3 Linear Regression Model

Are financial returns predictable? This question has received considerable attention in academic research and in the finance profession. The mainstream theory in financial economics is that markets are efficient and that prices reflect all available information. If this theory is correct, current values of economic and financial variables should not be useful in predicting future returns. The theory can thus be empirically tested by evaluating if the data show evidence of a relationship between future returns and current value of predictive variables, e.g. the dividend-price ratio. In practice, the fact that many fund managers follow an “active” strategy of “outperforming the market” seems at odd with the theory that prices are unpredictable and that investors should only follow a “passive” strategy.

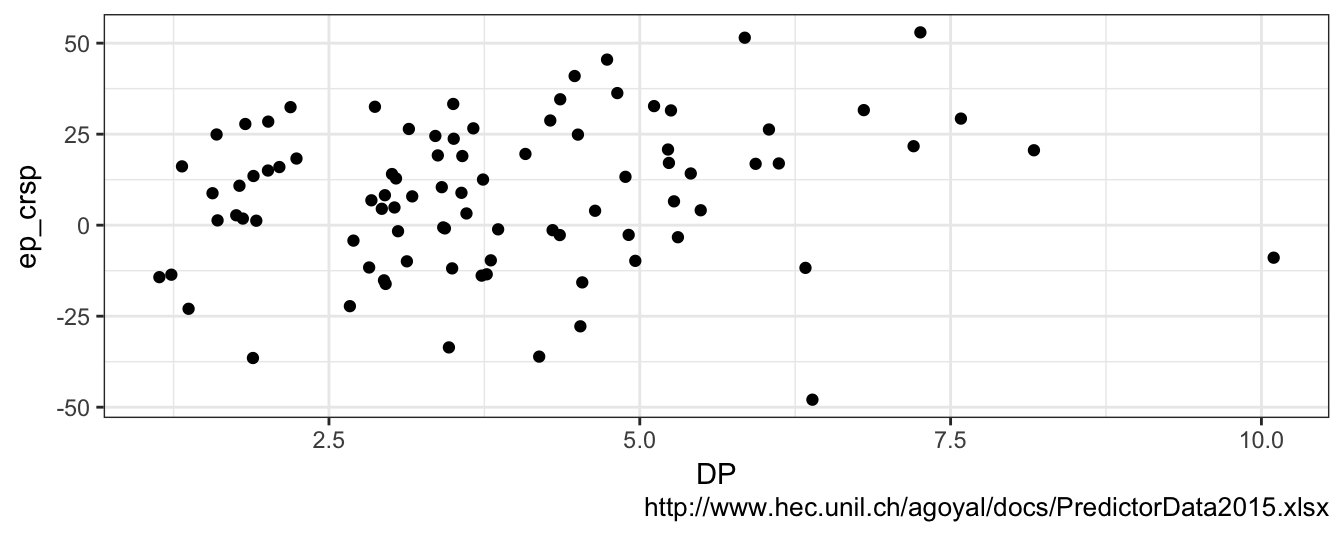

There is an extensive literature in financial economics trying to answer this question. A recent article by Welch and Goyal (2008) is a comprehensive evaluation of the many variables that were found to predict financial returns. The conclusion of the article is that there is some evidence, although not very strong, that returns are predictable. However, the predictability is hardly useful when trying to forecast returns in real-time19. The authors provide the data used in their paper and also an updated version to 2015 at this link. The dataset is provided at the monthly, quarterly, and annual frequency and contains several variables described in detail in the article. For now, we are only interested in using D12 (the dividend), the Rfree (riskfree rate proxied by the 3-month T-bill rate), and the CRSP_SPvw that represents the return of the CRSP value-weighted Index. The code below downloads and reads the Excel file and then creates new variables using the dplyr package. The new variables created are DP (the percentage dividend-price ratio) and ep_crsp that is the equity premium defined as the difference between next year’s percentage return on the CRSP value-weighted Index and the riskfree rate. Finally, a scatter plot of the equity premium against the dividend-price ratio at the annual frequency is produced in Figure 3.1. You should be able to reproduce the graph with the code below.

library(downloader) # package to download files

library(readxl) # package to read xlsx files

library(dplyr)

library(lubridate)

# link to the page of Amit Goyal with the data up to 2015; the file is an Excel xlsx file

url <- "http://www.hec.unil.ch/agoyal/docs/PredictorData2015.xlsx"

file <- download(url, destfile="goyal_welch.xlsx")

data <- read_excel("goyal_welch.xlsx", sheet="Annual", na = "NaN")

data <- data %>% mutate(date = ymd(paste(yyyy,"-01-01",sep="")),

DP = 100 * D12 / Index,

ep_crsp = 100 * (lead(CRSP_SPvw - Rfree, 1, order_by=yyyy))) %>%

dplyr::filter(yyyy >= 1926, yyyy < 2015)

library(ggplot2)

ep.plot <- ggplot(data, aes(DP,ep_crsp)) + geom_point() + theme_bw() + labs(caption=url)

ep.plot

Figure 3.1: Annual observations of the dividend-price (DP) ratio and the equity premium for the CRSP value weighted Index (calculated as the difference between the next year return on the CRSP Value Weighted Index and the riskfree rate).

So: are returns predictable? It seems that years when the DP ratio was high (e.g., higher than 5%) were followed by years with large positive returns. However, also low values of the DP ratio were followed by years with moderately positive returns, but also some negative returns. It seems that, on average, future returns are higher following years with higher DP ratio. The economic logic supporting this relationship is that a high value of the DP makes the asset attractive to investors that will buy more and put upward pressure on the price that is in denominator of the ratio. Sometimes, scatter plots are difficult to interpret and to extract a clear answer about the relationship between two variables. In these cases, it is useful to draw a regression line through the points. The regression line represents the average equity premium that is expected for a certain value of the dividend-price ratio and can be added to the previous graph with the geom_smooth() function as shown below:

ep.plot + geom_smooth(method="lm", se=FALSE, color="orange")

Figure 3.2: Scatter plot of the Dividend-to-Price ratio and the equity premium with the regression line added to the plot.

The regression line is upward sloping which means that increasing values of the dividend-price ratio predict higher returns in the following years. The regression line is equal to -0.04 + 2.16 * DP so that if the DP ratio is equal to 2.5% the model predicts that next year the equity premium will be 5.37% and if the ratio is equal to 5% then the premium is expected to be equal to 10.78%20. The fact that the data points are quite distant from the regression line indicates that the DP has some explanatory power for the equity premium, but we do not expect the predictions to be very precise. For example, if you consider the years in which the DP ratio was close to 5%, there have been years in which the premium has been -10% and others as high as 38% despite the regression line predicted 10.78%. Hence, the regression line seems to account for some dependence between the dividend-price ratio and the equity premium, although there is still large uncertainty. Also, it seems a bit puzzling the behavior of the DP below 2.5%. In the years in which the DP was extremely low the equity premium was actually mostly positive between 0 and 25% while there are only a few years with a negative premium.

A scatter plot is a very useful way to visually investigate the relationship between two variables. However, it eliminates the time series characteristics of these variables that could reveal important features in the data. Figure 3.3 shows the dividend-price ratio and the equity premium over time (starting in 1926).

plot1 <- ggplot(data, aes(yyyy, DP)) + geom_line() + theme_bw() + labs(x="", y="DP") +

geom_hline(yintercept = 5, color="violet") + geom_hline(yintercept = 2.5, color="violet")

plot2 <- ggplot(data, aes(yyyy, ep_crsp)) + geom_line() + theme_bw() +

geom_hline(yintercept = 0, color="tomato3") + labs(x="", y="Equity Premium")

grid.arrange(plot1, plot2)

Figure 3.3: Time series of the DP ratio (top) and the equity premium (bottom) from 1926 to 2015.

Let’s consider first the DP ratio. The ratio was larger than 5% mostly between the mid-1930s and the mid-1950s, fluctuated in the range 2.5-5% until approximately 1995, and since then it has been below 2.5% except for 2008. Notice how values of the ratio below 2.5% never occured before 1995 and were associated, in most cases, with positive premiums and larger than expected based on the regression line. While we see a clear decline in the DP ratio in the latest part of the sample, such a trend is not observable in the equity premium that oscillated approximately between plus/minus 25% throughout the sample. This raises several questions about the relationship between the DP ratio and future returns:

- will the

DPratio ever go back to 5% or more? - is the historical relationship between the

DPratio and the equity premium a good and reliable guidance for the future? - in other words, did the relationship change over time?

The goal of this Chapter is to review the Linear Regression Model (LRM) as the basic framework to investigate the relationship between variables. The goal is not to provide a comprehesive review, but rather to discuss the important concepts and discuss several applications to financial data. The most important task in data analysis is to be aware of the many problems that can arise in empirical work that can distort the analysis, such as the effect of outliers and of omitted variables. This Chapter is meant to provide an intentionally light review which will necessarily require that the reader consults more detailed and precise treatments of the LRM as in Stock and Watson (2010) and Wooldridge (2015).

3.1 LRM with one independent variable

The LRM assumes that there is a relationship between a variable \(Y\) observed at time \(t\), denoted \(Y_t\), and another variable \(X\) observed in the same time period, denoted \(X_t\), and that the relationship is linear, that is, \[Y_t = \beta_0 + \beta_1 * X_t + \epsilon_t\] where \(Y_t\) is called the dependent variable, \(X_t\) is the independent variable, \(\beta_0\) and \(\beta_1\) are parameters, and \(\epsilon_t\) is the error term. Typically, we use subscript \(t\) when the variables are observed over time (time series data) and subscript \(i\) when they vary across different individuals, firms, or countries at one point in time (cross-sectional or longitudinal data). The aim of the LRM is to explain the variation over time or across units of the dependent variable \(Y\) based on the variation of the independent variable \(X\): high values of \(Y\) are explained by high (or low) values of \(X\), depending on the parameter \(\beta_1\). For example, in the case of the equity premium our goal is to understand why in some years the equity premium is positive and large while in other years it is small positive or negative. Another example is the cross-section of stocks in a certain period (month or quarter) and the aim in this case is to understand the characteristics of stocks that drive their future performance. We estimate the LRM by Ordinary Least Squares (OLS) which is an estimation method that determines the parameter values such that they minimize the sum of squared residuals. For the LRM we have analytical formulas for the OLS coefficient estimates. The estimate of the slope coefficient, \(\hat\beta_1\), is given by \[\hat\beta_1 = \frac{\hat\sigma_{X,Y}}{\hat\sigma^2_{X}} = \hat\rho_{X,Y} \frac{\hat\sigma_{Y}}{\hat\sigma_{X}}\] where \(\hat\sigma^2_{X}\) and \(\hat\sigma^2_{Y}\) represent the sample variances of the two variables, and \(\hat\sigma_{X,Y}\) and \(\hat\rho_{X,Y}\) are the sample covariance and the correlation of \(X\) and \(Y\), respectively. The sample intercept, \(\hat\beta_0\), is given by \[\hat\beta_0 = \bar{Y} - \hat\beta_1 * \bar{X}\] where \(\bar{X}\) and \(\bar{Y}\) represent the sample mean of \(X_t\) and \(Y_t\). Let’s make the formulas operative using the dataset discussed in the introduction to this chapter. The dependent variable is actually \(Y_{t+1}\) in this application and represents the annual equity premium (ep_crsp) in the following year, while the independent variable \(X_t\) is the DP, the dividend-price ratio for the current year. To calculate the estimate of the slope coefficient \(\beta_1\) we need to estimate the covariance of the premium and the ratio as well as the variance of PD. We discussed already how to estimate these statistical quantities in R in the previous chapter using the cov() and var() commands:

cov(data$ep_crsp, data$DP) / var(data$DP)[1] 2.1637The interpretation of the slope estimate is that if the DP changes by 1% then we expect the equity premium in the following year to change by 2.164%. The alternative way to calculate \(\hat{\beta}_1\) is using the correlation coefficient and the ratio of the standard deviations of the two assets:

cor(data$ep_crsp, data$DP) * sd(data$ep_crsp) / sd(data$DP)[1] 2.1637This formula shows the relationship between the correlation and the slope coefficients when the LRM has only one independent variables. The correlation between ep_crsp and DP in the sample is 0.184 and it is scaled up by 11.76 that represents the ratio of the standard deviations of the dependent and independent variables. Notice that if we had standardized both \(X\) and \(Y\) to have standard deviation equal to 1 then the correlation coefficient would be equal to the slope coefficient. Once the slope parameter is estimated, we can then calculate the sample intercept as follows:

mean(data$ep_crsp) - beta1 * mean(data$DP)[1] -0.035942The OLS formulas for the estimators of the intercept and slope coefficients and their calculation are programmed in all statistical and econometric software, and even Microsoft Excel can provide you with the calculations. Still, it is important to understand what these numbers represent and how to relate to other quantities that we routinely use to measure dependence. The R function lm() (for linear model) estimates the LRM automatically and provides all accessory information that is needed to conduct inference and evaluate the goodness of the model. The following example estimates the LRM with the equity premium as the dependent variable and the DP ratio as the independent:

# two equivalent ways of estimating a linear model

fit <- lm(data$ep_crsp ~ data$DP)

fit <- lm(ep_crsp ~ DP, data=data)

Call:

lm(formula = ep_crsp ~ DP, data = data)

Coefficients:

(Intercept) DP

-0.0359 2.1637 The fit object produces only the coefficient estimates and a more detailed report of the relevant statistics can be obtained using the function summary(fit) as shown below:

summary(fit)

Call:

lm(formula = ep_crsp ~ DP, data = data)

Residuals:

Min 1Q Median 3Q Max

-61.72 -13.26 2.53 13.34 38.89

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.0359 5.2297 -0.01 0.995

DP 2.1637 1.2393 1.75 0.084 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 20 on 87 degrees of freedom

Multiple R-squared: 0.0339, Adjusted R-squared: 0.0227

F-statistic: 3.05 on 1 and 87 DF, p-value: 0.0844The summary() of the lm object provides the statistical quantities that are used in testing hypothesis and understand the relevance of the model in explaining the data. The information provided is21:

- Estimate: the OLS estimates of the coefficients in the LRM

- Std. Error: the standard errors represent the standard deviations of the estimates and measure the uncertainty in the sample about the coefficient estimates

- t value: the ratio of the estimate and the standard error of a coefficient; it represents the t-statistic for the null hypothesis that the coefficient is equal to zero, that is, \(H_0: \beta_i = 0\) (i=0,1). In large samples the t-statistic has a standard normal distribution and the two-sided critical values at 10, 5, and 1% are 1.64, 1.96, and 2.58, respectively. The null hypothesis that a coefficient is equal to zero against the alternative that is different from zero is rejected when the absolute value of the t-statistic is larger than critical values.

- Pr(>|t|): the p-value represents the probability that the standard normal distribution takes a value larger (in absolute value) than the t-statistic. The null \(H_0: \beta_i = 0\) is rejected in favor of \(H_1: \beta_i \not= 0\) when the p-value is smaller than the significance level (1, 5, 10%) .

- Residual standard error: the variance of the residuals \(\hat{\epsilon_t} = Y_t - \hat\beta_0 - \hat\beta_1 * X_t\).

- R\(^2\): a measure of goodness-of-fit that represents the percentage of the variance of the dependent variable that is explained by the model, while \(100- R^2\)% remains unexplained. The measure ranges from 0 to 1 with 0 meaning that the model is totally irrelevant to explain the dependent variable and 1 meaning that it completely explain it without errors.

- Adjusted R2: this quantity penalizes the \(R^2\) measure for the number of parameters that are included in the regression. This is because \(R^2\) does not decrease when additional independent variables are included in the model. Models with highest adjusted \(R^2\) are preferred.

- F-statistic: tests the null hypothesis that all slope parameters are equal to zero against the alternative that at least one is different from zero. The critical value of the F-statistic depends on the number of observations and the number of variables included in the regression.

The regression results show that an increase of the DP ratio by 1% (% is the unit of the DP variable) leads to an increase of future returns by 2.16% and confirms that higher dividend-price ratio predict higher future returns. The coefficient of the DP ratio has a t-statistic of 1.75 and a p-value of 0.08 which means that it is statistically significant at 10% but not at 5%. Hence, we do find evidence indicating that the dividend-price ratio is a significant predictor of future returns, although only at 10% significance level. The goodness-of-fit measure \(R^2\) is equal to 0.034 or 3.4% which is quite close to its lower bound of zero and indicates that the DP ratio has small predictive power for the equity premium. We thus find that returns are predictable, although the predictive content of the variable we used (the dividend-price ratio) is small. Maybe there could be other more powerful predictors of the equity premium, and the search continues.

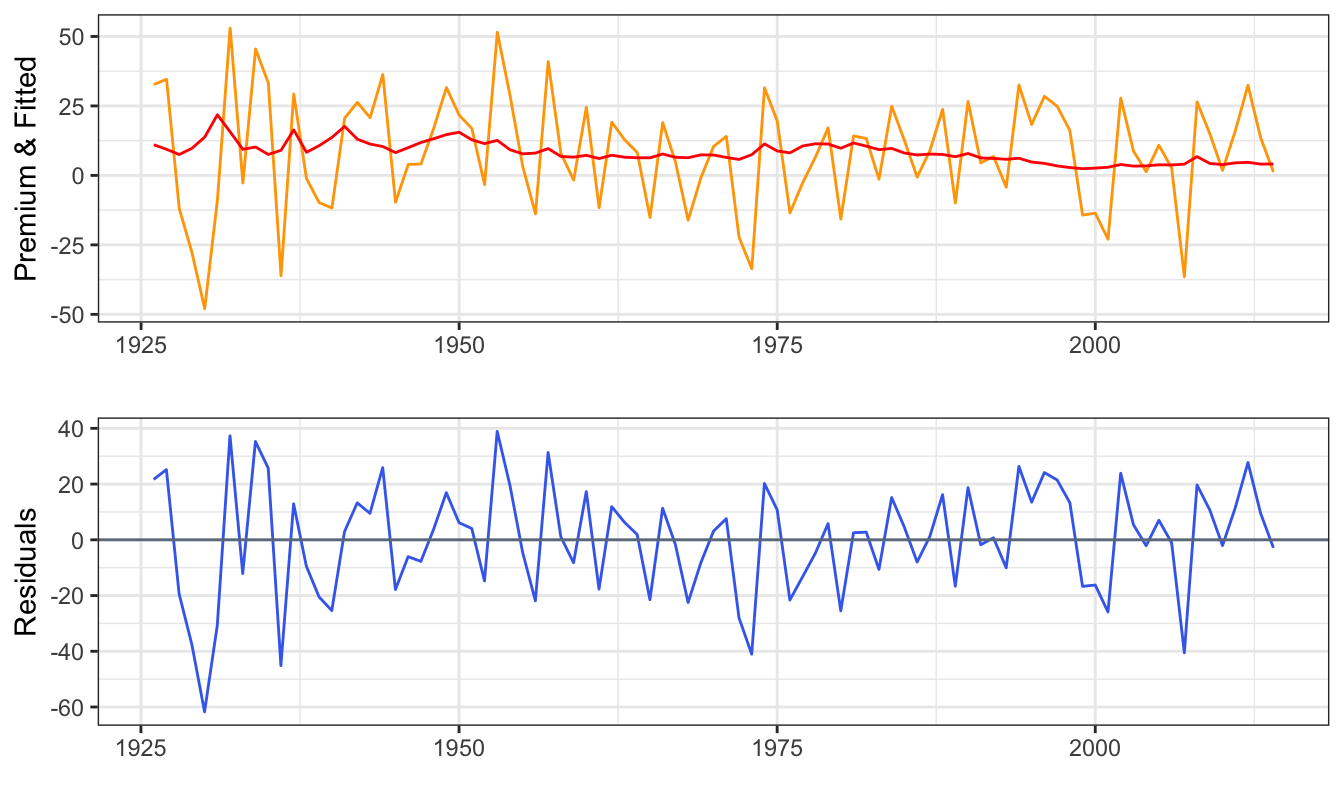

Based on the coefficient estimates, we can then calculate the fitted values and the residuals of the regression model. The fitted values are calculated as \(\hat\beta_0 + \hat\beta_1 * DP_t\) and represent the prediction of the equity premium in year \(t+1\) based on the DP ratio of year \(t\). We can denote the fitted values (or expected or predicted) as \(E(EP_{t+1})\) where \(E(\cdot)\) is the expectation and \(EP_{t+1}\) represents the equity premium in the following year. The residuals are the estimated errors and are obtained by subtracting the predicted equity premium to the value that actually realized, that is, \(\hat\epsilon_{t+1} = EP_{t+1} - E(EP_{t+1})\). Figure 3.4 shows the time series of the equity premium (orange line) and the forecast from the model (red line), while the bottom graph shows the residuals that represent the distance between the realized and fitted equity premium in the top graph.

plot1 <- ggplot(data) + geom_line(aes(yyyy, ep_crsp), color="orange") +

geom_line(aes(yyyy, fit$fitted.values), color="red") +

theme_bw() + labs(x="", y="Premium & Fitted")

plot2 <- ggplot(data) + geom_line(aes(yyyy, fit$residuals), color="royalblue2") +

theme_bw() + labs(x="",y="Residuals") +

geom_hline(yintercept=0, color="slategray4")

grid.arrange(plot1, plot2)

Figure 3.4: Time series of the realized and predicted equity premium (top) and the residuals obtained as the difference between the realized and predicted equity premium (bottom).

Let’s first look at the top graph. The red line (predicted equity premium) seems quite flat relative to the orange line (realized equity premium). The goal of the model is to produce predictions that are as close as possible to the realized values. Unfortunately, in this case it seems that the predictions of the model are not very informative about the following year equity premium. This makes visually clear the implications of a low \(R^2\). If the \(R^2\) was equal to zero the red line would have been flat and, at the other extreme, if \(R^2\) was equal to one then the red line would overlap with the orange line22. In this case, the predicted equity premium varies over time in response to changes in the DP ratio, but hardly enough to keep track of the changes of the realized equity premium in any useful way.

3.2 Robust standard errors

The standard errors calculated by the lm() function are based on the assumption that the errors \(\epsilon_t\) have constant variance and, for time series data, that they are independent over time. In practice, both assumptions might fail. The variance or standard deviation of the errors might vary over time or across individuals and errors might be dependent and correlated over time. For example, an indication of dependence in the error is when positive errors are more (less) likely to be followed by positive (negative) errors as opposed to be equally likely. Calculating the standard errors assuming homogeneity and independence when in fact the errors are heteroskedastic and/or dependent is that, typically, the standard errors are smaller than they should be to make correct inference. The solution is to correct the standard errors using Heteroskeasticity Corrected (HC) standard errors in cross-sectional regressions and using Heteroskedasticity and Autocorrelation Corrected (HAC) standard errors when dealing with time series data as proposed by Newey and West (1987). A practical rule is use corrected standard errors by default and in case the residuals are homoskedastic and independent over time there is only a small loss of precision in small samples. The code below shows how to calculate Newey-West HAC standard errors for a lm object.

library(sandwich) # function NeweyWest() to calculates HAC standard errors

library(lmtest) # function coeftest() produces a table of results with HAC s.e.

fit <- lm(ep_crsp ~ DP, data=data)

summary(fit)$coefficients

coeftest(fit, df = Inf, vcov = NeweyWest(fit, prewhite = FALSE)) Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.036 5.2 -0.0069 0.995

DP 2.164 1.2 1.7459 0.084

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.0359 4.9993 -0.01 0.99

DP 2.1637 1.3173 1.64 0.10Notice that:

- The coefficient estimates are the same since they are not biased by the presence of heteroskedasticity and auto-correlation in the errors

- The standard error for

DPand the intercept increase slightly. This implies that the t-statistic forDPdecreases from 1.75 to 1.64 and the p-value increases from 0.08 to 0.1. TheDPis still significant at 10% level but it becomes a even more marginal case.

As mentioned earlier, when dealing with time series data it is good practice to estimate HAC standard errors by default which is what we will do in the rest of this book.

3.3 Functional forms

In the example above we considered the case of a linear relationship between the independent variable \(X\) and the dependent variable \(Y\). However, there are situations in which the relationship between \(X\) and \(Y\) might not be well-explained by a linear model. This can happen, e.g., when the effect of changes of \(X\) on the dependent variable \(Y\) depends on the level of \(X\). In this Section, we discuss two functional forms that are relevant in financial applications.

One functional form that can be used to account for nonlinearities in the relationship between X and Y is the quadratic model, which simply consists of adding the square of the independent variable as an additional regressor. The Quadratic Regression Model is given by \[ Y_t = \beta_0 + \beta_1 * X_t + \beta_2 * X_t^2 + \epsilon_t\] that, relative to the linear model, adds some curvature to the relationship through the quadratic term. The model can still be estimated by OLS and the expected effect of a one unit increase in \(X\) is now given by \(\beta_1 + 2 \beta_2 X_t\). Hence, the effect on \(Y\) of changes in \(X\) is a function of the level of the independent variable X, while in the linear model the effect is \(\beta_1\) no matter the value of \(X\). Polynomials of higher order can also be used, but care needs to be taken since the additional powers of \(X_t\) are strongly correlated with \(X_t\) and \(X_t^2\). The cubic regression model is thus given by: \[ Y_t = \beta_0 + \beta_1 * X_t + \beta_2 * X_t^2 + + \beta_3 * X_t^3 + \epsilon_t\]

The second type of nonlinearity that can be easily introduced in the LRM assumes that the slope coefficient of \(X\) is different below or above a certain threshold value of \(X\). For example, if \(X_t\) represents the market return we might want to evaluate if there is a different (linear) relationship between the stock and the market return when the market return is, e.g., below or above the mean/median. We can define two new variables as \(X_t * I(X_t \geq m)\) and $ X_t * I(X_t < m)$, where \(I(A)\) is the indicator function which takes value 1 if the event \(A\) is true and zero otherwise, and \(m\) is a threshold value to define the variable above and below. The model is given by: \[Y_t = \beta_0 + \beta_1 X_t * I(X_t \geq m) + \beta_2 X_t * I(X_t < m) + \epsilon_t\] where the coefficients \(\beta_1\) and \(\beta_2\) represent the effect on the dependent variable of a unit change in \(X_t\) when \(X_t\) is larger or smaller than the value \(m\). Another way of specifying this model is by including the regressor \(X_t\) and only one of the two interaction effects: \[Y_t = \gamma_0 + \gamma_1 X_t + \gamma_2 X_t * I(X_t \geq m) + \epsilon_t\] In this case the coefficient \(\gamma_2\) represents the differential effect of the variable \(X\) when it is below or above the value \(m\). Testing the null hypothesis that \(\gamma_2 = 0\) represents a way to evaluate whether there is a nonlinear relationship between the two variables.

3.3.1 Application: Are hedge fund returns nonlinear?

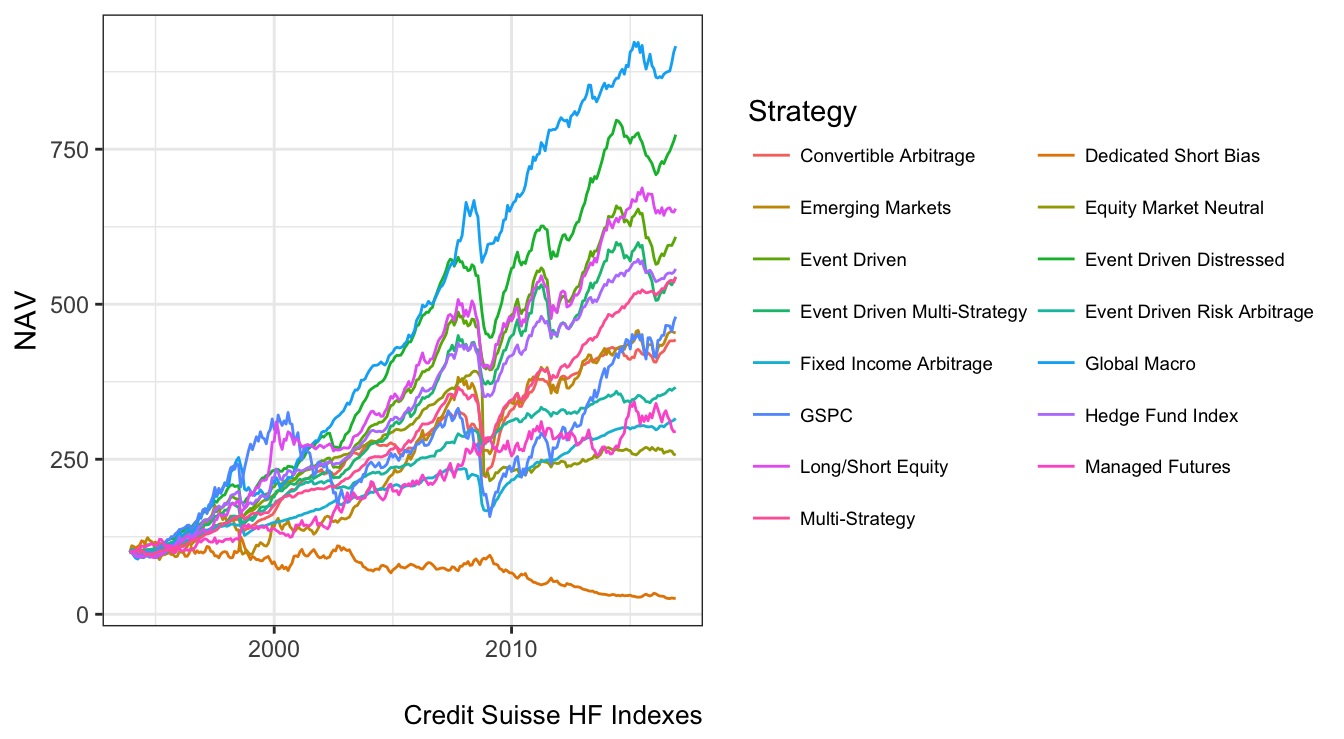

An interesting application of nonlinear functional forms is to model hedge fund returns. As opposed to mutual funds that mostly hold long positions and make limited use of financial derivatives and leverage, hedge funds make extensive use of these instruments to hedge downside risk and boost their returns. This potentially produces a nonlinear response to changes in market returns which cannot be captured by a linear model. As a simple example, assume that a hedge fund holds a portfolio composed of one call option on a certain stock. The performance/payoff will obviously have a nonlinear relationship to the price of the underlying asset and will be better approximated by either of the functional forms discussed above. We can empirically investigate this issue using the Credit Suisse Hedge Fund Indexes23 that provide the overall and strategy-specific performance of a portfolio of hedge funds. Indexes are available for the following strategies: convertible arbitrage, dedicated short bias, equity market neutral, event driven, global macro and long-short equity among others. Since individual hedge fund returns data are proprietary, we will use these Indexes that could be interpreted as a sort of fund-of-funds of the overall universe or for specific strategies of hedge funds.

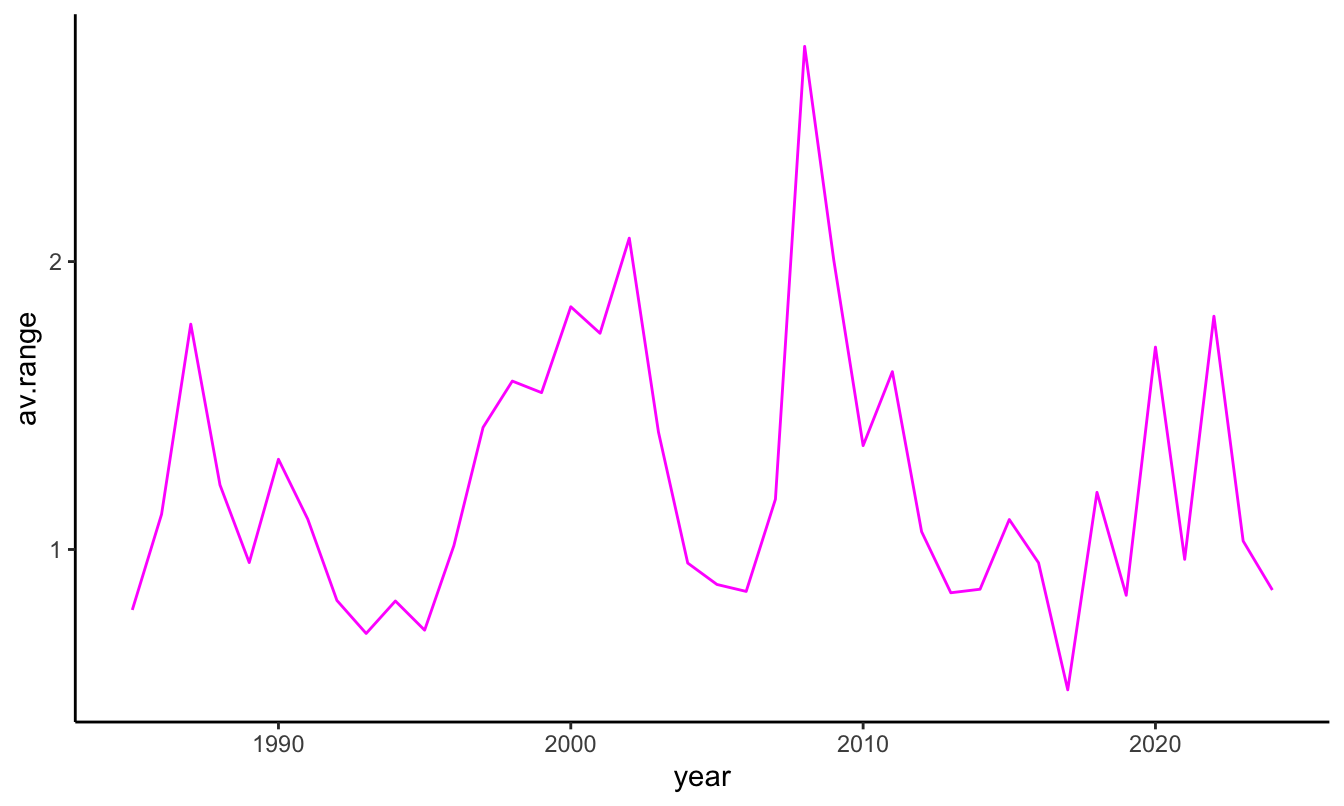

The file hedgefunds.csv contains the returns of 14 Credit Suisse Hedge Fund Indexes (the HF index and 13 strategies indexes) starting in January 1993 at the monthly frequency. Figure 3.5 shows the change in NAV for these indexes, with some strategies performing extremely well (e.g., global macro) and other performing rather poorly (e.g., dedicated short bias). All strategies seem to have experienced a decline during the 2008-2009 recession, although some strategies were affected to a lesser extent.

hfret <- read_csv('hedgefunds.csv')

hfret$date <- as.yearmon(mdy(hfret$date)) # format the date to match the format of factor

sp500 <- dplyr::select(mydata, date, GSPC) # merge with S&P 500

sp500$GSPC <- 100 * sp500$GSPC / sp500$GSPC[sp500$date == "Dec 1993"] # make Dec 1993 equal to 100

hfret <- inner_join(hfret, sp500, by="date") # join the hfret and sp500 in one data frame

# reorganize the data in e columns: date, Strategy, NAV (makes it easier to use ggplot2)

hfret <- arrange(hfret, date) %>% tidyr::gather(Strategy, NAV, -date)

ggplot(hfret, aes(date, NAV, color=Strategy)) +

geom_line() + theme_bw() + labs(x="", caption="Credit Suisse HF Indexes") +

theme(legend.text=element_text(size=7)) + guides(col = guide_legend(nrow = 8, byrow = TRUE))

Figure 3.5: Net Asset Value (NAV) of the Credit Suisse HF Indexes starting in December 1993. In this graph the NAV of all strategies is standardized at 100 in December 1993.

Alternatively, we can evaluate and compare the descriptive statistics of the strategies by calculating the mean, standard deviation, skewness, and kurtosis for the monthly returns defined as the percentage change of the NAV. In the code below I use the skewness and kurtosis functions from the e1071 package and format the results as a table using the kable function from the knitr package.

hfret <- hfret %>%

group_by(Strategy) %>%

mutate(RET = 100 * log(NAV / lag(NAV))) %>%

dplyr::filter(!is.na(RET))

strategy.table <-hfret %>%

group_by(Strategy) %>%

summarize(AV = mean(RET),

SD = sd(RET),

SKEW = e1071::skewness(RET),

KURT = e1071::kurtosis(RET),

MIN = min(RET), MAX = max(RET))

knitr::kable(strategy.table, digits=3, caption="Summary statistics for the HF strategy returns

from the Credit Suisse Hedge Fund Indexes starting in December 1993.")| Strategy | AV | SD | SKEW | KURT | MIN | MAX |

|---|---|---|---|---|---|---|

| Convertible Arbitrage | 0.54 | 1.9 | -3.003 | 20.36 | -13.5 | 5.6 |

| Dedicated Short Bias | -0.49 | 4.6 | 0.521 | 0.81 | -12.0 | 20.5 |

| Emerging Markets | 0.55 | 4.0 | -1.255 | 8.39 | -26.2 | 15.2 |

| Equity Market Neutral | 0.34 | 3.3 | -13.735 | 210.97 | -51.8 | 3.6 |

| Event Driven | 0.65 | 1.8 | -2.216 | 11.16 | -12.5 | 4.1 |

| Event Driven Distressed | 0.74 | 1.8 | -2.281 | 13.15 | -13.3 | 4.1 |

| Event Driven Multi-Strategy | 0.61 | 1.9 | -1.768 | 7.78 | -12.2 | 4.7 |

| Event Driven Risk Arbitrage | 0.47 | 1.1 | -0.990 | 4.87 | -6.4 | 3.7 |

| Fixed Income Arbitrage | 0.42 | 1.6 | -5.057 | 40.80 | -15.1 | 4.2 |

| Global Macro | 0.80 | 2.6 | -0.126 | 4.82 | -12.3 | 10.1 |

| GSPC | 0.57 | 4.3 | -0.840 | 1.66 | -18.6 | 10.2 |

| Hedge Fund Index | 0.62 | 2.0 | -0.263 | 3.15 | -7.8 | 8.2 |

| Long/Short Equity | 0.68 | 2.6 | -0.201 | 3.83 | -12.1 | 12.2 |

| Managed Futures | 0.39 | 3.3 | -0.046 | -0.15 | -9.8 | 9.5 |

| Multi-Strategy | 0.62 | 1.4 | -1.838 | 7.44 | -7.6 | 4.2 |

Some facts that emerge from this table:

- The best performing strategy is

Global Macrowith an average return of 0.8% monthly and the worst performing strategy isDedicated Short Biasthat realized an average return of -0.49%. As a comparison, the S&P 500 Index in the same period had a average return of 0.57% and theHedge Fund Indexof 0.62% - In terms of volatility, the standard deviation of the S&P 500 in this period was 4.28% monthly and the

Hedge Fund Indexof 2. The least volatile HF strategy wasEvent Driven Risk Arbitrage(1.14%) and the most volatile wasDedicated Short Bias(4.65%) - Overall, it seems that most strategies provide a better risk-return ratio relative to investing in the S&P 500 by providing higher returns per unit of volatility.

- Most strategies have negative skewness and positive excess kurtosis that indicate that the distribution of returns are left-skewed and fat tailed. This could be due to large negative returns due to significant declines in NAV. Some values of the kurtosis are quite extreme as in the case of the

Equity Market Neutralstrategy with a value of 210.97. This is an indication that some outliers might have occured in the sample and that further examination is required as discussed later in the Chapter. The columnMINandMAXshow thatEquity Market Neutralexperienced a loss of 51.84% in one month while the largest gain was 3.59%. In analyzing this dataset we will have to consider carefully whether these extreme observations might be considered outliers and have an effect on our analysis.

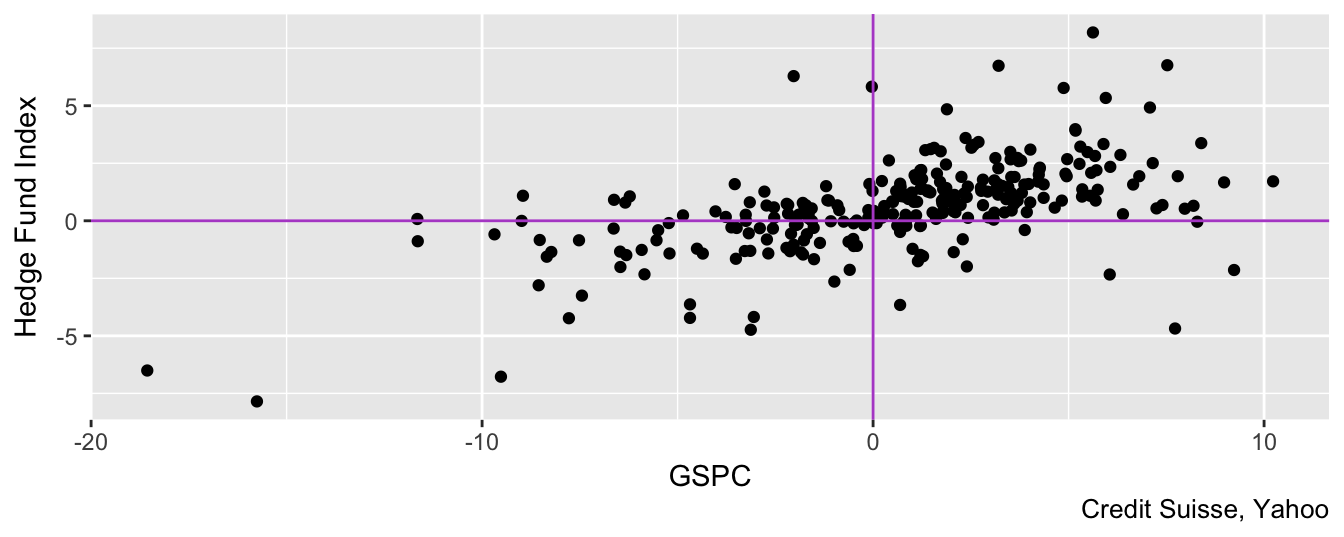

Are the HF returns sensitive to movements in the U.S. equity market? To evaluate graphically this question we can do a scatter plot of the HF Index return against the S&P 500. Figure 3.6 shows that there seems to be positive correlation between these two variables, although the most striking feature of the plot is the difference in scale between the x- and y-axis: the HF returns range between \(\pm 8\)% while the equity index between \(-20\)% and \(12\)%. The standard deviation of the HF index is 2% compared to 4.28% for the S&P 500 Index which shows that hedge funds provide a hedge against large movements in markets. Notice that the code to make Figure 3.6 keeps the column names to be the strategy names given by Credit Suisse. This is mostly driven by the intent to make the code easier to read and more transparent. In practice, it is more convenient to rename the columns to some shorter and faster to type names (e.g., HFI). Below is the code to produce Figure 3.6.

hfret1 <- hfret %>% dplyr::select(-NAV) %>% tidyr::spread(Strategy, RET)

ggplot(hfret1, aes(GSPC, `Hedge Fund Index`)) + geom_point() +

geom_vline(xintercept=0, color="mediumorchid3") +

geom_hline(yintercept=0, color="mediumorchid3") +

labs(caption = "Credit Suisse, Yahoo")

Figure 3.6: Scatter plot of the monthly returns of the SP 500 Index and the CSHedge Fund Index starting in December 1993.

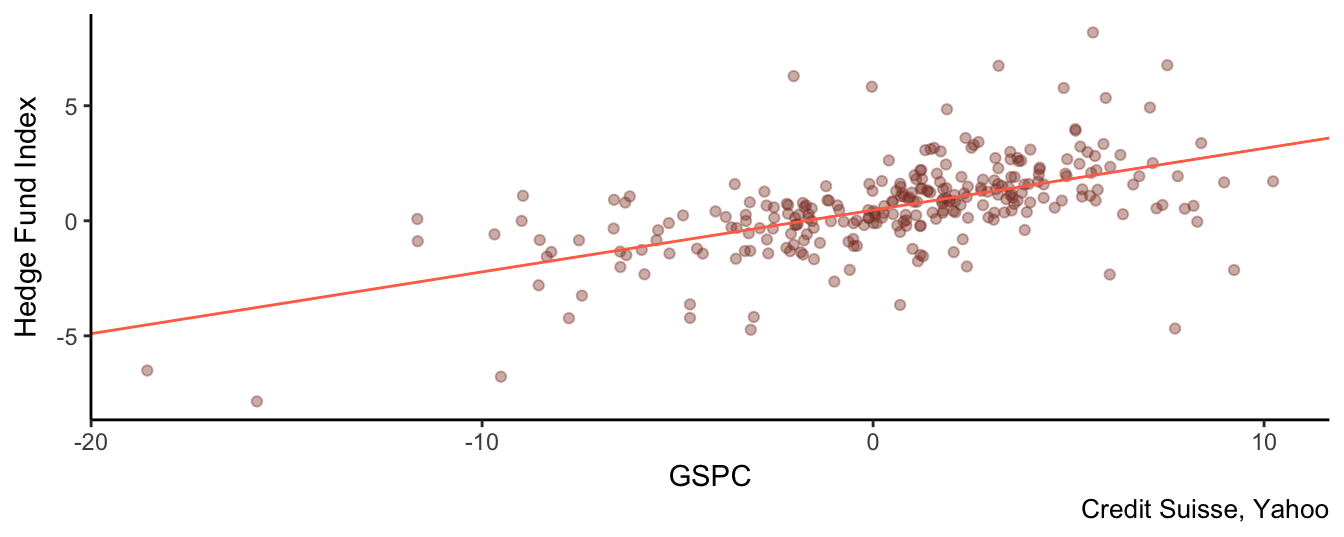

Before introducing non-linearities, let’s estimate a linear model in which the HF index return is explained by the S&P 500 return. The results below show the existence of a statistically significant relationship between the two returns. The exposure of the HF return to S&P 500 fluctuations is 0.27 which means that if the market return changes by \(\pm 1\)% then we expect the fund return to change by \(\pm\) 0.27%. The \(R^2\) of the regression is 0.33, which is not very high for this type of regressions. A (relatively) low \(R^2\) in this case is actually good news for hedge funds since most strategies promise to provide low (if none) exposure to market fluctuation. If this is case then a low goodness-of-fit statistic is good news. We can add the fitted linear relationship given by 0.47 + 0.27\(R_t^{SP500}\) to the previous scatter plot to have a graphical understanding of the LRM:

fitlin <- lm( `Hedge Fund Index` ~ GSPC, data=hfret1)

coeftest(fitlin, vcov=NeweyWest(fitlin, prewhite = FALSE))

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.4695 0.1162 4.04 7.0e-05 ***

GSPC 0.2687 0.0327 8.23 7.9e-15 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1ggplot(hfret1, aes(GSPC, `Hedge Fund Index`)) +

geom_point(color="coral4", alpha=0.4) +

geom_abline(intercept = coef(fitlin)[1], slope = coef(fitlin)[2], color="coral1") +

theme_classic() + labs(caption = "Credit Suisse, Yahoo")

Figure 3.7: Scatter plot of the SP 500 and the HF Index together with the regression line obtained from the fitlin object.

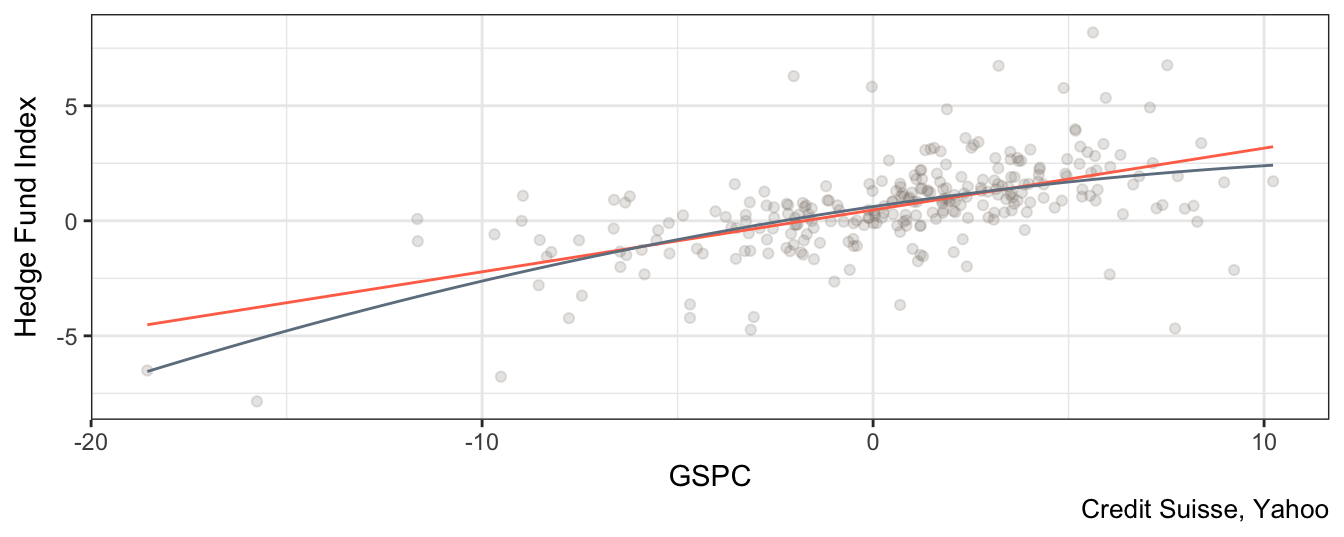

To estimate a quadratic model we need to add the quadratic term to the linear regression. This can be done adding the term I(GSPC^2) where I() is used to add transformations of variables in the formula of the lm() function:

fitquad <- lm(`Hedge Fund Index` ~ GSPC + I(GSPC^2), data=hfret1)

coeftest(fitquad, vcov=NeweyWest(fitquad, prewhite = FALSE))

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.61540 0.11323 5.44 1.2e-07 ***

GSPC 0.25064 0.03540 7.08 1.2e-11 ***

I(GSPC^2) -0.00729 0.00423 -1.73 0.086 .

---

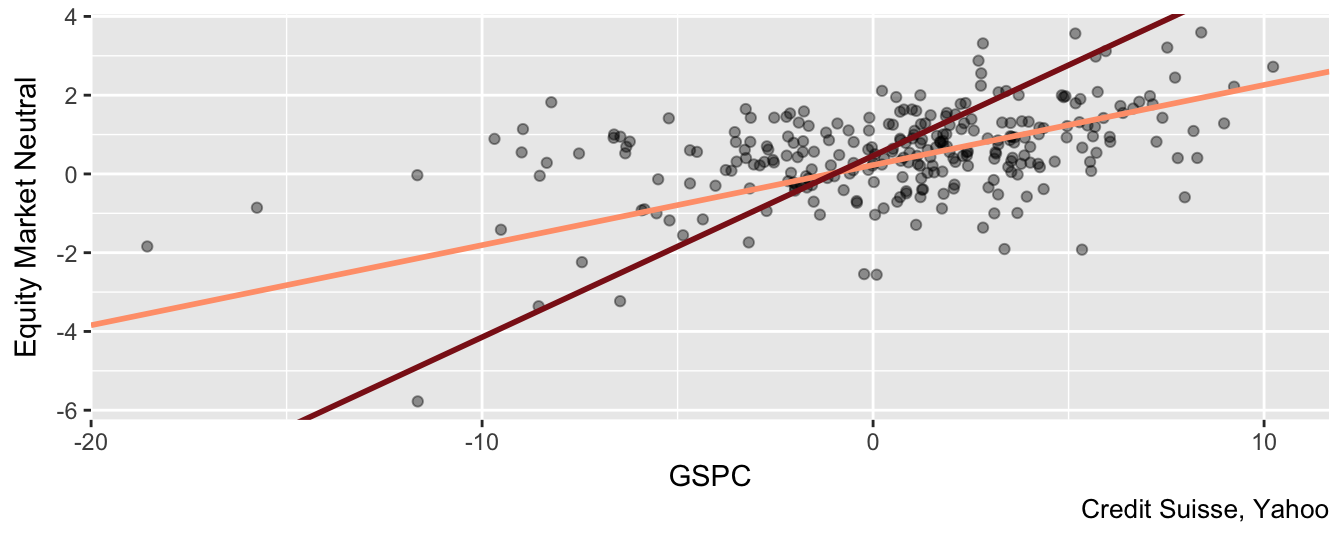

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Since the coefficient of the square term is statistically significant at 10% level we conclude that a nonlinear form is a better model to explain the relationship between the market and fund returns. In this case, we find that the p-value for the null hypothesis that the coefficient of the square market return is equal to zero is 0.09 (or 8.6%) which is smaller than 0.10 (or 10%) and we thus conclude that there is significant evidence of nonlinearity in the relationship between the HF and the market return. The effect of a \(\pm\) 1% change in the S&P 500 is given by 0.25 + (-0.01)\(R_t^{SP500}\).The fact that the coefficient of the quadratic term is negative implies that the parabola 0.62 + 0.25\(R_t^{SP500}\) + -0.01\((R_t^{SP500})^2\) will lay below the line 0.62 + 0.25\((R_t^{SP500})\). So, for large (either positive or negative) returns the parabola implies expectations of returns that are significantly lower relative to the line. Instead, if the coefficient of the quadratic term is positive then the parabola would lay above the line and imply that hedge fund returns become less sensitive (or even profit) from large movements in the market.

In Figure 3.8 we see that the contribution of the quadratic term (dashed line) becomes apparent at the extremes (large absolute market returns), while for small returns it is close or overlaps with the fitted values of the linear model. In terms of goodness-of-fit, the adjusted \(R^2\) of the quadratic regression is 0.34 which is a modest increase relative to 0.33 for the linear model.

ggplot(hfret1, aes(GSPC, `Hedge Fund Index`)) +

geom_point(color="antiquewhite4", alpha=0.2) +

stat_function(fun = function(x) coef(fitlin)[1] + coef(fitlin)[2]*x, color="coral1") +

stat_function(fun = function(x) coef(fitquad)[1] + coef(fitquad)[2]*x

+ coef(fitquad)[3]*x^2, color="slategrey") +

theme_bw() + labs(caption = "Credit Suisse, Yahoo")

Figure 3.8: Scatter plot of the SP 500 and the HF index returns with linear and quadratic regression line.

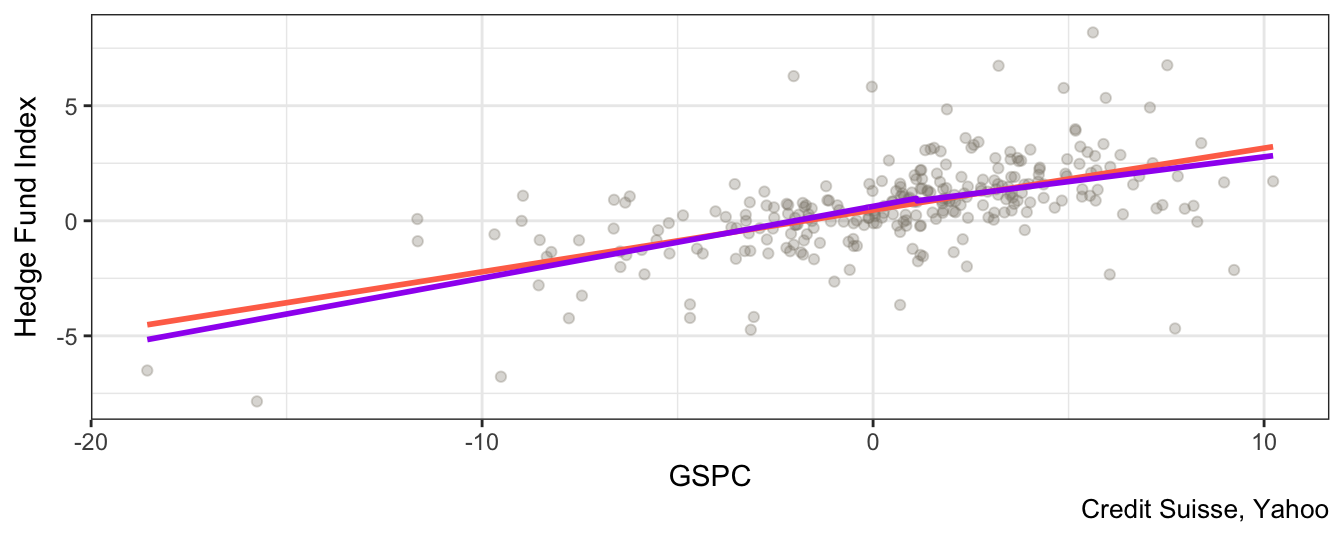

The second type of nonlinearity that was discussed earlier assumes that the relationship between dependent and independent variables is linear but with different slopes below and above a certain value of the independent variable. In the example below we consider the median value of the independent variable as the threshold value (in this sample the median value of the S&P 500 is 1.11%). There are two equivalent ways to specify model24 for estimation by including in the regression:

- the

GSPCreturn and the interaction termI(GSPC * (GSPC < m) - the

I(GSPC * (GSPC < m)andI(GSPC * (GSPC >= m)

To avoid perfect multicollinearity we need to avoid to include the variable (e.g., GSPC) and both of its transformations in the regression since the model cannot be estimated. The lm() function in these cases drops one of the regressors and estimates the model on the remaining ones. One advantage of the first specification is that the coefficient of the term I(GSPC * (GSPC < m)) represents the difference in the effect of a change of the independent variable on the dependent. If the null hypothesis that it is equal to zero is not rejected than the data indicate that the nonlinear model is not needed and we can continue the analysis with the linear model.

m <- median(hfret1$GSPC, na.rm=T)

fit.piecewise <- lm( `Hedge Fund Index` ~ GSPC + I(GSPC * (GSPC < m)), data=hfret1)

coeftest(fit.piecewise, vcov=NeweyWest(fit.piecewise, prewhite = FALSE))

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.6271 0.1380 4.54 8.3e-06 ***

GSPC 0.2152 0.0624 3.45 0.00066 ***

I(GSPC * (GSPC < m)) 0.0967 0.0915 1.06 0.29131

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1fit.piecewise <- lm( `Hedge Fund Index` ~ I(GSPC *(GSPC < m)) + I(GSPC * (GSPC >= m)), data=hfret1)

coeftest(fit.piecewise, vcov=NeweyWest(fit.piecewise, prewhite = FALSE))

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.6271 0.1405 4.46 1.2e-05 ***

I(GSPC * (GSPC < m)) 0.3119 0.0517 6.03 5.3e-09 ***

I(GSPC * (GSPC >= m)) 0.2152 0.0635 3.39 0.00081 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The two specifications achieve the same result in term of \(R^2\) (equal to 0.34) and the parameters of one model can be mapped into the parameters of the other model. The slope coefficient (or market exposure) of the HF Index below the median is 0.31 and above is 0.22, which suggests that the HF Index is more sensitive to downward movements of the market relative to upward movements. Instead, in the first regression the results show that a 1% change in the S&P 500 causes a 0.22 change, but the index return is below the median, that is I(GSPC < m)=1, then the effect is 0.31 which is obtained by summing 0.22 and 0.1. To evaluate statistically if the nonlinear specification is useful or not we can simply test whether the coefficient of I(GSPC * (GSPC < m)) is equal to zero against the alternative that it is different from zero. The pvalue for this hypothesis is 0.29and even at 10% we do not reject the null hypothesis that it is equal to zero. Hence, this nonlinear specification does not seem to be supported by the data, as opposed to the quadratic model. The shape of the regression line for this model and for the quadratic model are very similar as shown in Figure 3.9, although the quadratic model is marginally superior to the linear model by having a significant coefficient in the square term, and by achieving higher adjusted \(R^2\).

mat <- data.frame(X = (fit.piecewise$model[,2]+fit.piecewise$model[,3]), fitted = fitted(fit.piecewise))

mat <- arrange(mat, fitted)

ggplot(hfret1, aes(GSPC, `Hedge Fund Index`)) +

geom_point(color="antiquewhite4", alpha=0.3) +

geom_smooth(method="lm", se=FALSE, color="coral1") +

geom_line(data=mat, aes(X,fitted),color="purple", size=1) +

theme_bw() + labs(caption = "Credit Suisse, Yahoo")

Figure 3.9: Scatter plot of the SP 500 return and the Hedge Fund Index together with the linear regression line and the piece-wise or threshold linear model.

3.4 The role of outliers

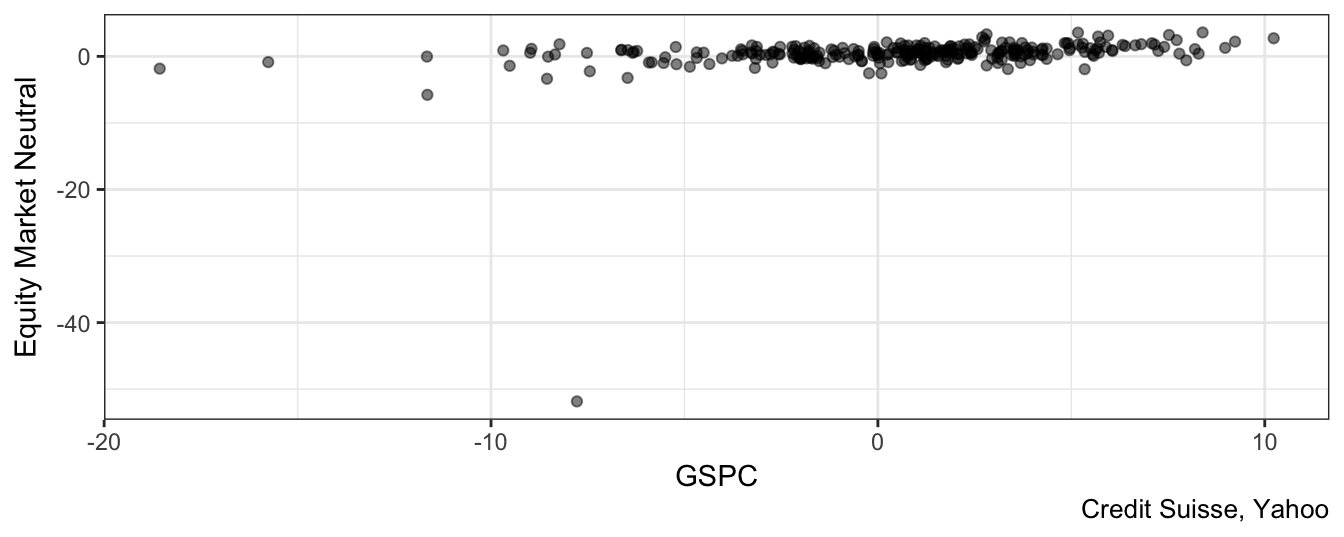

One of the strategies provided by Credit Suisse is the equity market neutral strategy that aims at providing positive expected return, with low volatility and no correlation with the equity market. Figure 3.10 represents a scatter plot of the market return (proxied by the S&P 500) and the HF equity market neutral return.

ggplot(hfret1, aes(GSPC, `Equity Market Neutral`)) +

geom_point(alpha=0.5) + theme_bw() + labs(caption = "Credit Suisse, Yahoo")

Figure 3.10: Scatter plot of the SP 500 returns and the HF Equity Market Neutral returns.

What is wrong with Figure 3.10? Did we do a mistake in plotting the variables? No, the only issue with the graph is the large negative return of -51.84% for the HF strategy relative to a loss for the S&P 500 of “only” 7.78%. To find out when the extreme observation occurred, we can use the command which.min(hfret1$'Equity Market Neutral') which indicates that it represents the 179th observation. What happened in November 2008 to create a loss of 51.84% to an aggregate index of market neutral strategy hedge funds? In a press release Credit Suisse discusses that they marked down to zero the assets of the Kingate Global Fund, which was a hedge fund based on the British Virgin Islands that acted as a feeder for the Madoff funds and was completely wiped out when the Ponzi scheme operated by Bernard Madoff was discovered. Does this extreme observation or outlier have an effect on our conclusions and our assessment of the equity market neutral strategy? Let’s consider how the descriptive statistics in Table 3.1 would change if the outlier is excluded:

- the mean would increase from 0.34% to 0.53%

- the standard deviation would decline from 3.35% to 1.13%

- the skewness would change from -13.74 to 0.53

- the excess kurtosis would change from 210.97 to 3.97

These results make clear that there is a significant effect of the outlier in distorting the descriptive statistics. Statistically speaking, the estimates might be biased because the outlier has the effect of pushing away the sample estimates from their population values. This is an important issue in practice because we use these quantities to compare the risk-return tradeoff of different assets and also because we wish to predict the expected future return from investing in such a strategy. Should we include or exclude the outlier when calculating quantities that are the basis for investment decisions? This choice depends on our interpretation of the nature of the extreme observation: is it an intrinsic feature of the process to produce outliers occasionally or can it be attributed to a one-time event that is unlikely to happen again? In the current situation we need to assess whether another Ponzi scheme of the magnitude operated by Bernard Madoff can occur in the future and lead to the liquidation of a large equity market neutral hedge fund. It is probably fair to say that the circumstances that led to the 51.84% loss were so exceptional that it is warranted to simply drop that observation from the sample when estimating the model parameters.

In addition to creating bias in the descriptive statistics, outliers have also the potential to bias the coefficient estimates of the LRM. The code below shows the estimation results for the model \(R_t^{EMN} = \beta_0 + \beta_1 R_t^{SP500} + \epsilon_t\), where \(R_t^{EMN}\) and \(R_t^{SP500}\) are the returns of the equity market neutral and S&P 500 returns. The first regression model includes all observations while the second drops the outlier:

fit0 <- lm(`Equity Market Neutral` ~ GSPC, data=hfret1)

coeftest(fit0, vcov=NeweyWest(fit0, prewhite = FALSE))

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.2261 0.2376 0.95 0.342

GSPC 0.2034 0.0821 2.48 0.014 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1fit1 <- lm(`Equity Market Neutral` ~ GSPC, data = subset(hfret1, date != "Nov 2008"))

coeftest(fit1, vcov=NeweyWest(fit1, prewhite = FALSE))

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.4606 0.0937 4.91 1.5e-06 ***

GSPC 0.1184 0.0252 4.69 4.3e-06 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1These results indicate that by dropping the November 2008 return the estimate of \(\beta_0\) increases from 0.23 to 0.46 while the market exposure of the fund declines from 0.2 to 0.12. Hence, the effect of the large negative return is to depress the estimate of the interecept (interpreted as the risk-adjusted return) and to increase the slope (the HF exposure to the market return). However, even after removing the outlier the exposure \(\beta_1\) is statistically different from zero at 1%, which indicates that the aggregate index has low but significant exposure to market fluctuations. The outlier has also an effect on the goodness-of-fit statistic since the \(R^2\) increases from 0.07 to 0.2 when the extreme observation is excluded from the sample. Figure 3.11 shows the scatter plot of GSPC and Equity Market Neutral together with the regression lines estimated above. In this graph the observations for November 2008 is dropped and clearly the lightsalmon1 line seems to be closer to the points relative to the firebrick4 line that is estimated including the outlier.

c0 <- coef(fit0)

c1 <- coef(fit1)

dplyr::filter(hfret1, `Equity Market Neutral` > -20) %>%

ggplot(., aes(GSPC, `Equity Market Neutral`)) + geom_point(alpha=0.4) +

geom_abline(intercept = c0[1], slope = c0[2], color="lightsalmon1", size = 1) +

geom_abline(intercept = c1[1], slope = c1[1],color="firebrick4", size = 1) +

labs(caption = "Credit Suisse, Yahoo")

Figure 3.11: Scatter plot of the Equity Market Neutral Index and the SP 500 returns excluding the November 2008 observations. The regression lines are estimated with/without the extreme observation.

3.5 LRM with multiple independent variables

In practice, we might be interested to include more than just one variable to explain the dependent variable \(Y\). Denote the \(K\) independent variables that we are interested to include in the regression by \(X_{k,t}\) for \(k=1,\cdots,K\). The linear regression with multiple regressors is defined as \[ Y_t = \beta_0 + \beta_1 * X_{1,t} + \cdots + \beta_K * X_{K,t} + \epsilon_t \] Also in this case we can use OLS to estimate the parameters \(\beta_k\) (for \(k=1,\cdots, K\)) by choosing the values that minimize the sum of the squared residuals. Care should be given to the correlation among the independent variables to avoid cases of extremely high dependence. The case of correlation among two independent variables equal to 1 is called perfect collinearity and the model cannot be estimated. This is because it is not possible to associate changes in \(Y_t\) with changes in \(X_{1,t}\) or \(X_{2,t}\) since the two independent variables have correlation one and move in the same direction and by a proportional amount. A similar situation arises when an independent variable has correlation 1 with a linear combination of the independent variables25. The solution in this case is to exclude one of the variables from the regression. In practice, it is more likely to happen that the regressors have very high correlation although not equal to 1. In this case the model can be estimated but the coefficient estimates become unreliable. For example, equity markets move together in response to news that affect the economies worldwide. So, there are significant co-movements among these markets and thus high correlation which can become problematic in some situations. Before estimating the LRM, the correlation between the independent variables should be estimated to evaluate whether there are high correlations that might make impossible or unreliable to estimate the model. Correlations are high when they are larger than 0.85 and you should start assessing if these variables are both needed in the regression. A practical way to assess the effect of these correlations is to estimate the LRM with both variables, and then excluding one of them and including the other. By comparing the adjusted \(R^2\) and the stability of the coefficient estimates and the standard errors should give an answer whether it is the case to include both or just one of the variables.

In R the LRM with multiple regressors is estimated using the lm() command discussed before. To illustrate the LRM with multiple regressors I will extend the earlier market model to a 3-factor model in which there are two more independent variables or factors to explain the variation over time of the returns of a portfolio. The factors are called the Fama-French factors after the two economists that first proposed these factors to model risk in portfolios. In addition to the market return (MKT), they construct two additional risk factors:

- Small minus Big (SMB) which is defined as the difference between the return of a portfolio of small capitalization stocks and a portfolio of large capitalization stocks. The aim of this factor is to capture the premium from investing in small cap stocks.

- High minus Low (HML) is obtained as the difference between a portfolio of high Book-to-Market (B-M) ratio stocks and a portfolio of low B-M stocks. The high B-M ratio stocks are also called value stocks while the low B-M ratio ones are referred to as growth stocks. The factor provides a proxy for the premium from investing in value relative to growth stocks.

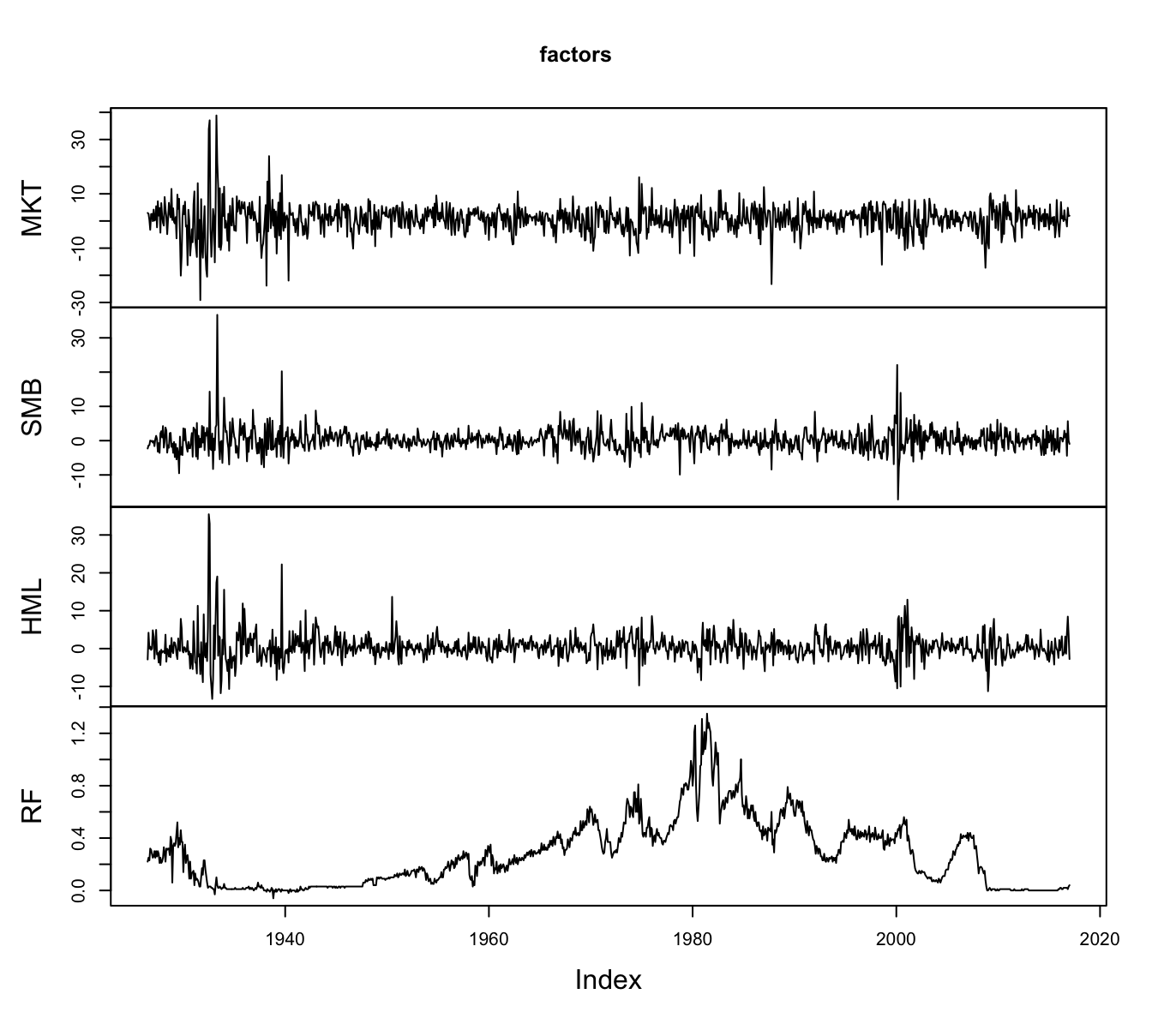

More details about the construction of these factors are available at Ken French webpage where you can also download the data for the MKT, SMB, and HML factors and the risk-free rate (RF). The dataset starts in July 1926 and ends in January 2017 and Figure 3.1226 shows the time series plot of the 3 factors and the risk-free rate.

plot.zoo(factors)

Figure 3.12: The time series of the Fama-French (FF) factors and the riskfree rate starting in 1926 at the monthly frequency. The data is obtained from Ken French website.

The data is in a xts-object called factors that has 1087 rows and 4 columns. To calculate the mean() and sd() of each column of the object we can use the apply() function that applies a function specified by the users to the rows or the columns of a data frame (specifying the argument MARGIN equal to 1 for rows and 2 for columns). The example below shows how to calculate the mean and standard deviation of the variables and combines them in a data frame:

data.frame(AVERAGE = apply(factors, 2, mean), STDEV = apply(factors, 2, sd)) AVERAGE STDEV

MKT 0.65 5.37

SMB 0.21 3.21

HML 0.40 3.50

RF 0.28 0.25The average monthly MKT return from 1926 to 2017 has been 0.65% in excess of the risk-free rate. The average of SMB is 0.21% and represents the monthly premium deriving from investing in small capitalization relative to large capitalization stocks. The sample average of HML is 0.4% which measures the premium from investing in value stocks (high book-to-market ratio) relative to growth stocks (low book-to-market ratio). The standard deviation of MKT, SMB, and HML factors are 5.37%, 3.21%, and 3.5%, respectively. Another statistic that is useful to estimate is the correlation between the factors that allows us to measure their dependence. We can calculate the correlation matrix using the cor() function that was introduced earlier:

cor(factors) MKT SMB HML RF

MKT 1.000 0.319 0.241 -0.065

SMB 0.319 1.000 0.122 -0.052

HML 0.241 0.122 1.000 0.018

RF -0.065 -0.052 0.018 1.000The correlation matrix is a table that shows the pair-wise correlation between the variable in the row and the one in the column. The numbers in the diagonal are all equal to 1 because they represent the correlation of a factor with itself. The correlation estimates show that SMB and HML are weakly correlated to the MKT returns (0.32 and 0.24, respectively) and also among each other (0.12). In this sense, it seems that the factors capture moderately correlated sources of risk which can be valuable from a diversification stand-point.

3.5.1 Size portfolios

Financial economics has devoted lots of energy to understand the factors driving asset prices and their expected returns. On the way, many anomalies have emerged in the sense of empirical facts that did not align with a theory. In this case the theory is the Capital Asset Pricing Model (CAPM) which states that the expected return of an asset should be proportial to the exposure to systematic risk measure by the excess market return relative to the risk-free rate of return. If we denote by \(R_t^{i}\) the excess return of asset \(i\) in period \(t\) and by \(R_t^{MKT}\) the excess market return in the same period, the CAPM predicts that \[ R_t^i = \alpha + \beta R_t^{MKT} + \epsilon_t \] where the intercept \(\alpha\) in the theory should be equal to zero and the slope \(\beta\) measures the exposure of the asset to market risk. Let’s consider an application. The data library in Ken French webpage provides historical data for the returns of portfolio of stocks formed based on their market capitalization. The way these portfolio are constructed is by sorting once a year all the stocks listed in the NYSE, AMEX, and NASDAQ from the largest capitalization to the smallest and then creating portfolios that invest in a fraction of these stocks. The French dataset forms size portfolios as follows:

- 3 portfolios: the 30% of smallest capitalization, the 30% of largest, and the 40% of medium capitalization

- 5 portfolios: lowest 20%, largest 20%, and 20% interval between the smallest and largest (quintiles)

- 10 portfolios: divide the sample at intervals of 10% (deciles)

This process can be interpreted as a mutual fund that once a year (typically in June) forms a portfolio of stocks based on their market capitalization and keeps that allocation for one year. First, let’s consider the 10 decile portfolios and calculate the average return over the period 1926-2017:

port10 <- c("Lo 10", "Dec 2","Dec 3","Dec 4","Dec 5",

"Dec 6","Dec 7","Dec 8", "Dec 9", "Hi 10")

size10 <- subset(port.size, select=port10)

table.size10 <- data.frame(`AV RET` = apply(size10, 2, mean),

`STD DEV` = apply(size10, 2, sd))

knitr::kable(t(table.size10), digits=3,

caption = "Average return and standard deviation of the decile

portfolios sorted by size.")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| AV.RET | 1.1 | 0.99 | 0.98 | 0.94 | 0.89 | 0.9 | 0.83 | 0.79 | 0.73 | 0.6 |

| STD.DEV | 10.0 | 8.75 | 7.99 | 7.46 | 7.07 | 6.8 | 6.45 | 6.16 | 5.81 | 5.1 |

The results in Table 3.2 show that, historically, portfolios of small caps have provided significantly higher returns relative to portfolios of large caps. A portfolio that consistently invested in the 10% of smaller caps earned an average monthly return of 1.12% relative to the portfolio of the largest companies that earned 0.6%. Why is the expected return of small caps portfolios higher relative to the larger caps? Is it because they are more risky? This is definitely the case since the standard deviation of the smallest cap portfolio is 9.98% relative to the 5.06% of the largest cap portfolio. Why is the standard deviation higher for small caps? do we want to look for an explanation to both? The CAPM model predicts that stocks or portfolios that are more exposed to systematic risk (high \(\beta\)) are riskier and receive compensation in the form of higher expected returns. Let’s estimate the CAPM model in the previous Equation to the 10 size portfolios and, if the CAPM is correct, we should find that \(\beta\)s decline moving from the 1st decile portfolio to the 10th portfolio and that \(\alpha\)s are close to zero. The code below estimates the CAPM model with the dependent variable being size10 which is a xts object with 10 columns and 1087 rows. The lm() command will automatically estimate the regression on the independent variable MKT for each column of the object size10.

size.capm <- lm(size10 ~ MKT, data=factors)

knitr::kable(coef(size.capm), digits=3,

caption="OLS estimates of the intercept and slope coefficients in the CAPM

regression for 10 portfolio sorted by size (market capitalization).")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Intercept) | 0.19 | 0.08 | 0.11 | 0.11 | 0.088 | 0.12 | 0.074 | 0.064 | 0.036 | -0.007 |

| MKT | 1.42 | 1.39 | 1.33 | 1.26 | 1.229 | 1.20 | 1.152 | 1.115 | 1.063 | 0.931 |

The estimates of the slope coefficients in Table 3.3 show, as expected, that smaller caps have higher betas relative to portfolios of large cap stocks (1.42 vs 0.93). This explains the fact that portfolios with more exposure to small caps are more volatile and provide higher expected returns relative to portfolios with predominantly larger stocks. What about the intercepts or alpha? The CAPM model predicted that these coefficients should be equal to zero, but a first assessment of the estimates does not seem to confirm this. The first portfolio has an estimate of \(\alpha\) of 0.19 which, from the perspective of monthly returns, is a considerable number. However, a proper assessment of the hypothesis that \(\alpha = 0\) should account for the standard errors of the estimates and perform a statistical test of the hypothesis against the alternative that the intercept is different from zero. The CAPM model also implies that the expected return of the portfolios, \(E(R_t^i)\), is given by the sum of \(\alpha\) and the compensation for exposure to market risk, \(\beta R_t^{MKT}\). We can use the ggplot2 package to do a bar-plot that helps visualizing the contribution of each component of the expected return.

size10.stat <- data.frame(PORT = factor(names(size10), levels=names(size10)),

AVRET = apply(size10, 2, mean),

ALPHA = coef(size.capm)['(Intercept)',],

BETA = coef(size.capm)['MKT',])

ggplot(size10.stat) + geom_bar(aes(x = PORT, y = AVRET), fill="gray90", stat = "identity") +

geom_bar(aes(x = PORT, y = ALPHA),fill = "lightsteelblue2", stat="identity") +

theme_bw() + labs(x = "", y = "Return", title="Size Portfolios") +

geom_hline(yintercept = mean(factors$MKT), color="orangered2")

Figure 3.13: Bar plot of the average return of the decile portfolios sorted on size together with the estimated intercept (alpha). The horizontal line represents the average MKT return.

Figure 3.13 shows that the CAPM model explains a significant component of the average return of the portfolios, but there is still between 10-20% of the return that is attributed to alpha. As we said before, it could be that these intercepts are not estimated very precisely so that statistically they are not different from zero. To evaluate this hypothesis we need to obtain the standard errors or the t-statistic from the lm() object. Since the dependent variable size10 in the previous regression is composed of 10 variable, the lm object for summary(size.capm) stores the regression results in a list with 10 elements and each element represents the results for one portfolio. For example:

summary(size.capm)[[1]]

Call:

lm(formula = `Lo 10` ~ MKT, data = factors)

Residuals:

Lo 10

Min -18.592

1Q -2.851

Median -0.394

3Q 1.982

Max 78.069

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.1919 0.1970 0.97 0.33

MKT 1.4205 0.0365 38.96 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 6.5 on 1085 degrees of freedom

Multiple R-squared: 0.583, Adjusted R-squared: 0.583

F-statistic: 1.52e+03 on 1 and 1085 DF, p-value: <2e-16To extract the t-statistic of the intercept for each item in the list in one line we can use the lapply() or the sapply() function that apply a user-specified function to each item of a list. In this simple case, the function sapply() is preferable because it returns a vector rather than a list as the lapply() function does. The code to obtain this is shown below where we extract the value in row 1 and column 3 of coefficients for each item in the list:

capm.tstat <- sapply(summary(size.capm), function(x) tstat = x$coefficients[1,3])Lo 10 Dec 2 Dec 3 Dec 4 Dec 5 Dec 6 Dec 7 Dec 8 Dec 9 Hi 10

0.97 0.57 1.00 1.16 1.13 1.77 1.33 1.43 1.06 -0.26 Since all t-statistics are smaller than 1.96 we do not reject the null hypothesis that the \(\alpha = 0\) for each of these 10 portfolios at 5% significance level, while at 10% significance only the intercept for the 6th decile is significant. Let’s also extract from the regression results the adjusted \(R^2\) of the regression and the standard error of regression. In the code below, I also bind the standard deviation of each portfolio return so that we can access the magnitude of the variables.

size.capm.stats <- sapply(summary(size.capm),

function(x) c(SER = x$sigma, AD.RSQ = x$adj.r.squared))

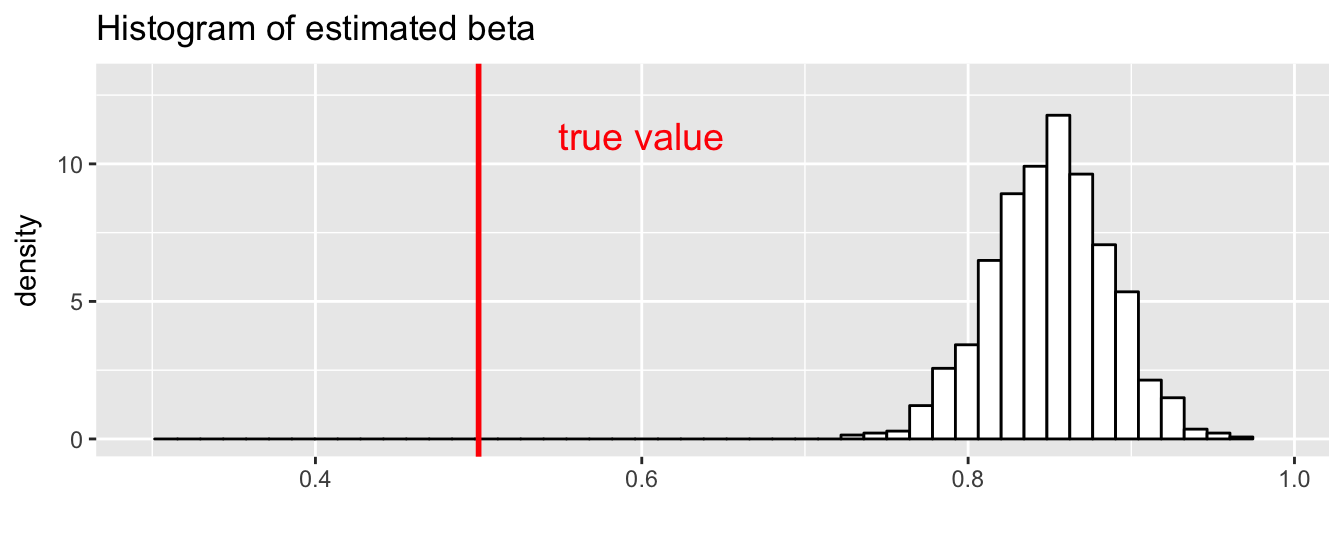

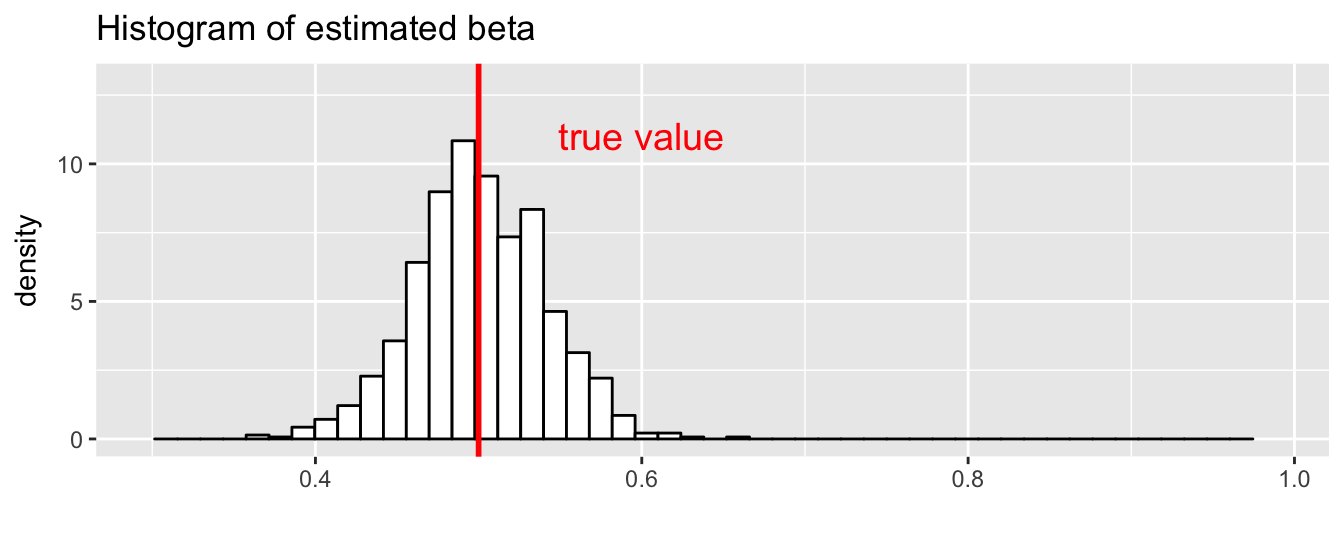

colnames(size.capm.stats) <- colnames(size10)The first portfolio is twice more volatile relative to the last portfolio and the CAPM model contributes to explain most of its variability (adjusted \(R^2\) of 0.97), but only 0.58 for Lo 1027. This suggests that the small cap portfolios could benefit from adding additional risk factors that might explain some of the unexplained variation of the returns and so improve \(R^2\).

The CAPM model predicts that the portfolio return should be explained by just one factor, the market return. This assumption might work for some portfolios, but it seems that it has some difficulties explaining the return of portfolios in which small cap stocks are predominant. Fama and French (1993) proposed a 3-factor model that add SMB and HML to the MKT factor given by \[ R_t^i = \alpha + \beta_{MKT} R_t^{MKT} + \beta_{SMB} SMB_t + \beta_{HML} HML_{t} + \epsilon_t \] Let’s see how the results would change if we estimate the 3-factor model on the size portfolios:

size.3fac <- lm(size10 ~ MKT + SMB + HML, data=factors)

knitr::kable(coef(size.3fac), digits=3,

caption="Loadings of 3 Fama-French factors on 10

portfolio sorted by market capitalization.")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Intercept) | -0.17 | -0.17 | -0.089 | -0.055 | -0.032 | 0.006 | -0.001 | 0.009 | -0.004 | 0.022 |

| MKT | 1.00 | 1.07 | 1.079 | 1.042 | 1.061 | 1.075 | 1.053 | 1.052 | 1.033 | 0.977 |

| SMB | 1.56 | 1.27 | 1.005 | 0.881 | 0.724 | 0.493 | 0.408 | 0.236 | 0.066 | -0.215 |

| HML | 0.78 | 0.48 | 0.375 | 0.308 | 0.192 | 0.224 | 0.132 | 0.115 | 0.114 | -0.034 |

The results in Table 3.4 show that:

- the estimated alpha are mostly negative

- the exposure to market risk (market beta) is very close to 1 for all portfolios and significantly smaller for the low decile portfolios relative to the CAPM regression (the beta for the first portfolio decreases from 1.42 to 1).

- The loading on the SMB for the low decile portfolios is large and positive and decreases until it becomes negative for the last decile portfolios. This is expected since the low portfolios have a larger exposure to small caps and thus benefit from the risk premium of small caps.

- Although we are not sorting stocks based on the book-to-market ratio but only on size, the loading on the HML factor is positive and large at low quantiles and decreases to approximately zero for the portfolio of largest cap stocks. This indicates the out-performance of the small caps portfolios is partly due also to a book-to-market effect, in the sense that small stocks are more likely to be value stocks and the regression is able to distinguish the component of the return that is due to the size effect and the part that is due to the value effect.

In addition, the comparison in Table 3.5 of the adjusted \(R^2\) for the CAPM and 3-factor model indicates that the largest improvements in goodness-of-fit occur for the lowest decile portfolios, while for the top decile portfolios the improvement is marginal.

size.capm.stats <- sapply(summary(size.capm), function(x) AD.RSQ = x$adj.r.squared)

size.3fac.stats <- sapply(summary(size.3fac), function(x) AD.RSQ = x$adj.r.squared)

size.stats <- rbind(CAPM = size.capm.stats, `3-FACTOR` = size.3fac.stats)

colnames(size.stats) <- colnames(size10)

knitr::kable(size.stats, digits=3, caption="Adjusted R-square for the CAPM

and the 3-factor models estimated on the size portfolios.")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| CAPM | 0.58 | 0.72 | 0.80 | 0.82 | 0.87 | 0.90 | 0.92 | 0.94 | 0.96 | 0.97 |

| 3-FACTOR | 0.89 | 0.96 | 0.98 | 0.97 | 0.98 | 0.96 | 0.96 | 0.96 | 0.97 | 0.99 |

3.5.2 Book-to-Market Ratio Portfolios

Another indicator that is often used to form portfolios is the book-to-market (BM) ratio, i.e., the ratio of the book value of a company to its market capitalization. Portfolios are formed by sorting stocks based on the BM ratio and decile portfolios are formed. Stocks with high BM ratio are called value and those with low BM ratio are called growth. Historically, value stocks have outperformed growth stocks which calls for an explanation similar to our earlier discussion of the outperformance of small relative to large capitalization stocks. Below is the code that calculates the average return and the standard deviation of the BM portfolios.

port10 <- c("Lo 10", "Dec 2","Dec 3","Dec 4","Dec 5",

"Dec 6","Dec 7","Dec 8", "Dec 9", "Hi 10")

b2m10 <- subset(port.b2m, select=port10)

table.b2m10 <- data.frame(AVRET = apply(b2m10, 2, mean),

STDEV = apply(b2m10, 2, sd))

knitr::kable(t(table.b2m10), digits=3,

caption = "Average return and standard deviation of the decile

portfolios sorted by Book-to-Market ratio.")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| AVRET | 0.58 | 0.68 | 0.69 | 0.66 | 0.72 | 0.8 | 0.73 | 0.92 | 1.1 | 1.1 |

| STDEV | 5.71 | 5.32 | 5.41 | 5.93 | 5.71 | 6.0 | 6.44 | 6.74 | 7.7 | 9.2 |

Table 3.6 shows that the first BM portfolio (growth stocks), has an average monthly return of 0.58% and a standard deviation of 5.71% as opposed to the last portfolio (value stocks) that has an average return of 1.07% and a standard deviation of 9.23%. Similarly to the size portfolios, there is a significant increase in the average return that comes also with an increase of its uncertainty. Similarly to the previous analysis, we will proceed by estimating the CAPM model and the 3-factor model and evaluate the performance of each model in explaining the expected return of the BM portfolios.

b2m.capm <- lm(b2m10 ~ MKT, data=factors)

knitr::kable(coef(b2m.capm), digits=3,

caption="Coefficient estimates for the CAPM model on 10 portfolio

sorted by book-to-market ratio.")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Intercept) | -0.082 | 0.062 | 0.052 | -0.023 | 0.065 | 0.12 | 0.008 | 0.17 | 0.23 | 0.11 |

| MKT | 1.011 | 0.947 | 0.970 | 1.049 | 1.002 | 1.03 | 1.101 | 1.14 | 1.28 | 1.46 |

As expected the exposure to market risk (beta) reported in Table 3.7 increases from 1.01 for the growth portfolio to 1.46 for the value portfolio. The beta for the BM portfolios is mostly close to 1 and increases significantly only for the top decile portfolios. In terms of the intercept \(\alpha\), the estimates are close to zero except for the top three deciles that are larger than zero and have t-statistics of 1.98, 2.118, 0.772 respectively.

b2m.3fac <- lm(b2m10 ~ MKT + SMB + HML, data=factors)

knitr::kable(coef(b2m.3fac), digits=3,

caption="Coefficient estimates of the 3-factor model on 10 portfolio

sorted by book-to-market ratio.")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Intercept) | 0.024 | 0.118 | 0.070 | -0.064 | -0.008 | -0.001 | -0.156 | -0.039 | -0.047 | -0.26 |

| MKT | 1.077 | 0.978 | 0.985 | 1.033 | 0.975 | 0.978 | 1.011 | 1.015 | 1.103 | 1.19 |

| SMB | -0.072 | -0.003 | -0.044 | -0.037 | -0.079 | -0.058 | 0.021 | 0.119 | 0.223 | 0.55 |

| HML | -0.336 | -0.191 | -0.047 | 0.151 | 0.271 | 0.426 | 0.546 | 0.666 | 0.853 | 1.09 |

Table 3.8 shows the results for the 3-factor model. The MKT beta for the value portfolio (top decile) has declined but it is still significantly larger than one. The SMB beta is mostly close to zero, except for the top three deciles where it is increasingly positive (equals 0.55 for the Hi 10 portfolio). This confirms the findings for the size portfolios that value and small cap stocks intersect to a certain degree. Finally, the HML beta shows negative loadings in the growth portfolios and positive loadings in the value portfolios. In terms of goodness-of-fit, comparing the adjusted \(R^2\) in Table 3.9 the 3-factor model is preferable for all portfolios to the CAPM model with the largest improvements occuring for the top decile portfolios.

b2m.capm.stats <- sapply(summary(b2m.capm), function(x) AD.RSQ = x$adj.r.squared)

b2m.3fac.stats <- sapply(summary(b2m.3fac), function(x) AD.RSQ = x$adj.r.squared)

b2m.stats <- rbind(CAPM = b2m.capm.stats, `3-FACTOR` = b2m.3fac.stats)

colnames(b2m.stats) <- port10

knitr::kable(b2m.stats, digits=3, caption="Adjusted R-square for the CAPM

and the 3-factor models estimate on the Book-to-Market portfolios. ")| Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| CAPM | 0.90 | 0.92 | 0.93 | 0.90 | 0.89 | 0.85 | 0.84 | 0.83 | 0.80 | 0.72 |

| 3-FACTOR | 0.94 | 0.93 | 0.93 | 0.91 | 0.91 | 0.91 | 0.93 | 0.95 | 0.95 | 0.93 |

3.5.3 CAPM and 3-factor models using dplyr

An alternative approach to estimate the asset pricing models on a set of portfolios or funds is to use the package dplyr. The advantage of using dplyr is that it allows to leverage its syntax and make the code more compact and transparent. In the application below, we estimate the CAPM and 3-factor model to the 10 size portfolios, but the code scales up to many more assets by only changing the input data frame. Some notes on the various steps and the new commands that are used below:

- first, the xts object

size10is converted to a data frame and a columndateis created - the data frame is re-organized from 10 columns representing the returns over time of the strategy to a data frame with three columns representing:

date: the month of the observationPortfolio: the portfolio (Lo.10, …,Hi.10)RET: the value of the monthly return

- The function used to re-organize the data is

gather()from the packagetidyrthat takes three arguments:- a data frame

- the name of the new column to create based on the column names of the data frame

- the name of the new column to create that will be filled wi the values of the returns of each strategy

- The

do()command used to createsize.modelis used because there is nodplyrverb that does the operation we are interested in; in this case thedo()command consists of the estimation of the CAPM and 3-factor model. Thesize.modelwill be a data frame with 10 rows and 3 columns representing the portfolio name, and the two additional columns containing the estimation output. - To extract information from

size.modelwe use the functionstidy()andglance()from packagebroom; the functiontidy()produces a data frame with the portfolio names, the regressor (e.g.,(Intercept),MKT,SMB,HML) and additional columns forestimate,std.error,statistic, andp.value. Instead, the role ofglance()is to extract the additional information about the regression such as the \(R^2\), the adjusted \(R^2\), the standard error of the regression (sigma), the F-statistic, its p-value, and a few more statistics. - We then reorganize the information in a table format (

capm.tabandff3fact.tab) and print the tables usingkable()

size10.df <- data.frame(date = ymd(time(size10)), coredata(size10))

factors.df <- data.frame(coredata(factors))

size10.df <- tidyr::gather(size10.df, "Portfolio", "RET", 2:ncol(size10.df), factor_key = TRUE)

size.model <- size10.df %>%

group_by(Portfolio) %>%

mutate(MKT = factors.df$MKT, SMB = factors.df$SMB, HML = factors.df$HML) %>%

do(fit.capm = lm(RET ~ MKT, data=.),

fit.3f = lm(RET ~ MKT + SMB + HML, data=.))

capm.tab <- broom::tidy(size.model, fit.capm) %>% dplyr::select(Portfolio, term, estimate) %>%

tidyr::spread(term, estimate) %>% rename(alpha = `(Intercept)`) %>%

full_join(broom::glance(size.model, fit.capm), by = "Portfolio")

ff3fact.tab <- broom::tidy(size.model, fit.3f) %>% dplyr::select(Portfolio, term, estimate) %>%

tidyr::spread(term, estimate) %>% rename(alpha = `(Intercept)`) %>%

full_join(broom::glance(size.model, fit.capm), by = "Portfolio") | Portfolio | alpha | MKT | r.squared | adj.r.squared | sigma | statistic | p.value |

|---|---|---|---|---|---|---|---|

| Lo.10 | 0.192 | 1.42 | 0.58 | 0.58 | 6.45 | 1518 | 0 |

| Dec.2 | 0.080 | 1.39 | 0.72 | 0.72 | 4.61 | 2825 | 0 |

| Dec.3 | 0.109 | 1.33 | 0.80 | 0.80 | 3.58 | 4308 | 0 |

| Dec.4 | 0.112 | 1.26 | 0.82 | 0.82 | 3.16 | 4956 | 0 |

| Dec.5 | 0.088 | 1.23 | 0.87 | 0.87 | 2.55 | 7271 | 0 |

| Dec.6 | 0.115 | 1.20 | 0.90 | 0.90 | 2.13 | 9959 | 0 |

| Dec.7 | 0.074 | 1.15 | 0.92 | 0.92 | 1.82 | 12523 | 0 |

| Dec.8 | 0.064 | 1.11 | 0.94 | 0.94 | 1.46 | 18182 | 0 |

| Dec.9 | 0.036 | 1.06 | 0.96 | 0.96 | 1.11 | 28901 | 0 |

| Hi.10 | -0.007 | 0.93 | 0.97 | 0.97 | 0.83 | 39357 | 0 |

| Portfolio | alpha | HML | MKT | SMB | r.squared | adj.r.squared | sigma | statistic | p.value |

|---|---|---|---|---|---|---|---|---|---|

| Lo.10 | -0.175 | 0.782 | 1.00 | 1.562 | 0.58 | 0.58 | 6.45 | 1518 | 0 |

| Dec.2 | -0.172 | 0.481 | 1.07 | 1.269 | 0.72 | 0.72 | 4.61 | 2825 | 0 |

| Dec.3 | -0.089 | 0.375 | 1.08 | 1.005 | 0.80 | 0.80 | 3.58 | 4308 | 0 |

| Dec.4 | -0.055 | 0.308 | 1.04 | 0.881 | 0.82 | 0.82 | 3.16 | 4956 | 0 |

| Dec.5 | -0.032 | 0.192 | 1.06 | 0.724 | 0.87 | 0.87 | 2.55 | 7271 | 0 |

| Dec.6 | 0.006 | 0.224 | 1.07 | 0.493 | 0.90 | 0.90 | 2.13 | 9959 | 0 |

| Dec.7 | -0.001 | 0.132 | 1.05 | 0.408 | 0.92 | 0.92 | 1.82 | 12523 | 0 |

| Dec.8 | 0.009 | 0.115 | 1.05 | 0.236 | 0.94 | 0.94 | 1.46 | 18182 | 0 |

| Dec.9 | -0.004 | 0.114 | 1.03 | 0.066 | 0.96 | 0.96 | 1.11 | 28901 | 0 |

| Hi.10 | 0.022 | -0.034 | 0.98 | -0.215 | 0.97 | 0.97 | 0.83 | 39357 | 0 |

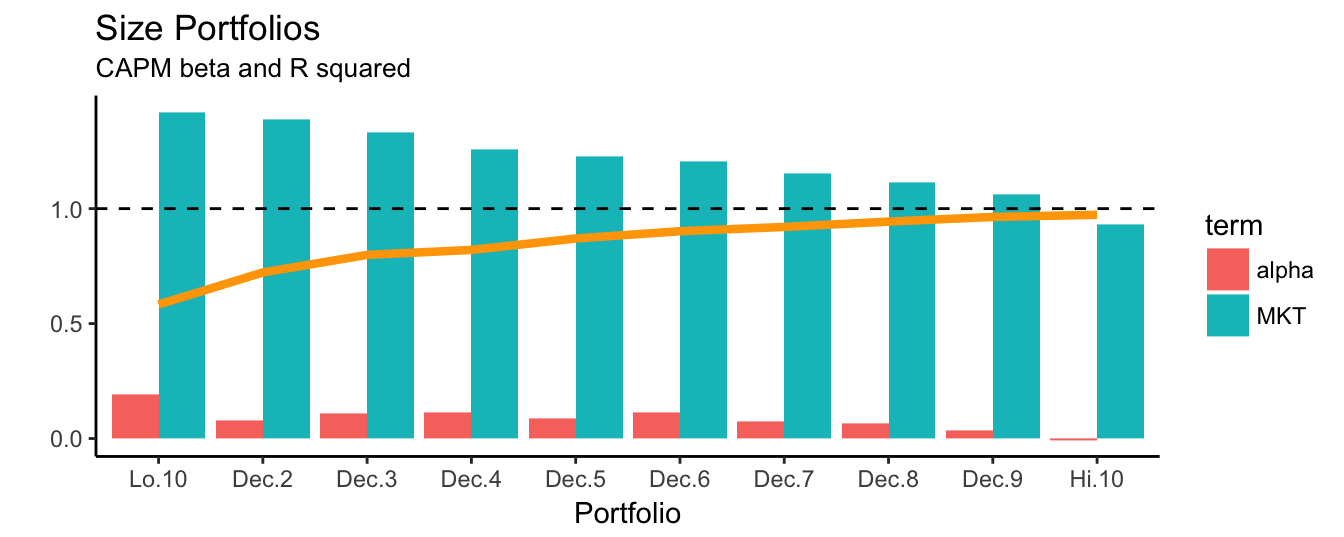

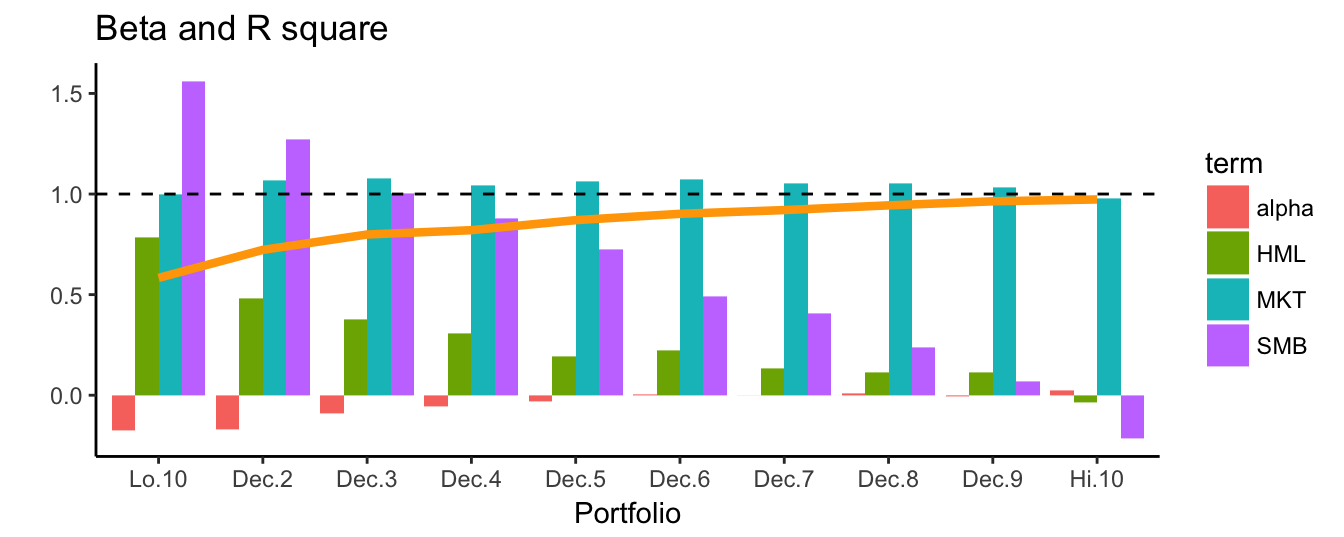

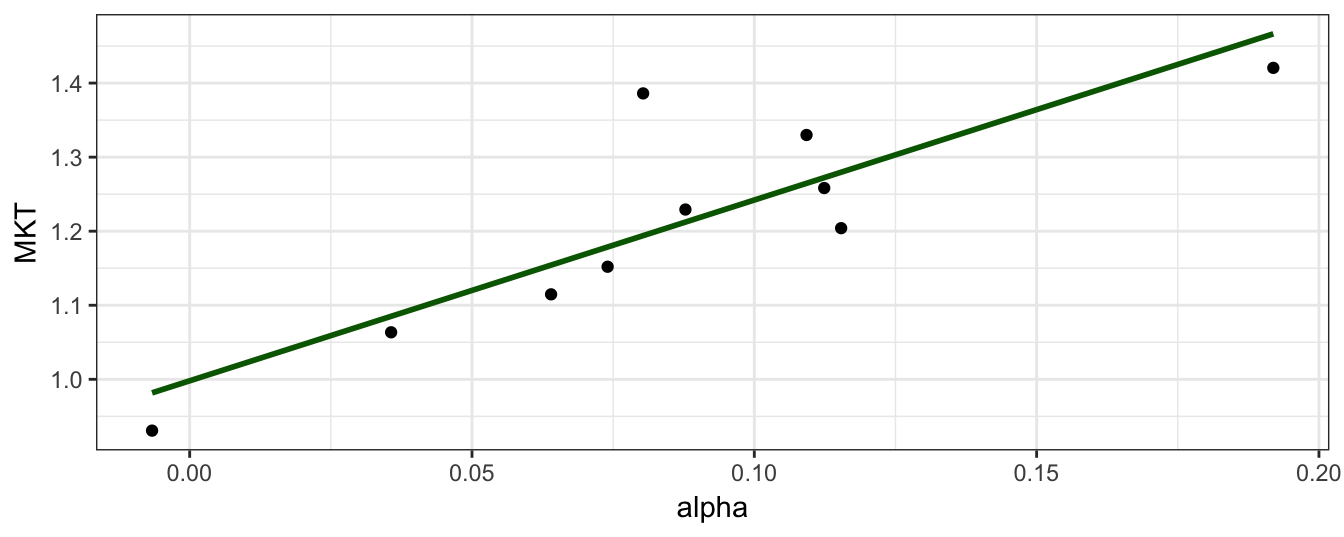

Table 3.10 and 3.11 show the regression results for the two asset pricing models estimated on the returns of the 10 size portfolios that includes the coefficient estimates of alpha and the exposures, in addition to the adjusted and unadjusted \(R^2\) of the regression, the standard error of the regression (sigma), the F-statistic (statistic) and its p-value. Instead of presenting the regression results in a table format, we can plot the information in a graph which might be a more intuitive way of communicating the results. In Figure 3.14 the CAPM beta estimates for the 10 size portfolios are shown together with a line that represents the \(R^2\) goodness-of-fit statistics for the portfolios. As we move from Lo.10 to Hi.10 (from small to large caps) the MKT beta decreases, the goodness-of-fit increases, and alpha decreases. These three indicators point in the same direction: the CAPM model is a good at explaining the top decile portfolios, but has some difficulties in pricing the low decile portfolios since \(R^2\) is (relatively) low and alpha is large.

capm.plot <- broom::tidy(size.model, fit.capm) %>%

mutate(term = plyr::mapvalues(term, from="(Intercept)", to="alpha"))

ggplot(capm.plot) +

geom_bar(aes(x=Portfolio, y=estimate, fill=term), stat="identity", position="dodge") +

geom_line(aes(x=Portfolio, y=r.squared,group=1), data=capm.tab, color="orange", size=1.5) +

theme_classic() + geom_hline(yintercept = 1, color="black", linetype="dashed")+

labs(x="Portfolio", y="", title="Size Portfolios", subtitle="CAPM beta and R squared")

Figure 3.14: The alpha and beta estimates for the CAPM model for 10 portfolio sorted on size. The line represents the \(R^2\) of the regression model.

When extending the analysis to the 3-factor model we find that the MKT exposure is quite similar across portfolios and close to 128. The exposure to SMB risk is high for Lo.10 and reduces as the component of small cap stocks decreases in higher decile portfolios. The contribution of the HML factor to the expected returns of the portfolios follows a similar pattern. Hence, low decile size portfolios benefit from both a small cap and a value perspective. In addition, it turns out that the alpha estimates are negative, in particular for the low quantile portfolios which suggests that the model is actually over-correcting for the small size effect. A visualization of the estimation results is given in Figure 3.15.

ff3fact.plot <- broom::tidy(size.model, fit.3f) %>%

mutate(term = plyr::mapvalues(term, from="(Intercept)", to="alpha"))

ggplot(ff3fact.plot) +