: -0.935 12.8384 2.442

Critical values for test statistics:

1pct 5pct 10pct

tau3 -3.98 -3.42 -3.13

phi2 6.15 4.71 4.05

phi3 8.34 6.30 5.36In this case the ADF test statistic is -0.935 which should be compared to the critical value at 5% -3.42 and we fail to reject the null hypothesis that the series is non-stationary so that we concluded that it follows a random walk with drift model.

4.5.5 What to do when a time series is non-stationary

If the ADF test leads to the conclusion that a series is non-stationary then we need to understand if the nature of the non-stationarity is a trend-stationary model or a random walk model (with or without a drift). In the first case, the non-stationarity is solved by de-trending the series, which means that the series is regressed on a time trend and the residuals of the regression are then interpreted as the deviation from the long-run trend and modeled using time series techniques (e.g., AR). This approach is often used for the logarithm of GDP and the deviation is interpreted as the output gap. However, in our results the log of GDP is non-stationary even when including a trend which indicates that the deviation might also be non-stationary. On the other hand, in case we find that the series follows a random walk model then the solution to the non-stationarity is differencing the series and modeling \(\Delta Y_t = Y_t - Y_{t-1}\). The reason for this is that differencing the series removes the trend and this can be seen in the random walk with drift model \(Y_t = \mu + Y_{t-1} + \epsilon_t\) where by taking \(Y_{t-1}\) to the left-hand side results in \(\Delta Y_t = \mu + \epsilon_t\). When we consider returns of an asset prices we are differencing the price which, from a statistical perspective, is justified in order to induce stationarity in the price series.

4.6 Structural breaks in time series

Another issue that we need to keep in mind when analyzing time series is that there could have been a shift (or structural change) in its mean or its persistence over time. The economy is an evolving system changing over time which makes the past less relevant, to some extent, to understand the future. It is important to be able to recognize structural change because it can be easily mistaken for non-stationarity when indeed it is not.

Let’s assume that at time \(t^*\) the intercept of a time series shifts so that we can write the AR(1) model as \[ Y_t = \beta_{00} + \beta_{01} * I(t > t^*) + \beta_1 * Y_{t-1} + \epsilon_t \] where \(\beta_{00}\) represents the intercept of the AR(1) model until time \(t^*\), \(\beta_{00}+\beta_{01}\) after time \(t^*\), and \(I(A)\) denotes the indicator function that takes value 1 if A is true and 0 otherwise. In the above example we assume that the dependence of the time series, measured by \(\beta_1\), is constant, although it might as well change over time as we discuss later.

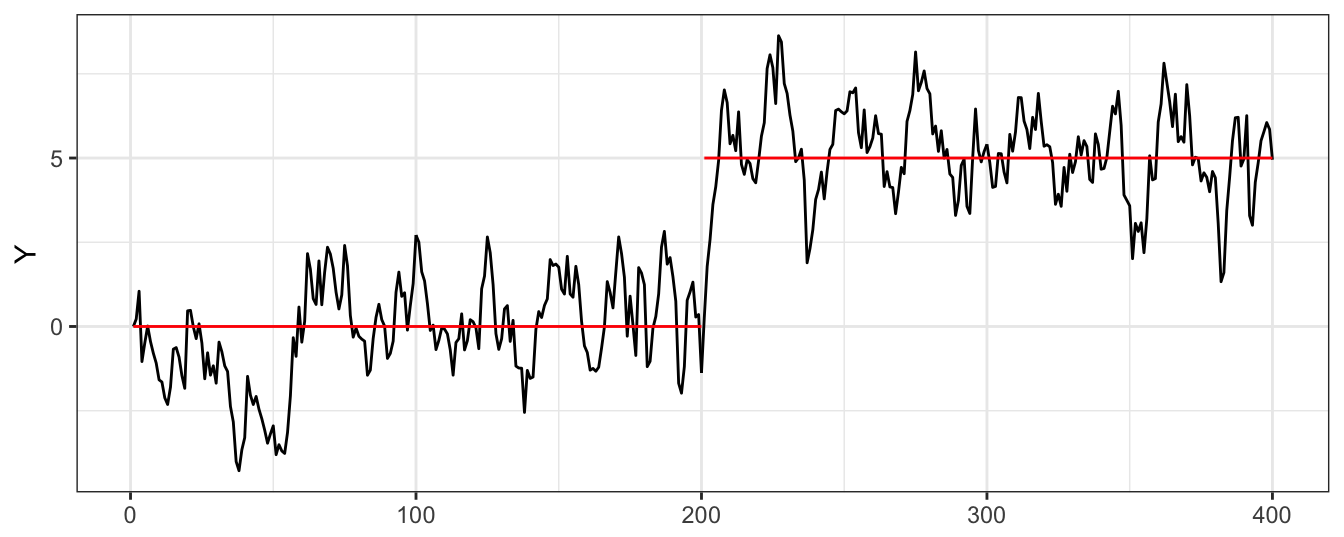

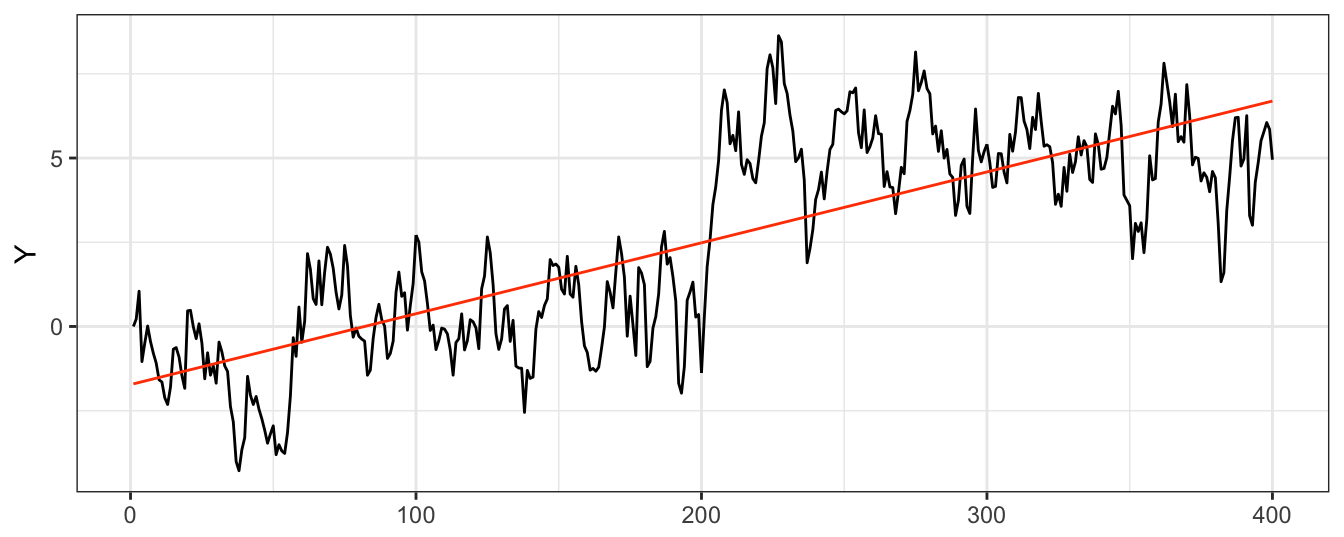

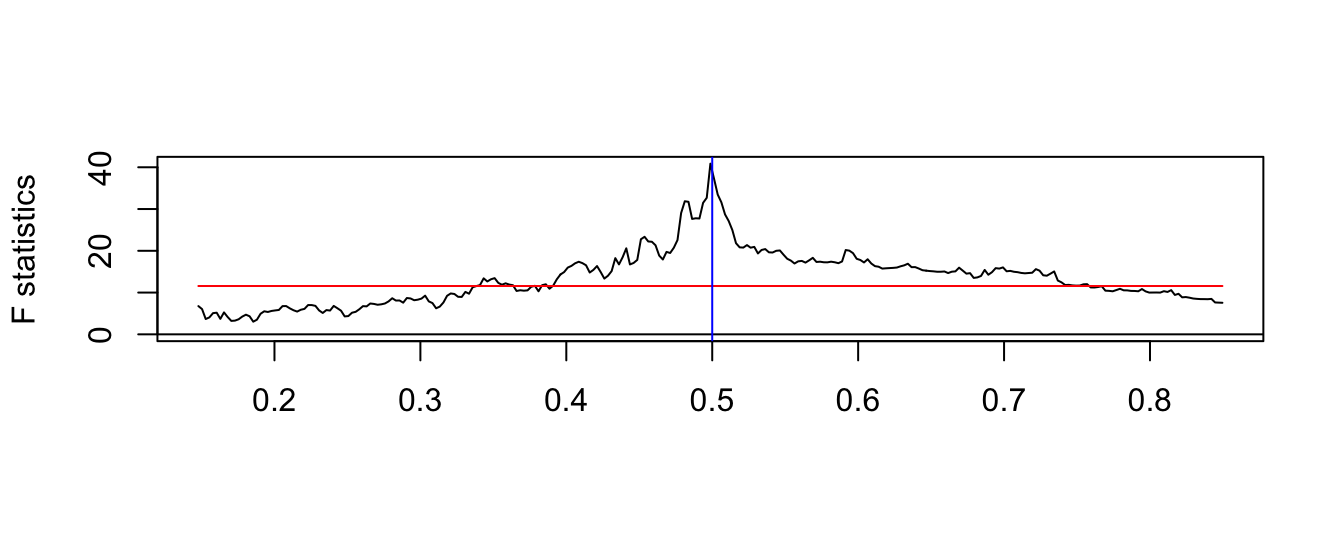

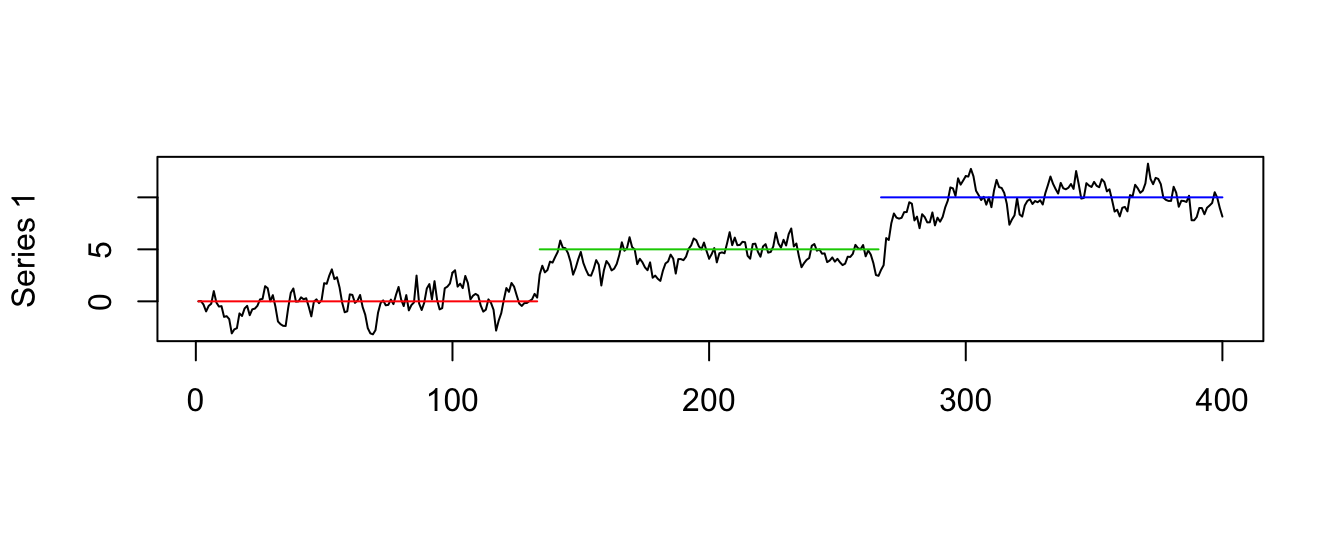

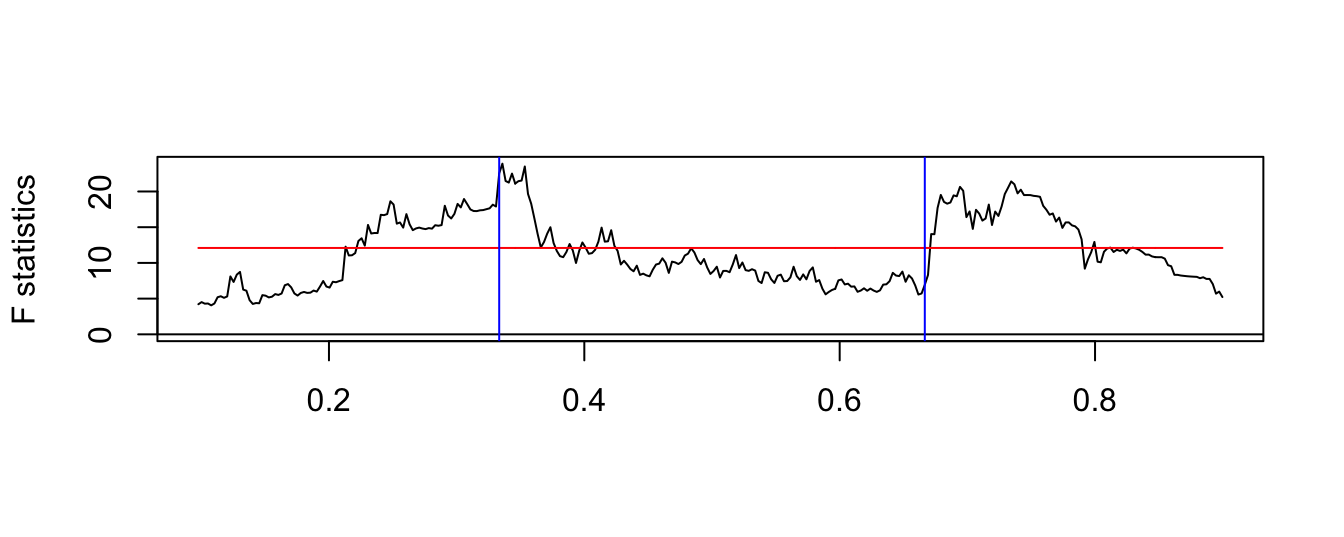

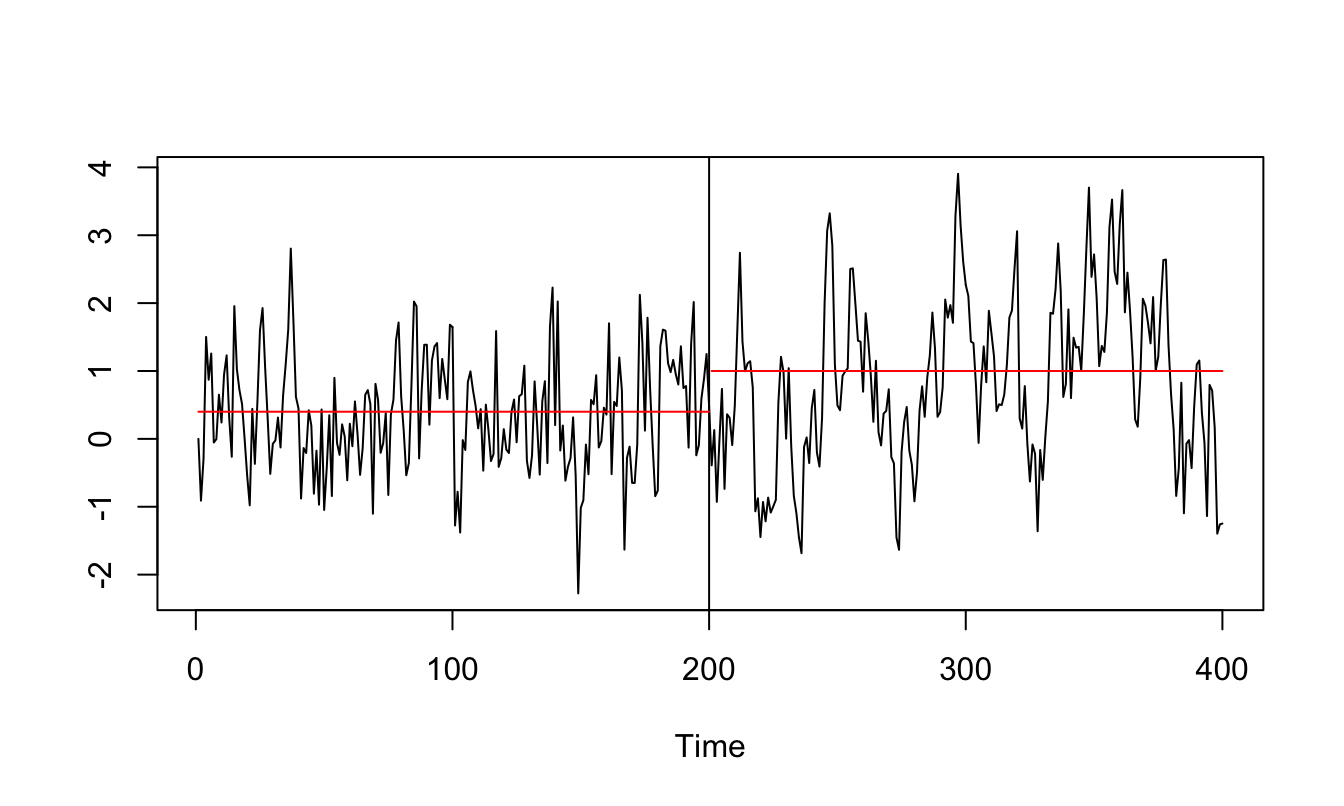

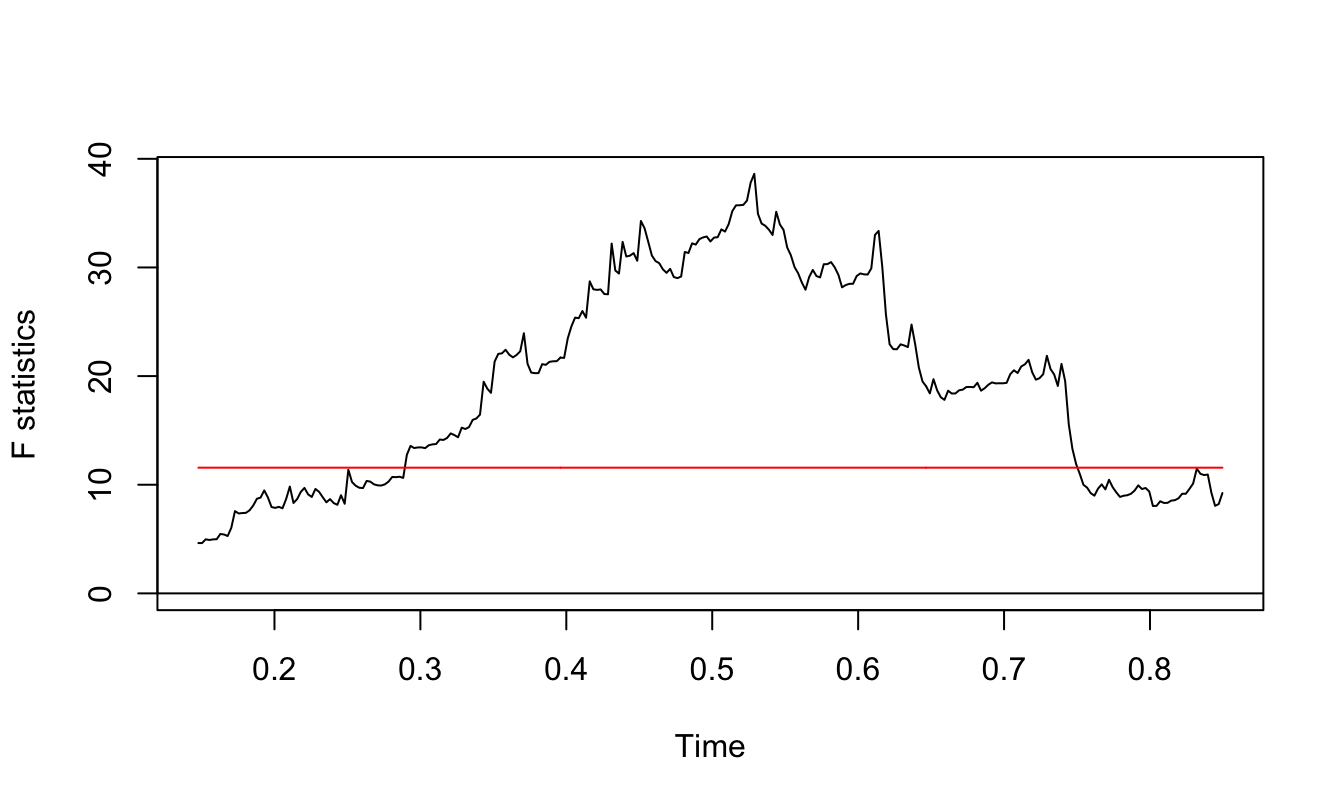

Let’s simulate a time series from this model with a shift in the intercept at observation 200 on a total sample of length 400. To show the effect of an intercept shift we simulate a time series with a shift of the intercept from \(\beta_{00}\)=0 to \(\beta_{0,1}\)=1, while the AR(1) parameters is constant and equal to 0.8. The resulting time series is shown in Figure 4.16, with the horizontal line representing the unconditional means before/after the break at the values \(\beta_{00}/(1-\beta_1)\) and \(\beta_{01}/(1-\beta_1)\), respectively. For this choice of parameters it is clear that there was a shift at observation 200 when the unconditional mean of the time series shifts from 0 to 5.

set.seed(1234)

T = 400; Tbreak <- round(T/2)

beta00 = 0; beta01 = 1

beta1 = 0.8; sigma.eps = 0.8

eps = sigma.eps * rnorm(T)

Y = as.xts(ts(numeric(T)))

for (t in 2:T) Y[t] = beta00 + beta01 * (t > Tbreak) + beta1 * Y[t-1] + eps[t]

Figure 4.16: Simulated AR(1) time series with a structural break in the intercept.